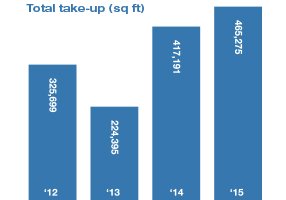

Office space Solihull and the M42 corridor – research Qtr 4 2015

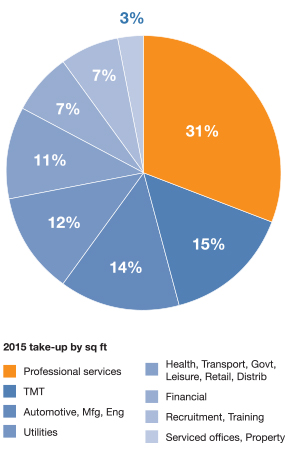

465,275 sq ft – another great year for office space in Solihull and the Birmingham out-of-town office market, with several substantial and significant transactions, most notably, 114,000 sq ft pre-let to Interserve and 46,000 sq ft let to National Grid. In addition, Changan Automotive acquired a part-investment office complex, totalling 80,000 sq ft, at Birmingham Business Park for their own phased occupation.

With no speculative developments for office space in Solihull on the horizon, demand is starting to outstrip supply. This leaves occupiers with few options and rents have been pushed up, particularly on the highest quality office space. Unlike Birmingham city centre, the out-of-town office market has yet to respond with speculative development – choosing to refurbish many substantial pieces of existing, vacant space – but that could be set to change in the near future.

Inward investment

Changan Automotive, the Chinese automobile group, completed the acquisition of 80,000 sq ft at Parkside, Birmingham Business Park. Initially occupying 27,000 sq ft of the scheme – space that was secured in a temporary lease earlier in the year, Changan occupies office space in 3500 and 3700. Consolidating existing offices in Nottinghamshire and Warwickshire, this is an excellent example of inward investment for the area. The site will form the worldwide HQ of its Powertrain and R&D divisions, housing c. 200 staff.

Changan has been granted planning permission to demolish and rebuild 3600 Parkside to create a new, state-of-the-art research and development centre, or ‘test cell’. The remaining units of 3800 and 3900 Parkside are currently occupied – but are likely to provide Changan with readily available space for future expansions of their workforce at the site.

Availability of office space in Solihull and the M42 Corridor: New stock

With only 10,000 sq ft of brand new, Grade A office space in Solihull and the M42 Corridor remaining, and no speculative development on the horizon – an obvious shortage of high quality office space now exists. Occupiers demand high quality space, and this is why investors and developers have been motivated to refurbish stock extensively, even down to the complete overhaul of all mechanical and electrical elements of the property – making it attractive to occupiers.

Availability of office space in Solihull and the M42 Corridor: Refurbished stock

| Grade A under construction/refurbishment | sq ft | Available |

| Phoenix Building | 50,000 | Q4 2016 |

| Trident Court | 41,000 | Q4 2016 |

| 31 Homer Road | 63,000 | Q1 2017 |

Shortage of high quality stock is a developing issue. Demand remains strong and landlords are planning comprehensive refurbishments of existing office stock to meet occupier expectations.