M42 and Solihull office market research — Quarter 3 2022

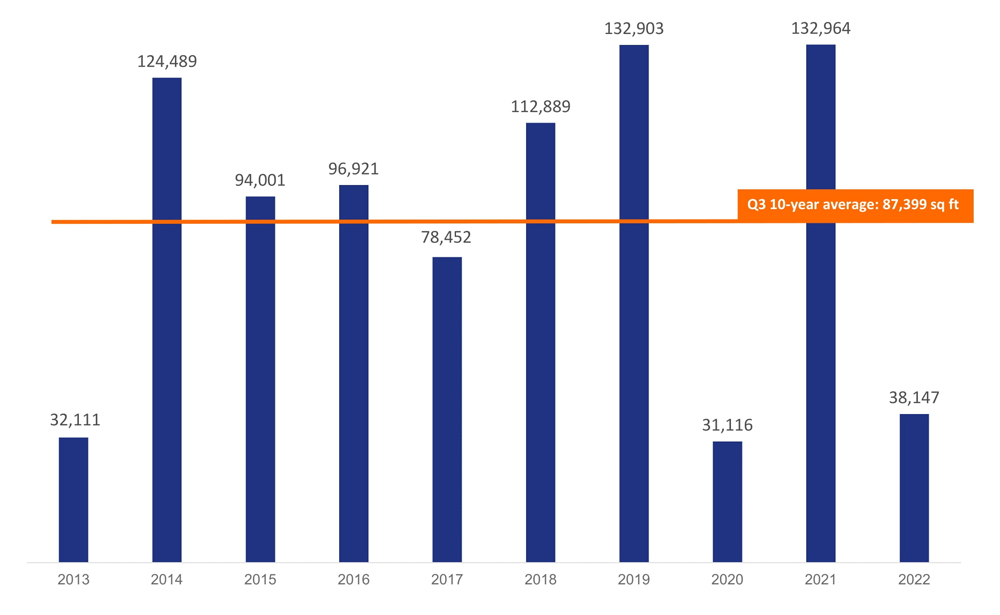

A slightly larger quarter than Q2, the Solihull office market secured 38,147 sq ft across eight lettings with a diverse range of occupiers and a lean towards construction.

Junction 6 of the M42 was the focus of the majority of Solihull office market deals in a quarter that was quietened by lack of office stock. With newly vacated and refurbished office buildings coming to market, occupiers keen to move may now find the offices they need.

Q3 2022 stats

3 8 , 1 4 7

total take-up (sq ft)

1 7 , 2 8 5

largest transaction (sq ft)

8

total transactions

M42 / Solihull office market Q3 take-up (sq ft)

M42/Solihull office market at a glance

- Tarmac Trading takes a new road – largest transaction of the quarter

- Flight to Eagle 2 – Eagle 2 attracts two new occupiers

- A modest year – lack of options to relocate quietens market

- Construction sector continues to build – more construction businesses take space

- Space is coming – several office buildings coming back to market

- Retention and renewals – transactions are few, but confidence is strong

- Rents rising – availability nudging rental levels up

- Outlook – updates to M42 junction 6 to enhance commuter experience

Tarmac Trading takes a new road

The largest letting of the quarter was to Tarmac Trading, which took 17,285 sq ft at T3 Trinity Park. This letting represented 45% of the total square footage transacted in the Q3 Solihull office market.

Tarmac is relocating from its existing offices at nearby Portland House, which is now vacant. On the market, Portland House offices are currently not refurbished but we would expect to see works carried out – including replacement of the building’s M&E, before a new occupier moves in.

Flight to Eagle 2

Eagle 2 at Eagle Court secured two occupiers in transactions that totalled 8,536 sq ft. Between the two lettings is a perfect demonstration of the diverse appeal of Birmingham’s out of town office market.

| Occupier | Sector | Size (sq ft) |

|---|---|---|

| Enerveo | M&E contractors | 4,492 |

| Brooks Running | Sports clothing and footwear | 4,044 |

| Total | 8,536 |

M&E contractor, Enerveo, took the larger space – 4,492 sq ft. It is one of the latest occupiers among construction sector and related businesses that have been a strong contingent in recent quarters. One of the UK’s largest contracting businesses, Enerveo also recently launched an apprenticeship programme in collaboration with training company, JTL – further demonstrating its commitment to the region.

The other new occupier at Eagle 2 is the well-known sports clothing and footwear brand, Brooks Running, based in Seattle.

A modest year for the Solihull office market

With two consecutive quarters delivering shy of 40,000 sq ft, despite a bumper Q1, the year will finish modestly in comparison to the 10-year average of 314,789 sq ft.

There are a number of contributing factors towards the low total for the Solihull office market this year. One of the key reasons is the lack of larger transactions driven by lack of larger space.

The largest transaction of 2022 so far was to the Government, which took 37,509 sq ft at 3010 & 3020 The Crescent on Birmingham Business Park. We don’t expect this to be topped in Q4, but the Park’s inability at the time to fulfil such a requirement in one building demonstrates the lack of availability. Though refurbished office space will soon come to market at the Park, the letting to the Government represented the removal of the largest space there from the market.

Whilst some businesses have seen a quick return to the office, post-pandemic, others have not – with many workers taking a hybrid approach blending in-office working and working from home. With this in mind, some occupiers are still figuring out exactly what their office requirements are.

Furthermore, given the cycles the market operates in – typically around 5 years – we are only now about halfway through a cycle that began at the start of the pandemic. As we approach the end of this five-year cycle – in the next year or two – we could well see more decisions being made in terms of long-term office requirements.

Construction sector continues to build

In the previous quarter, construction and related businesses accounted for more than half of the transactions in the Solihull office market. In Q3, we see another strong showing from the sector – three transactions totalling 25,311 sq ft, 66% of the quarter’s take-up.

| Occupier | Sector | Building | Size (sq ft) |

|---|---|---|---|

| Tarmac Trading | Construction services | T3 Trinity Park | 17,285 |

| Enerveo | M&E contractors | Eagle 2 | 4,492 |

| Stonebond | Housebuilder | 2030 The Crescent | 3,534 |

| Total | 25,311 |

Space is coming

With a quiet period in lettings driven by lack of supply, it is somewhat of a relief to see offices coming to the market – or on the way – totalling 228,000 sq ft.

Office space new to the market and in the pipeline

| Building | Location | Size (sq ft) | Availability |

|---|---|---|---|

| AIR | Solihull | 70,000 | |

| Portland House | NEC / Birmingham Airport | 61,000 | |

| One Central Boulevard | Blythe Valley Park | 60,000 | Available now |

| Blake House | Eagle Court Business Park | 37,000 | |

| Total | 228,000 |

AIR

The 70,000 sq ft office building, also known as 35 Homer Road, has been undergoing a refurbishment that will deliver a triple height external canopy, fitness studio, cycle hub and roof terrace.

One Central Boulevard

Following lease events, this Blythe Valley Park building has available c. 60,000 sq ft, though not currently all grouped together.

Portland House

Newly vacated by Tarmac Trading, this 61,000 sq ft building has come to market, but would need refurbishment to secure an occupier. Alternatively, these works might be done in collaboration with an occupier in order to meet their specific needs.

Blake House

Located adjacent to Eagle 2 on Eagle Court Business Park, Blake House offers 37,000 sq ft of self-contained offices in Solihull – and an ideal regional HQ.

The introduction of this newly available space provides much needed stock to the market and may loosen up the gridlock we’ve seen over recent years, with occupiers having fewer options for office relocation.

With high quality, refurbished office space available – providing heightened ESG credentials and cost-efficient M&E, occupiers are likely to be more inclined to move. In turn, their former offices will be vacated allowing for quality-raising refurbishment.

Retention and renewal

Transactions are not the only measure of an office market’s strength. Retention and renewals are another reliable and informative indicator of an area’s prosperity and the state of its office occupiers.

The Solihull office market has seen excellent retention throughout and following the pandemic. Occupiers have been retaining space, arguably at a higher rate than was expected.

A key takeaway from this, if you’re a landlord, is that you may have been hearing ‘the office market might crash’ and you may lose occupiers. As far as traditional space is concerned, this did not – and is not – happening.

Even serviced offices, which saw their space empty during the lockdowns, have seen a strong return to form. Space has not been vacated and occupiers have been renewing leases.

The market isn’t even seeing significant changes to requirements, which would be visible in grey space – surplus space that an occupier is looking to sublet or otherwise relinquish. We are not seeing such space being freed up.

Rents rising

Availability, among other factors, is slowly but surely nudging rents upwards. Whilst there is a national slowing of enquiries, there is still strong demand for high quality office space in the Solihull office market.

We would anticipate that a new-build high quality offices could command around £32-£33 per sq ft. The resultant yields should be an encouraging motivator for investors and developers considering the area.

Newly refurbished office stock is achieving around two-thirds of this and, as such, represents a more affordable prospect for occupiers. However, with the cost of refurbishment works and materials increasing significantly, refurbished rents could be pushed on as landlords look to recoup these investments.

Outlook

The buildings coming to the Solihull office market are expected to improve manoeuvrability for occupiers that have yet to find the right available office building to relocate to. It’s important though not to see this as a ‘sea change’ for the market, as there remains a need to see new office developments brought forward.

On the topic of better manoeuvring, the new bridges being added at Junction 6 – where this quarter saw the bulk of office market activity – will provide a welcome improvement to communications links.

You can watch a video of the recent progress at the site below.

The £285m upgrade includes:

- New 2.4km dual carriageway link road, aligned to the west of Bickenhill

- New junction (5a) on the M42, approximately 1.8km south of the existing M42 Junction 6 (Solihull)

- Two new roundabouts north of the B4102 Solihull Road on either side of the M42

- A new overbridge above the A45 near the Arden Hotel, providing cyclists and walkers with a safer route to cross the A45

Due for completion in 2024-2025, this will enhance the occupier appeal of this particular part of Birmingham’s out-of-town market – home to the NEC, Birmingham International Station and Birmingham Airport.

STOP THE PRESS! We’re delighted to hear that Arden Cross – which promises much needed office space – will hopefully take another step forward this month. The cabinet of Birmingham City Council will meet on 8 November to review the appointment of a development partner for the scheme. The £3.2bn project will deliver six million sq ft of commercial development space, up to 3,000 homes and a network of public realm and green spaces.

See full details of the transactions featured in our M42 and Solihull office market research.

For more information, please contact Malcolm Jones on 0121 233 2330 or email mjones@kwboffice.com.

To register for future research updates, click here. See also our Birmingham office market research.

Want to know more?

Contact Malcolm Jones

0121 233 2330