Annual review: Solihull office market

– The second in a series of three commentaries on the Midlands commercial property market, providing in-depth analysis and insights into 2016 and outlook for 2017.

Where, in Birmingham city centre, we saw a sharp contrast between the two halves of the year, following the June referendum, the M42 and Solihull office market achieved almost the same amount of square footage in both halves.

The biggest question in 2016 for British business has been, and remains, “What impact will Brexit have?”. The market for offices in Solihull and M42 remained incredibly consistent throughout last year – despite the outcome of the June referendum.

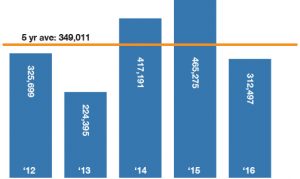

Of the 312,497 sq ft total transacted in the year, 154,341 sq ft was transacted in HY1 and 158,156 sq ft in HY2. Furthermore, KWB can confirm that enquiry levels are currently up on where they were this time last year – indicating a defiantly healthy property market.

2016 is down on 2015’s total take-up, which saw two landmark deals – 114,000 sq ft at International House, an off-market letting, to Interserve, and a sale of 80,000 sq ft at Parkside on Birmingham Business Park to Changan. However, if these are removed from the equation, we see a very similar level of activity between 2016 and 2015.

“The market for offices in Solihull and the M42 corridor is typically more sustainable than Birmingham city centre, as can be said for many out-of-town office locations, and industrial locations also. The impact of a significant economic or political event tends to have a more visible effect on the transaction figures of a city centre, whilst the business park market has a wider and more diverse range of business sectors that leads to a more sustainable level of demand.

“It is also worth noting that one of the foremost trends in the Solihull and M42 office space market has been consolidation – this is a cost saving measure, and an event such as the referendum will only mean additional impetus to make a move into more efficient and cost-effective accommodation.

“The effects of Brexit on office markets are too early to call, given that we have yet to actually trigger Article 50 and see what Brexit will entail – hard, soft or otherwise. However, the out-of-town market’s current resilience – shown in 2016’s transaction figures, the rise in rents, and this year’s enquiry levels – is encouraging.” – Mark Robinson, Director of KWB – pictured right.

Below: sq ft of office space transacted in Solihull, year on year.

For further details, please see the full KWB 2016 review for offices in Solihull

Key Solihull office market transactions

- Uniper – 32,692 sq ft at 2300 The Crescent, Birmingham Business Park

- Occupier not disclosed – 26,498 sq ft at 2920 Trident Court, Birmingham Business Park

- Phoebus Software – 14,967 sq ft at Lansdowne Gate, Solihull

- Caterpillar Financial Services – 13,811 sq ft at Friars Gate, Solihull

- Canon UK – 11,989 sq ft at 3180 Park Square, Birmingham Business Park

- MWH – 11,952 sq ft at One Paper Mill Drive, Redditch

For the full list of 2016 office space transactions for Solihull, click here

Business sector analysis

In 2016, automotive, manufacturing and engineering accounted for 26% of the sales and lettings in Solihull and the M42 corridor. This business sector always holds a significant position in this respect, due to the size of JLR’s operations in the M42 and Solihull office market, as well as the industrial market. However, in 2015, professional services was the business sector that accounted for the largest share of Solihull office market take-up, bolstered by the off-market pre-let of 114,000 sq ft to Interserve at International House.

Transactional analysis by size bracket

We see a similar pattern of transactions with regards to size bracket as we did in 2015, the key difference being the absence of a landmark 50k+ sq ft deal. Instead, the 0-5k sq ft bracket represents a far higher proportion of the overall number of transactions, at 35%, compared with 22% in 2015. Also, the 10-20k deals, whilst similar in number, were larger in size and equated to a 27% share in 2016 (12% in 2015).

No new stock and refurbishments pay off

We now face a situation, within the M42 and Solihull office market, where there is no brand new Grade ‘A’ office space available. Property developers have, instead, moved to refurbish the stock that remains unoccupied, to dispose of this before considering any new development.

Notably, Canmoor has done, and continues to do, an excellent job of refurbishing the available space in the Birmingham Business Park portfolio, and that has both secured new occupiers and put much needed space into the Solihull office market. However, demand still outstrips supply.

The only current way in which an occupier can acquire new space within the Solihull office market is to agree a pre-let. With new build costs at c. £145 per sq ft on gross internal area, then rents of at least £23.50 per sq ft and at least 15-year certain lease terms will be required.

Rental levels

This gap between demand and supply drove rents upwards in 2016. The pre-let of 15,000 sq ft on Blythe Valley Park to Prologis, announced at the end of 2016, is understood to have commanded a rent in excess of £23.50 per sq ft – representing the market’s highest rental level since 2009. We anticipate that with this precedent set, other rents will rise in the area.

UK Central and Arden Cross

Following HS2’s Royal Assent, the Arden Cross and UK Central regeneration projects take a step closer to becoming a reality. Arden Cross is a proposed mixed-purpose development, which would surround the HS2 Interchange station. Plans show the development to consist of residential, retail, industrial and commercial space.

Currently, these developments do not pose a viable solution to an occupier that has an existing or upcoming requirement. The office space drought in Birmingham’s out-of-town office market can be met, in part, by the development opportunities at existing business parks: Blythe Valley Park offers a million sq ft of outlined, but undeveloped, space with Birmingham Business Park also offering 500,000 sq ft.

“Looking ahead, our plans for ‘UK Central Solihull’ are gaining momentum, capitalising on the opportunity that the HS2 Interchange station presents, in addition to significant development and investment in infrastructure across the area. To realise the growth ambitions in this area, known as the ‘Hub’, we have established an Urban Growth Company to drive development and deliver £1bn of infrastructure investment to create a truly compelling and globally connected destination.” – Anne Brereton, Director for Managed Growth & Communities, Solihull Metropolitan Borough Council

For her full contribution to our research… click here.

Outlook for 2017

Office space continues to run dry, driving rents on – as we have seen with the pre-let to Prologis. There are still significant opportunities to occupy high quality office space in the area, in the thoroughly refurbished units that have come to market, and these are likely to be snapped up very quickly.

Occupiers that are looking for new space at this point, their only option is a pre-let or to identify a design and build opportunity, which could be fulfilled at existing sites such as Birmingham Business Park and Blythe Valley Park. Occupiers that decide to take this course may need to re-gear, and extend their existing lease in order to wait for their new development to be built.

UK Central and Arden Cross plans will become more of a prospect, following Royal Assent on HS2, and they represent the most exciting development in the Solihull area for a long time. Should these developments come to fruition, they will supply the market with much needed, new Grade ’A’ office space.

The above is an excerpt from the full analysis, which can be found here.

For more information on Solihull office market research, please contact Mark Robinson on 0121 212 5994 or email mrobinson@kwboffice.com or download the KWB Annual Office and Industrial Market Review 2016 – Outlook 2017