M42 and Solihull office market research – quarter 4 and full year 2016

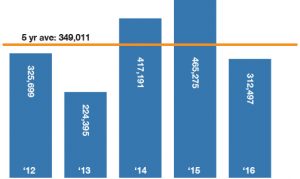

Where, in Birmingham city centre, we saw a sharp contrast between the two halves of the year, the M42 and Solihull office market achieved almost exactly the same amount of square footage in both halves. The 312,497 sq ft total transacted in the year was made up of 154,341 sq ft in HY1 and 158,156 sq ft in HY2.

Defiantly consistent

When you consider how visible it is in the city centre’s figures, where HY1 accounted for 72% of the year’s total, an impact of the Brexit vote is far harder to determine in the transaction figures of Birmingham’s out-of-town M42 and Solihull office market.

Generally speaking, the market for offices in Solihull and the M42 corridor has seen a more sustainable level of take-up than that of Birmingham city centre. This year is down on 2015’s total take-up, which saw two landmark deals – 114,000 sq ft at International House, an off-market letting, to Interserve, and a sale of 80,000 sq ft at Parkside on Birmingham Business Park to Changan. However, if these are removed from the equation, we see a very similar level of activity between 2016 and 2015.