Annual review: Birmingham office market

– The first in a series of three commentaries on the Midlands commercial property market, providing in-depth analysis and insights into 2016 and outlook for 2017.

With 1.4 million sq ft of offices under construction by the end of 2016, Birmingham city centre is seeing its highest level of office development for 15 years.

“Brexit had a notable impact on the office space transactions in the second half of last year – with the investment area of the market being particularly quiet.

“However, in the opening months of 2017, we’ve seen several investment purchases, including that of Brindleyplace offices by HSBC Alternative Investments – with HSBC themselves being set to move into adjacent HQ offices at Two Arena Central, currently under construction.

“When you take this, together with the level of office developments under construction and the Royal Assent of HS2 into account – with the latter expected to now galvanise the HS2 halo effect on the Birmingham office market – quarters 3 and 4 of 2016 may well appear as a blip in the market rather than the beginning of a downward trend.” – Nigel Tripp, Director of KWB – pictured right.

KWB’s Nigel Tripp gives a review of 2016’s Birmingham office market transactions, examining the individual deals and putting the findings into context.

A year of two halves

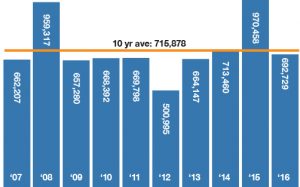

At the year’s halfway point, the Birmingham office market had achieved 499,792 sq ft in transactions, yet the second half of the year only totalled 200,000 sq ft, ending the year at 692,723 sq ft – just below the 10-year average figure.

Brexit is an obvious factor here, however, this had little or no impact on the out-of-town market, and a number of known city centre deals simply failed to complete legals within the calendar year.

Above: sq ft of office space transacted in Birmingham city centre, year on year.

For further details, please see the full KWB 2016 review for offices in Birmingham city centre

Key transactions

- PWC – 90,000 sq ft at One Chamberlain Square

- Network Rail – 83,406 sq ft at Baskerville House

- Pinsent Masons – 40,538 sq ft at 55 Colmore Row

- DAC Beachcroft – 40,045 sq ft at Tricorn House

For the full list of 2016 office space transactions for Birmingham city centre, click here

HS2 halo effect

Royal Assent is now granted for the HS2 project, but 2016 transactions in the Birmingham office market show that ‘the wheels had already been turning’. Laing O’Rourke and Galliford Try’s relocations to Birmingham city centre in 2016 are regarded as direct reactions to the forthcoming train line.

“With our plans for the HS2 terminal set to expand the city centre, alongside increasing interest from overseas investors and the strengthening of the business, professional and financial service sectors, the demand for new and refurbished office space in Birmingham is set to continue into 2017.”

– Waheed Nazir, Strategic Director, Birmingham City Council

For his full contribution to our research… click here.

Birmingham office market business sector analysis

Bolstered by lettings such as PWC, professional services represented the largest sector of occupiers taking Birmingham city centre office space in 2016. In 2015, banking and financial services represented the largest sector of occupiers taking space, driven primarily by the letting of 212,000 sq ft at 2 Arena Central to HSBC.

Square footage analysis

This year, whilst we see fewer Birmingham city centre office space transactions above 5,000 sq ft, there is a significant increase in the 0-5,000 sq ft bracket. This led the market to achieve more lettings this year than in 2015. As with the previous year, and as is generally to be expected, this bracket was the most active and, this year, provides the largest contribution to the overall square footage, 206,149 sq ft or 30% of the total.

Birmingham office space availability

The amount of available Grade ‘A’ Birmingham city centre office space stands at around 550,000 sq ft, equating to c. 10% of total Grade ‘A’ stock and just 3% of all central Birmingham office stock. Of this, only 130,000 sq ft is considered ‘new’ Grade ‘A’, and 104,000 sq ft of this is provided at just one property – The Colmore Building.

However, with the current level of office space development being the highest for 15 years, there is a plethora of new stock on the way. For the full list of upcoming new Birmingham office space stock, see the full list in the KWB 2016 review for offices in Birmingham city centre.

Rental levels

Prime office rents in Birmingham peaked at £33 per sq ft in 2008, before dropping back during the recession. They have since recovered, with prime rents standing at £32 per sq ft.

Hipster space

For the first time in the history of the Birmingham office market, an increasing number of office properties are being brought to market that offer aesthetic interior features such as exposed brickwork. The identities of these buildings, akin to what we see in areas of London like Shoreditch, hold currency for a select area of the market, which consists predominantly of companies in the TMT sector.

The Assay Studios, Birmingham’s Jewellery Quarter

2017 outlook

We anticipate some significant lettings in the coming months. The much reported HMRC requirement is anticipated to see a letting of 200,000-300,000 sq ft this year, with the relocation programme amounting to close to 1,000,000 sq ft of lettings over the coming years.

With Royal Assent for HS2 now granted, we expect to see an intensifying of the HS2 halo effect. So far, we have seen several companies relocate to Birmingham city centre and close to the HS2 headquarters at Two Snowhill. These companies are either in, or seeking to be in, the HS2 supply chain, or are attracted by the anticipated economic growth that the line will bring.

Headline rents on the best quality, new, Grade ‘A’ office stock are expected to hit the pre-2008 recession high of £33 per sq ft.

The above is an excerpt from the full analysis, which can be found here.

For more information on Birmingham office market research, please contact Nigel Tripp on 0121 212 5981 or email ntripp@kwboffice.com or download the KWB Annual Office and Industrial Market Review 2016 – Outlook 2017.