Birmingham office market research – quarter 4 and full year 2016

The biggest news for the city this year is that development levels for Birmingham city centre office space are at their highest rate for 15 years. With the old Paradise Forum now levelled and the new Paradise project well under way, the landscape of the city is changing.

A year of two halves

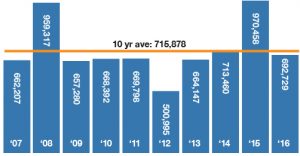

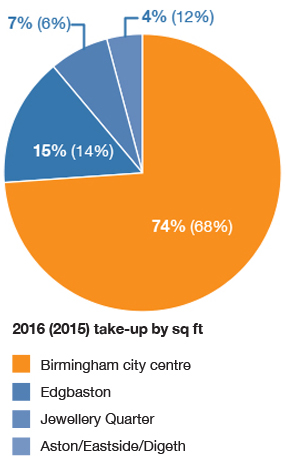

At the year’s halfway point, it looked as if the market for Birmingham city centre office space was on course for another record year, with 499,792 sq ft transacted. Unfortunately, transactions completed in the second half of the year only totalled 200,000 sq ft, ending the year at 692,723 sq ft, just below the 10-year average figure.

Lettings to PWC of 90,000 sq ft at One Chamberlain Square, and 83,406 sq ft to Network Rail at Baskerville House supplied the year’s ‘hero deals’ in Q1 and Q2 respectively.

Brexit is an obvious factor in the reduced second half take-up. However, this had little or no impact on the out-of-town market, and a number of known Birmingham city centre deals simply failed to complete legals within the calendar year.

Law firm accounts for biggest letting of Q4

Pinsent Masons’ letting represented the largest transaction in the market for Birmingham city centre office space, with a letting of just under 20,000 sq ft at 19 Cornwall Street. This letting was the result of Pinsent Masons seeking space to house its back office function, following its recent relocation to 55 Colmore Row, from Wesleyan Building – where it had been based for many years. As the largest letting of the quarter, this was substantially smaller than those which we saw topping the table in Q1 and Q2.