| Office building | Size (sq ft) | Location | Occupier | Sector |

|---|

| 6060 Knights Court | 13,430 | Birmingham Business Park | IWG | Serviced offices |

| 6130 Knights Court | 3,057 | Birmingham Business Park | Galldris | Civil engineering |

| The Gardens, Coleshill Manor | 2,873 | Coleshill | Remmers (UK) | Building materials |

| 2450 Regents Court | 2,659 | Birmingham Business Park | Attire | Workwear |

| Total | 22,019 | 83% of quarterly take-up, 4 transactions |

Sub 5,000 sq ft spaces prove most popular

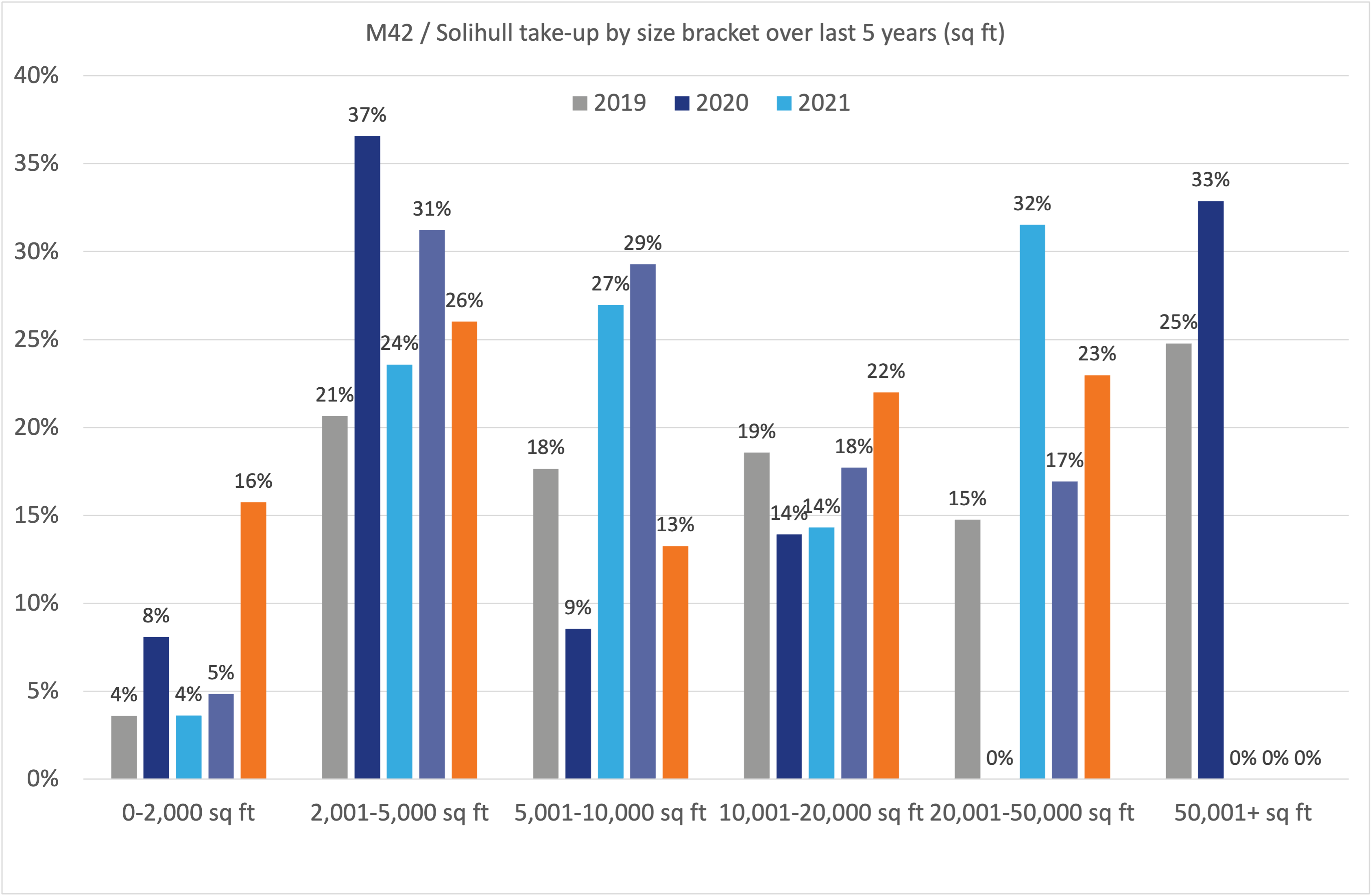

Throughout the year, we saw a preference towards office space under 5,000 sq ft in the M42 and Solihull office market 2023. Of the year’s 33 transactions, 27 of these were for space under 5,000 sq ft, with businesses typically located at Birmingham Business Park, Coleshill or Solihull town centre. These sites offer easy access to the J4-J6 M42 corridor and there was clear commercial confidence in, and appeal of, the M42 and Solihull.

With this in mind, it makes sense that we saw less interest in locations outside of this core area. From Bromsgrove and Redditch further south, to Shirley and Hockley Heath along the M42 North, we saw less stock and fewer transactions in the office market within these locations.

Solihull’s flexible office sector flourishes

In 2023, hybrid working continued to feature in both the Birmingham and out-of-town markets.

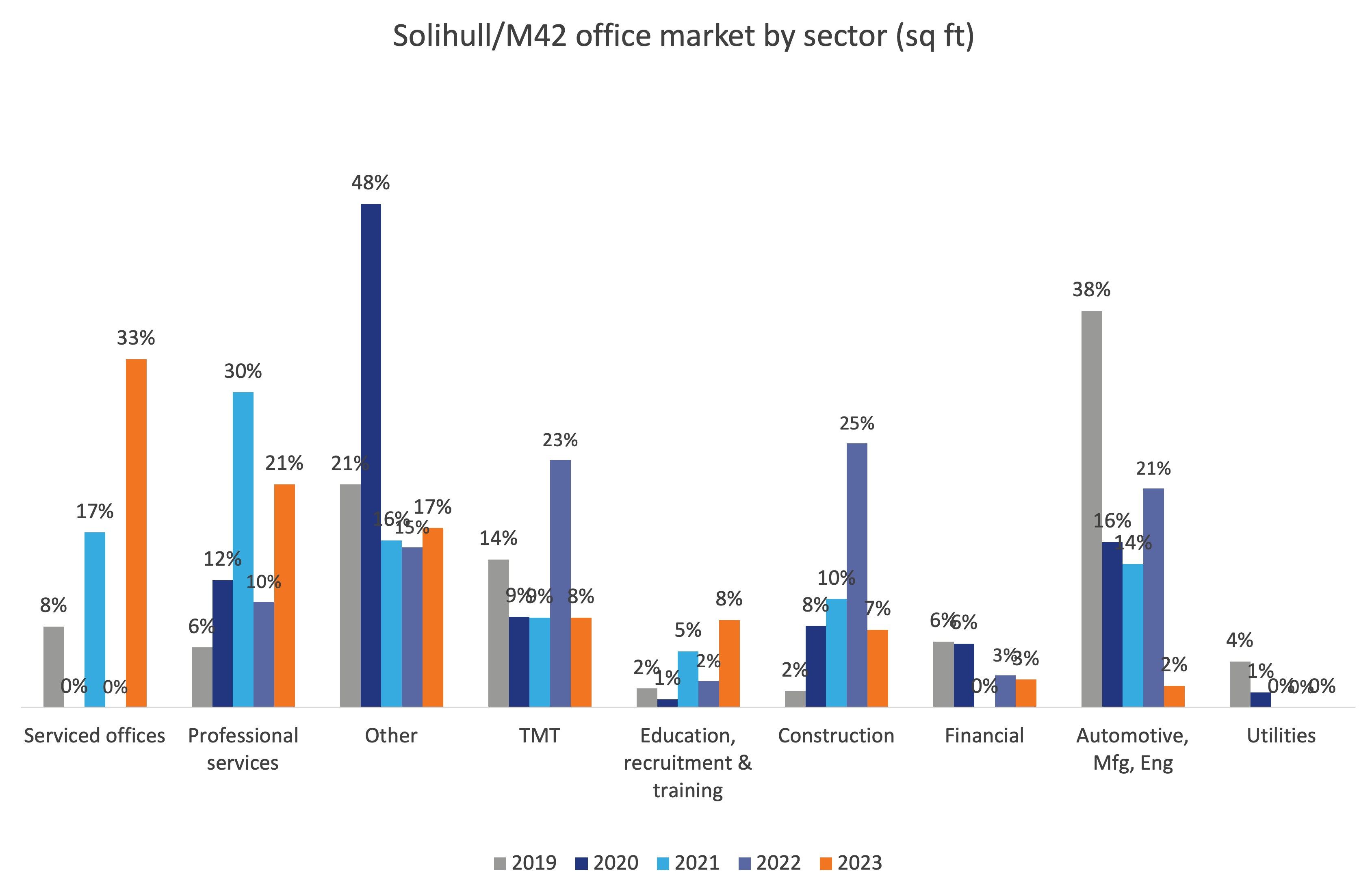

Serviced office providers accounted for 33% of take-up in Solihull and the M42 – the largest proportion by sector, followed by professional services at 17%. The year’s two largest serviced office deals totalled 44,063 sq ft, with Orega occupying Ingenuity House in Q3 and IWG at 6060 Knights Court, Birmingham Business Park.

The majority of professional services transactions were across commercial property, construction consultancy and civil engineering. After Holman, Galldris and JBA Consulting, businesses took up smaller premises below 2,000 sq ft at locations including Dominion Court in Solihull town centre and Knights Court at Birmingham Business Park. While construction transactions were down compared with 2022, we still saw one of the largest transactions of the year from Avant Homes with 6,938 sq ft at Wingfield Court in Coleshill (Q2).

Other industries that performed well in 2023’s office market were fleet management, education, recruitment and training. We also noticed an increase in transactions among education companies in Birmingham city centre – a sign that this sector is one to watch over the next 12 months.