Birmingham office market research — Quarter 3 2022

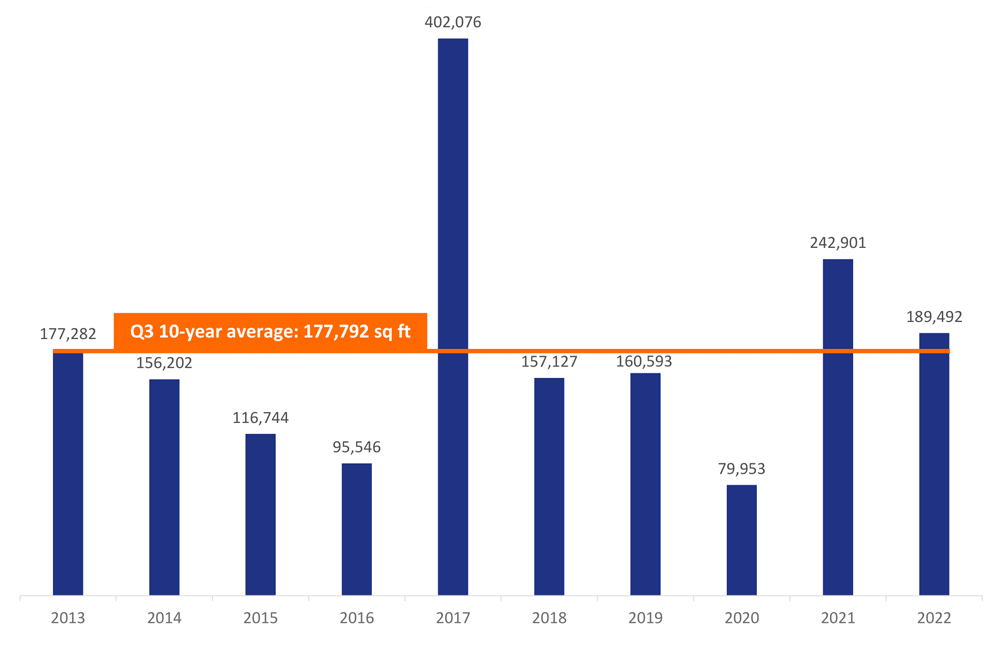

The best quarter this year, the Birmingham office market delivered 189,492 sq ft across 28 transactions. The quarter was topped by a landmark letting to Goldman Sachs.

This major Birmingham office market transaction to the investment banking firm may eclipse everything else taking place this quarter in terms of size, but there’s still plenty of interesting activity.

For example, iCentrum secured six occupiers in a single quarter after the building was refurbished to a high standard. The entrepreneurial businesses taking space within this digital innovation centre, and the community of companies they join, are an excellent example of Birmingham’s position at the forefront of the design and TMT industry.

1 8 9 , 4 9 2

total take-up (sq ft)

1 1 0 , 0 0 0

largest transaction (sq ft)

2 8

total transactions

Birmingham office market Q3 take-up (sq ft)

Birmingham office space market at a glance

- Goldman Sachs invests in Brum – investment banking giant commits to city with 110,000 sq ft at One Centenary Way

- Key transactions – Goldman Sachs tops the table, but 10,000+ sq ft deals are lacking due to stock

- Serviced offices, hidden occupiers – flexibility attracts some from traditional space

- Traditional core renewed – landmark new builds refocus bulk of major activity on core

- Arena Central – what oven-ready office space remains at the major redevelopment site?

- Eyes drawn to iCentrum – refurbishment attracts forward-thinking smaller businesses

- Outlook – BBC chooses Digbeth and government set to announce next big deal

Goldman Sachs invests

The largest letting of the quarter was to American multinational investment bank and financial services company, Goldman Sachs.

It has taken 110,000 sq ft at One Centenary Way, accounting for 58% of the Birmingham office market total this quarter, and 23% of the year-to-date. This is the latest in a series of lettings to the investment bank in Birmingham city centre, having established a temporary base here last year.

Gurjit Jagpal, Managing Director and Head of the Birmingham office at Goldman Sachs, said: “This new office space will be perfectly suited to our collaboration, flexibility and growth requirements in the years ahead. We are excited to cement and grow our position as an important employer and member of the business community in the city and the region.”

At the beginning of 2021, Goldman Sachs announced it was planning significant inward investment in the second city. Richard Gnodde, Chief Executive Officer for Goldman Sachs International, said:

“Establishing a new office in Birmingham will diversify our UK footprint and give us access to a broad and deep talent pool in the local area. We see tremendous opportunity to enhance our UK presence and continue delivering for our global clients.”

Following hot on the heels of the announcement in Q2 2021, the bank took 7,551 sq ft of flexible workspace at WeWork within the majorly-refurbished 55 Colmore Row. The offices opened in September of that year.

Then, earlier this year, they took a further 7,090 sq ft in the building, bringing its total occupancy to 14,641 sq ft. Over this time, the firm has recruited nearly 250 new positions in functions such as engineering, human capital management, legal, audit and corporate and workplace solutions.

WeWork’s managed office space provided Goldman Sachs with the necessary flexibility and capacity for expansion – whilst reducing liabilities and responsibilities. At the same time, it provided the business with a home in a renowned, landmark building in the city’s prime Colmore Business District.

The new office space in One Centenary Way comprises floors 8-12 and includes the building’s roof terrace, which overlooks Centenary Square. The business is understood to be planning to relocate and recruit several hundred staff into the space, with scope for the headcount to reach more than 1,000 people in future years.

Gurjit said: “The quality, depth and breadth of Birmingham’s talent pool has exceeded expectations in our first year in the city.”

Key transactions in the Birmingham office market

Birmingham city centre transactions over 10,000 sq ft in Q3 2022

| Location | Size (sq ft) | Occupier | Business sector |

|---|---|---|---|

| One Centenary Way | 110,00 | Goldman Sachs | Financial |

| 103 Colmore Row | 12,178 | Facepunch Studios | Gaming / TMT |

| Total | 122,178 | 64% of take-up, 2 transactions |

Q3 saw just two deals over 10,000 sq ft. Where normally we see a flurry of deals in the bracket of 10,000-15,000 sq ft, there are few readily-available, high-quality options currently in the Birmingham office market.

Besides Goldman Sachs, the other deal over 10,000 sq ft was to gaming company, Facepunch Studios. The software developer is well-known in the gaming community for producing Garry’s Mod and Rust, two of the most popular games for the pioneering video game digital distribution service, Steam. Currently based at Bloxwich Hall, Elmore Court in Walsall, the relocation will see Facepunch upgrade its office space substantially and move to one of Birmingham city centre’s most prominent and sought-after office buildings, 103 Colmore Row.

Craig Gwilt, director at Facepunch, said: “We’re really excited to be relocating to 103 Colmore Row. Birmingham is the right choice for our expansion plans as there’s an abundance of creative talent in the area we can attract, with excellent transport links for our local, national and international employees and visitors, as well as the local amenities all within easy reach.

“Sitting right in the heart of the city centre, 103 Colmore Row is the perfect location for our new home.”

103 Colmore Row has been the focal point for many of these size of deals in recent quarters. However, availability at the new office building is now low, following a strong and steady stream of lettings. The mix of occupiers and the standalone nature of the building, as opposed to multi-building sites such as Paradise, casts 103 as a kind of ‘vertical business park’ that is drawing in a diverse range of occupiers.

Though deals of 10,000 sq ft and above were thin on the ground, there were other not-so-big but nevertheless notable deals:

Colliers

Not far off the 10,000 sq ft mark, was a further letting at 103 Colmore Row. Commercial property agents and joint-agent on the office building, Colliers took 9,215 sq ft to house its 125-strong team. Having seen such strong market appeal first hand as it secured lettings at the property, the agents moved quickly to ensure their own occupancy at the landmark building.

This reflected a more traditional letting than some recent deals within the property, where the space-headcount ratio has clearly indicated more of a hybrid working model. Knight Frank commercial property agents, another joint-agent for the scheme, took office space within the building at the end of last year.

EU Automation

The global automation parts supplier took 5,000 sq ft of comprehensively refurbished office space at 10 Temple Street. Interestingly, the letting is a case of inward investment, which sees the business move its office-based staff from Staffordshire Technology Park.

This makes it the latest example of a traditionally out-of-town occupier moving into Birmingham city centre. Last quarter, we examined the reasons some occupiers may have for doing this, including the need to attract the best talent into the business.

Serviced offices, hidden occupiers

A considerable amount of office space has been let to serviced office operators, particularly in the three years prior to the pandemic where almost 645,000 sq ft was let to this sector between 2017 and 2019. Whilst the pandemic hit serviced offices hard, their popularity has surged back with a vengeance since the end of lockdowns.

Office space taken by serviced office operators 2017-2019

| Year | Take-up | No of transactions |

|---|---|---|

| 2017 | 200,202 | 9 |

| 2018 | 215,316 | 8 |

| 2019 | 229,042 | 3 |

| Total | 644,560 | 20 |

KWB understands that some key serviced office sites in Birmingham city centre, even ones that have opened very recently, are now full. It is fair to assume then that some occupiers that we might have otherwise seen taking traditional lettings and appearing in the transaction figures have instead taken managed or serviced office space.

The numbers involved here are difficult to calculate as these deals are not typically made public, save for landmark deals such as Goldman Sachs at WeWork. They would also be regarded as ‘double-counting’, having already recorded the letting to the serviced office operator ahead of their licensees taking space. Nevertheless, healthy levels of occupancy within serviced office centres reflect a positive outlook for the city’s economy.

Traditional core renewed

As the cranes have returned to Birmingham city centre over the past 5 years, and new office buildings have gone up, the focus of occupiers has been drawn back to Birmingham’s traditional core.

Two and Three Snowhill, 103 Colmore Row, Two Chamberlain Square and One Centenary Way are all new buildings that have seen lettings over the past 5 years and taken the lion’s share of the major landmark office transactions.

Meanwhile, locations further out such as Brindleyplace and fringe areas like Edgbaston and Digbeth have been quieter. Many fringe buildings have been converted to residential rather than being refurbished, and the reasons for this are varied. It could be that the layout and fabric of the building made it not possible to deliver a certain specification or that the potential residential yield would be so much higher than that of offices.

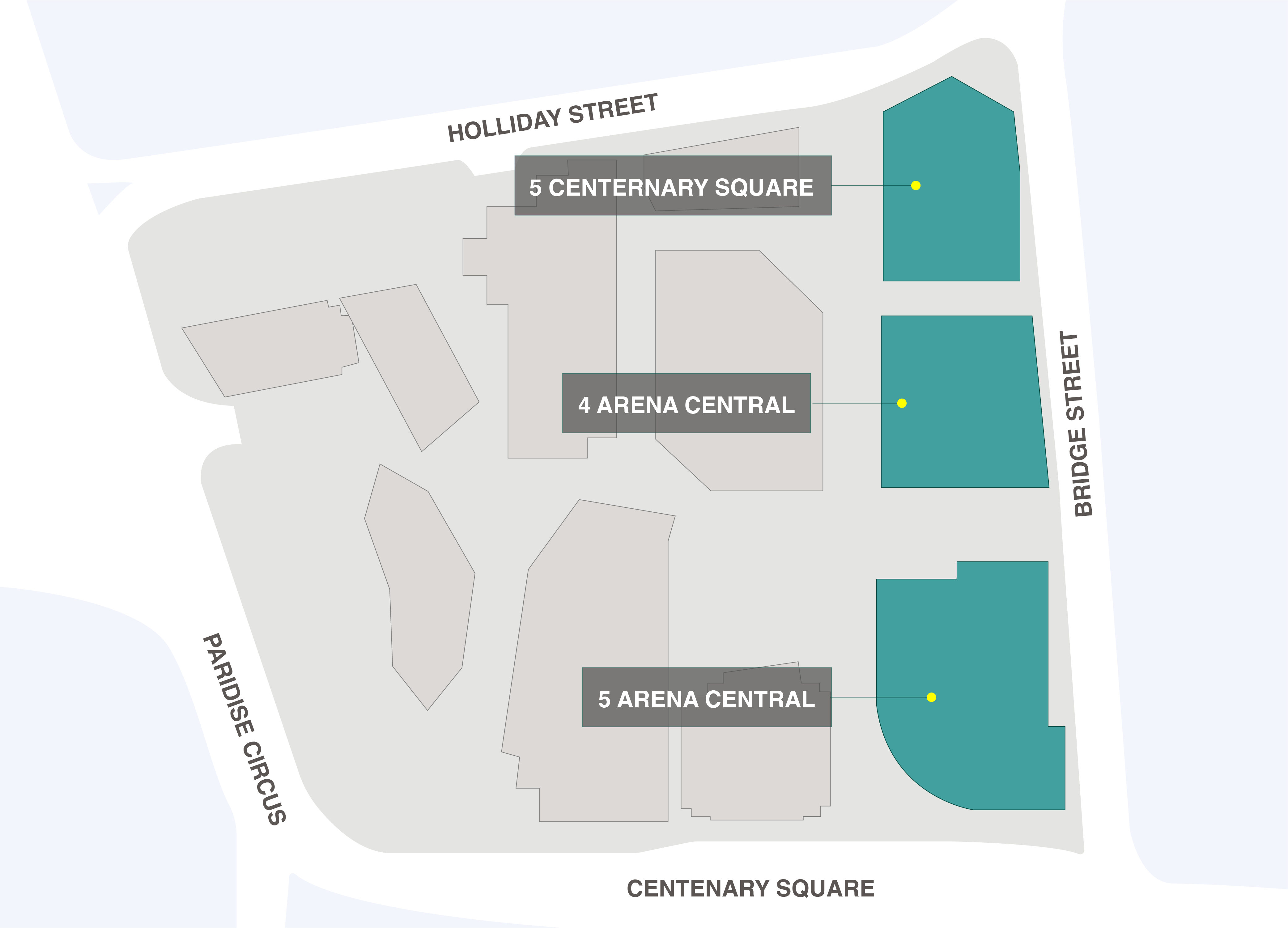

Arena Central

With a string of high-profile pre-lets across the Arena Central site, availability at this major redevelopment is now focused on three remaining proposed buildings – totalling 519,582 sq ft.

| Building | Size (sq ft) |

|---|---|

| 5 Centenary Square | 140,000 |

| 4 Arena Central | 189,544 |

| 5 Arena Central | 190,038 |

| Total | 519,582 |

Paradise is unrecognisable from 10 years ago, and landmark occupiers have cemented the landmark status of the redevelopment. Arena Central’s ready-to-go development projects therefore represent opportunities for occupiers to position themselves close to the Paradise site.

Eyes drawn to iCentrum

iCentrum was the original anchor building completed in 2016 for the wider Innovation Birmingham Science Park in Aston. It was designed to be at the forefront of ICT-enabled collaborative environments aimed at the Gen Z social media generation, creating a place for Birmingham’s future entrepreneurs to connect and collaborate.

It has recently undergone refurbishment and this has seen the building attract new occupiers – six this quarter, totalling 10,536 sq ft – that’s 13% of the remaining deals in the quarter after excluding the landmark deal to Goldman Sachs.

| Occupier | Size (sq ft) | Business Sector |

|---|---|---|

| WLF Innovations | 3,389 | Design consultants |

| Aston Cyber | 2,237 | IT / TMT |

| Xindao / XD Connects | 1,513 | Promotional items / Marketing services |

| Cyber Working Group | 1,245 | IT / TMT |

| High Value Manufacturing Catapult (HVMC) | 1,191 | Manufacturing consultants |

| Quicktron | 961 | Robotics / TMT |

| Total | 10,536 |

The range of occupiers are well within the wheelhouse of the innovation campus, which typically attracts businesses in fintech, manufacturing, cyber security and sports tech. A great example from the new cohort of occupiers is High Value Manufacturing Catapult (HMVC), which took 1,191 sq ft in a relocation from Blythe Valley Park, Solihull. Formed 11 years ago by Innovate UK, HMVC has seven research centres across the UK and focuses on innovation in fields such as materials, automation, virtual reality and additive manufacturing.

Outlook

Looking ahead, there’s plenty of office space transactions coming down the line. It’s been announced that the BBC will be relocating from its offices in The Mailbox and into the former Typhoo factory located in Digbeth, which the tea company vacated in 1978. The development project will be led by Stoford, the Birmingham-based commercial property developer.

Director General Tim Davie said: “Moving our Birmingham headquarters to Digbeth is going to help build the creative success of the region – drawing new investment and production to the Midlands – and sits at the heart of the BBC’s Across the UK plans to deliver significant increases in editorial spend and decision-making outside London.”

Much of Birmingham’s brand-new office space, either built or currently coming out of the ground, has now been secured by occupiers. Sites where new high-quality office space can still be found include Three Snowhill, which has 137,000 sq ft of new vacant office space remaining following the letting to BT, which took two-thirds of the building in 2020.

The city centre core has undergone a transformation and a revival, having previously lost its ‘crown’ to Brindleyplace, which in itself now represents an interesting proposition. It is still, undeniably, a very attractive location and has played host to the Commonwealth Games planning team, but a significant portion of the office space is currently vacant. Could sufficiently high-level refurbishment of these offices provide a new lease of life, and a new flurry of leases, to Brindleyplace? It’s certainly possible, and as the Paradise development continues to evolve, it should strengthen the connectivity of Broad Street with the city core.

The Oozells Building at Brindleyplace should be a centre for transactions, as the office space has been comprehensively refurbished to provide 36,000 sq ft of Grade A space.

In terms of major deals coming down the line, the Government is set to announce the latest in a long line of major office space acquisitions in Birmingham city centre. The soon-to-be launched Audit, Reporting and Governance Authority (ARGA) will be basing itself in Birmingham. Though it is not yet known where the new regulator, which is set to replace the UK’s Financial Reporting Council (FRC), will go. However, with its predecessor comprising around 400 staff based in London, the size of the letting is expected to be substantial. The public sector has long been a frequent fixture at the top of the ‘leaderboard’ as far as quarterly and, indeed, annual Birmingham office market transaction figures are concerned.

See full details of the transactions featured in our Birmingham office market research, comprising office space in Birmingham city centre and Edgbaston.

For more information on the Birmingham office market, please contact Malcolm Jones on 0121 233 2330 or email mjones@kwboffice.com

To register for future research updates, click here. See also our M42 and Solihull office market research.

Want to know more?

Contact Malcolm Jones

0121 233 2330