Key Birmingham office transactions

With a total take-up of 843,218 sq ft, 2024 has recorded the 3rd largest total square footage take-up in the last 15 years. Only 2015’s total of 970,458 sq ft and the tremendous 2017 total of 1,007,812 sq ft, have surpassed 2024’s overall number.

This is hugely positive news for the market, highlighting consistency and confidence since having to rebuild from the impact of the pandemic.

More movement within the CBD (Colmore Business District), as well as an emerging trend of a larger, more high-profile deal being supported by several mid-range transactions, has meant the Birmingham office market has seen reliably solid take-up across every quarter.

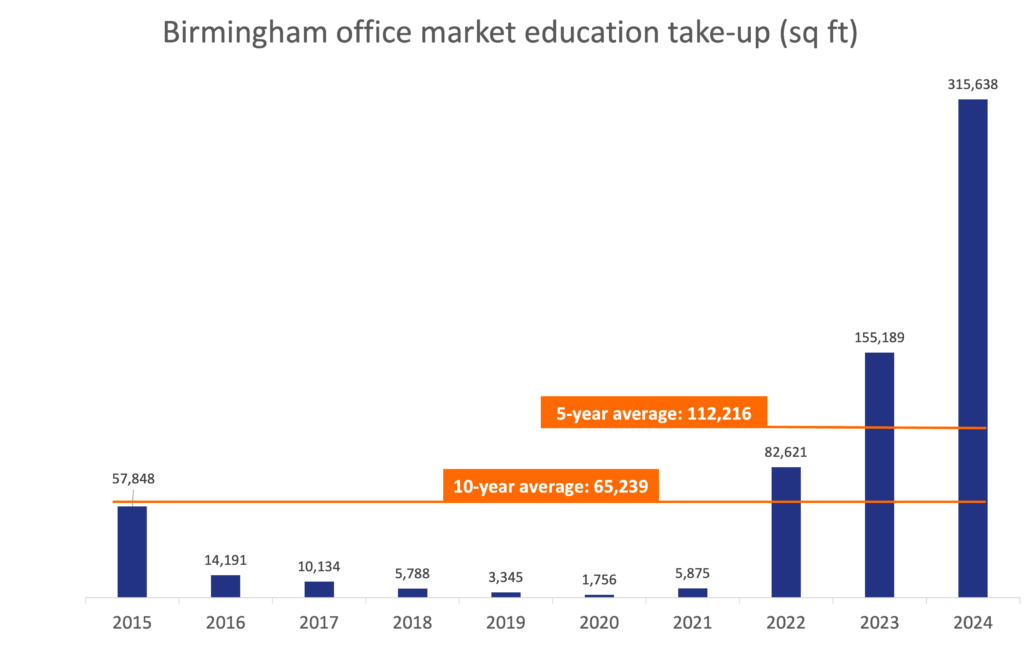

Birmingham has established itself as a true alternative to London, attracting respected businesses, such as the BBC, to invest with large transactions in the city. This investment has made 2024 a key year for the TMT (technology, media and telecoms) sector, but surprisingly, even more so for the Education sector. The latter took 315,638 sq ft in Birmingham over the whole of 2024, the sector’s biggest take-up since records began.

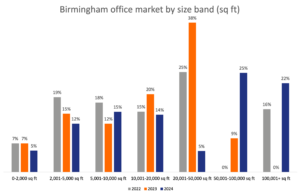

While 2024 has been a year of headlining deals, it has also been one of steady, smaller transactions to aid in the smaller size brackets’ growth. 398,606 sq ft was taken across all four quarters in size brackets of 0-20,000 sq ft – 47% of the year’s total.