M42 / Solihull office market 2022 review

Large, refurbished space coming on stream will energise the Solihull office market, which has showcased its resilience and buoyancy throughout 2022.

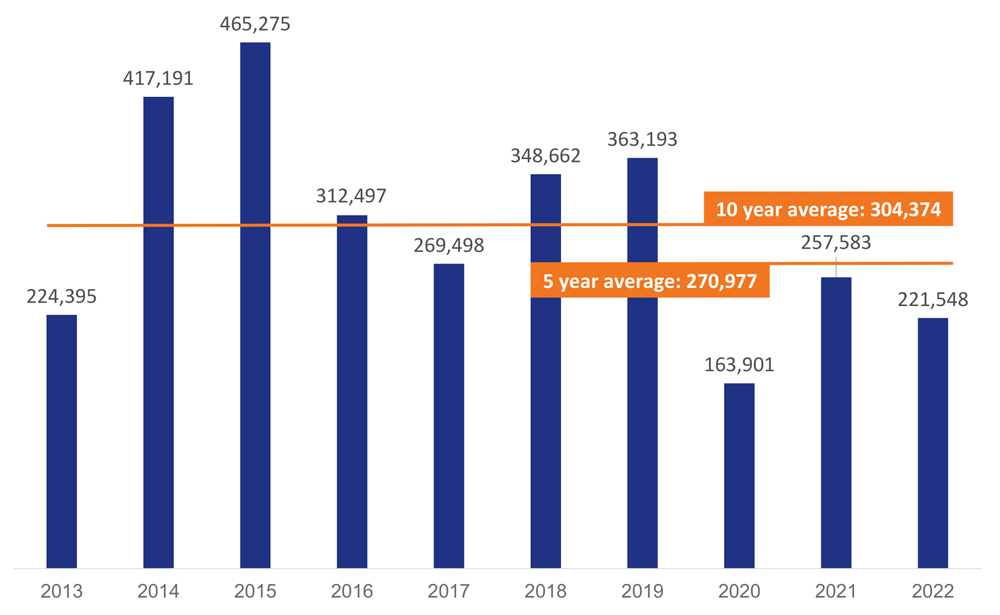

The Solihull office market 2022 demonstrated the prosperity and appeal of the M42 corridor, as it delivered a modest but respectable range of 44 deals, totalling 221,548 sq ft. The larger space that is now coming to market in 2023 will free up office space options for occupiers that have been restricted in recent years, by offering them the high quality offices they need to relocate.

2022 stats

2 2 1 , 5 4 8

total take-up (sq ft)

3 7 , 5 0 9

largest transaction (sq ft)

4 4

total transactions

M42 / Solihull office market annual take-up (sq ft)

Solihull office market 2022 at a glance

- Key transactions – 4 deals over 10,000 sq ft provide 35% of take-up

- Smaller deals dominate – and deliver most of the market

- An active final quarter – in deals if not square footage

- Housebuilders building a presence – in support of future developments

- Government deal now revealed – making Solihull a leading destination for telecoms R&D

- BBP and J6 take lion’s share – two-thirds of annual take-up

- Expansions, always a good sign – with businesses prospering

- From flexibility to stability – a return to offices and office strategies adjusted

- A very different out-of-town ahead – new developments on the horizon edge closer

- Activity centres around M42 J4/J6 – business parks drive lettings

- Outlook for 2023

Key Solihull office transactions

The Solihull office market 2022 secured four transactions over 10,000 sq ft – totalling 76,761 sq ft, representing 35% of take-up.

M42 / Solihull transactions over 10,000 sq ft in 2022

| Location | Size (sq ft) | Occupier | Qtr |

|---|---|---|---|

| 3010 & 3020 The Crescent | 37,509 | UK Telecoms Lab | Q1 |

| T3 Trinity Park | 17,285 | Tarmac Trading | Q3 |

| Cala House | 11,244 | Hayfield Homes | Q2 |

| 6190 Knights Court | 10,723 | Persimmon Homes | Q4 |

| Total | 76,761 | 35% of take-up, 4 transactions |

Smaller deals dominate

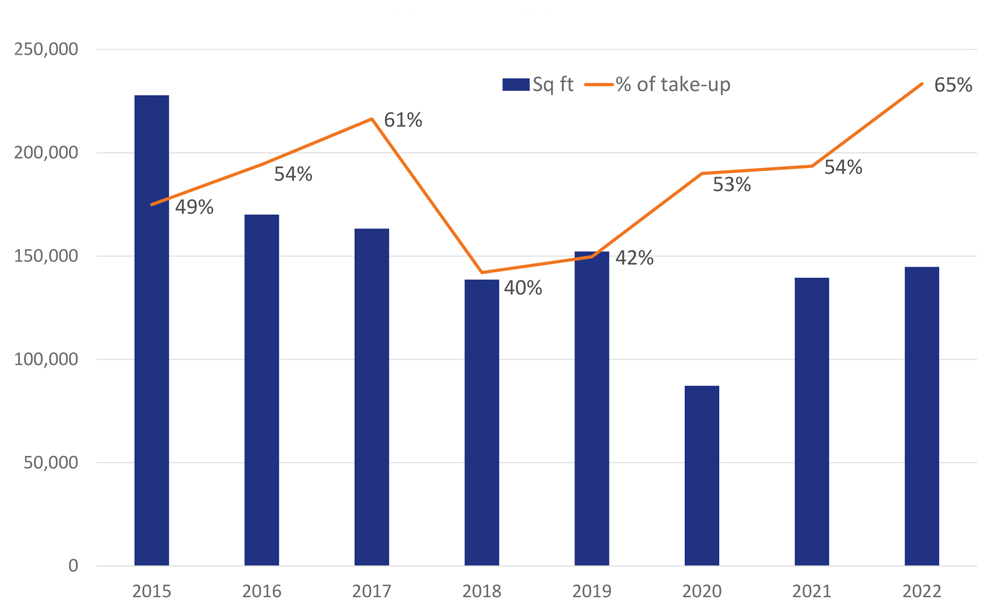

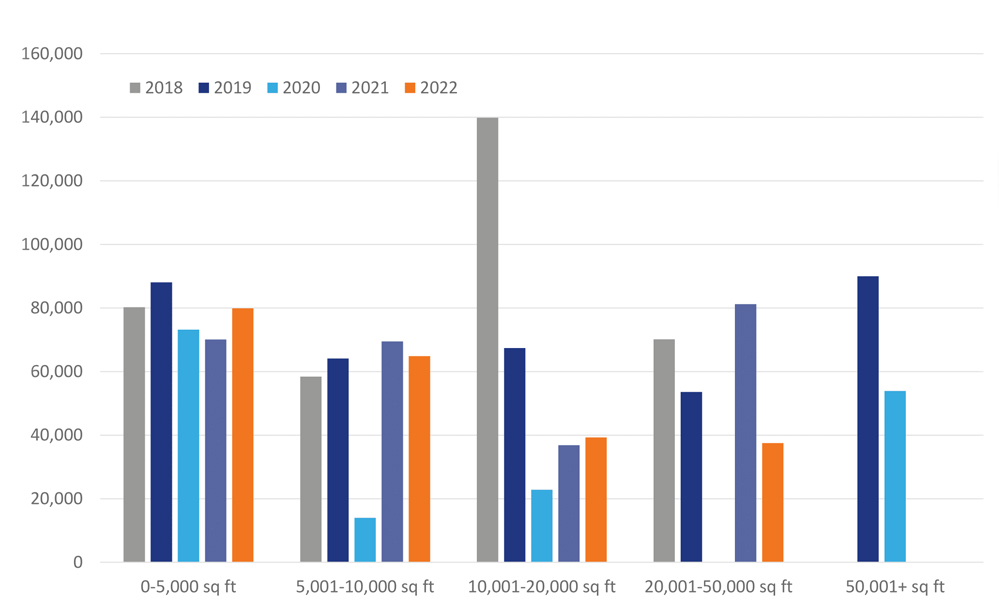

In 2022, the 0-5,000 and 5,000-10,000 sq ft size brackets represented 65% of the year’s take-up in the Solihull office market, the highest since records began.

M42 / Solihull 0-10,000 sq ft size bracket as % of 2022 take-up

In contrast, in Birmingham city centre, whilst 0-5,000 sq ft consistently accounts for around a quarter of the square footage each year, the 20,000-50,000 sq ft bracket routinely secures a large amount of the market’s take-up – 25% in 2022. Whilst there are various reasons for this, availability is one of the most important considerations.

In Solihull, we are now seeing newly refurbished office stock coming to market, which will change the dynamic we have seen in recent years that has prevented larger occupiers from relocating.

An active final quarter

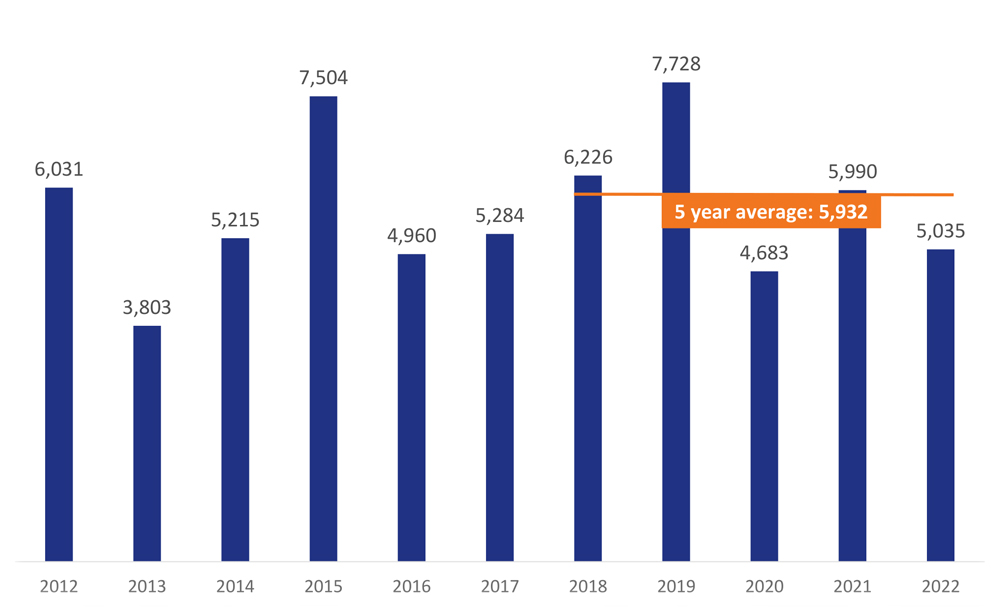

The Solihull office market 2022 finished the year strongly, with 18 transactions in Q4 – 40% of the annual total (44). However, whilst achieving the most deals of any quarter in the last six years, Q4’s average transaction size was relatively low at 3,489 sq ft. The following graph shows its impact on the overall year – and again the impact of smaller deals.

M42 / Solihull average transaction size (sq ft) in 2022

The active lower end of the Solihull office market demonstrates that there is continued buoyancy here – but that only translates to activity in the size brackets where space is available. Long-term and current trends show us that we can expect to see larger deals taking place once occupiers have high quality alternatives to their existing office space – which bodes well for 2023 with its increasing availability of larger high quality office space.

M42 / Solihull take-up by size bracket over last 5 years (sq ft)

Housebuilders building a presence

In recent years, a variety of construction businesses have expanded in or gravitated to the M42 corridor. Given the plans for major developments such as Arden Cross and the NEC Masterplan, spurred on by HS2, this is hardly surprising.

In the Solihull office market 2022, we saw several housebuilders taking space, with four transactions totalling 29,906 sq ft – 13% of the year’s square footage. The largest of these was to Hayfield Homes, which took 11,244 sq ft at Cala House and represented the largest transaction of Q2.

In Q4, Persimmon moved to 10,723 sq ft of high quality office space at 6190 Knights Court on Birmingham Business Park. The largest transaction of the quarter was a relocation for the housebuilder to higher quality office space, moving from its offices at Tameside Drive in Castle Vale.

These companies may not yet be connected to the aforementioned new commercial property developments. However, positioning themselves and their highly skilled teams close to these sites could be a logistical advantage for the residential elements associated with or supporting these projects.

M42 / Solihull transactions to housebuilders in 2022

| Location | Size (sq ft) | Occupier | Qtr |

|---|---|---|---|

| Cala House | 11,244 | Hayfield Homes | Q2 |

| 6190 Knights Court | 10,723 | Persimmon Homes | Q4 |

| Barnsley Hall | 4,405 | BN Developments | Q2 |

| 2030 The Crescent | 3,534 | Stonebond | Q3 |

| Total | 29,906 | 13% of take-up, 4 transactions |

Government deal revealed

In the first quarter, the largest deal was the last available large office space on Birmingham Business Park – 3010 & 3020 The Crescent. At the time, it was only announced that it had been let to an unnamed government department, but towards the end of the year more details were revealed.

Taking the 37,509 sq ft on Birmingham Business Park is UK Telecoms Lab, a government-funded initiative being led by NPL, The National Physical Laboratory. The first of its kind in the country, the lab will act as a secure research facility bringing together telecom operators, suppliers and academics to research and test innovative new ways of boosting the security, resilience and performance of the UK’s mobile networks.

The NPL, which is based in West London, was where Alan Turing built the Automatic Computing Engine in the late 1940s, on which the first modern computer was based.

This is a prime example of job generation in a region where tech is one of the fastest growing sectors. Digital Infrastructure Minister, Julia Lopez, said: “We are determined to harness the power of ultrafast, seamless 5G connectivity to boost economic productivity and close the digital divide.

“With 6G on the horizon, our £80 million investment in this state-of-the-art lab will maximise the innovation, security and resilience of these revolutionary digital networks. It will help turn Solihull into a leading destination for telecoms R&D – unlocking jobs and growth right across the West Midlands.”

BBP and J6 take lion’s share

Birmingham Business Park accounted for the largest share of annual take-up with 37% of square footage across 9 transactions. The Park often achieves a significant proportion of the office space transacted in Solihull and the M42 corridor, as a go-to location.

The Park is home to an impressive range of high-profile occupiers, and it is one of the few locations in Birmingham’s out-of-town office market that can support large relocations, expansions or consolidations. Occupiers are also attracted by its strategic connectivity – being close to J6 M42 and J4 M6, with Birmingham Airport and Birmingham International train station right on the doorstep.

Transactions at Birmingham Business Park in 2022

| Qtr | Office building | Occupier | Size (sq ft) | Business sector |

|---|---|---|---|---|

| Q1 | 3010 & 3020 The Crescent | UK Telecoms Lab | 37,509 | TMT / Government |

| Q4 | 6190 Knights Court | Persimmon Homes | 10,723 | Housebuilder |

| Q4 | 3100 Park Square | NTT DATA | 9,021 | IT services / TMT |

| Q1 | 2800 The Crescent | Align Technology | 8,401 | Orthodontic manufacturing |

| Q2 | 2470 Regents Court | Daikin | 4,705 | Manufacturers of heating and air conditioning systems |

| Q4 | 6240 Bishops Court | TVH | 3,909 | Industrial parts & accessories |

| Q3 | 2030 The Crescent | Stonebond | 3,534 | Housebuilder |

| Q4 | 6110 Knights Court | Acer Healthcare | 2,614 | Care |

| Q4 | 2675 Kings Court | Spirotech | 2,018 | Heating & cooling manufacturer |

| Total | 82,434 | 37% of take-up, 9 transactions |

In addition to Birmingham Business Park, the areas adjacent to Junction 6 of the M42 (including Coleshill) accounted for a further 30% of annual take-up. The importance of this strategic location at the junction of the M42 and M6 is demonstrated by two-thirds of the office market activity being concentrated in this area in 2022.

Expansions, always a good sign

Several transactions in Q4 2022 represented businesses taking additional space at their existing premises. These deals always provide a useful indication that businesses are prospering within an area, as they look to grow their teams to fulfil increasing demand.

Aspen Bridging

The largest of these expansions was principal lender, Aspen Bridging who were already based at Cranmore and took 4,285 sq ft at 2 Stratford Court.

Dodd Group

Taking 2,508 sq ft at 3 Quartz Point, electrical and mechanical services provider, Dodd Group expanded their stake at Junction 6 of the M42.

Handelsbanken

In one of the few office lettings taking place this year in Bromsgrove, Handelsbanken took 2,414 sq ft at 2 Topaz.

From flexibility to stability

Post-pandemic, we’ve seen teams return to offices, as well as office strategies being adjusted. 2022 provided evidence of occupier decision-making in action, as they identify what they need from offices going forward.

The example of Spirotech provides an insight into how businesses modified their office strategy in response to the pandemic. During this time, the office-based team of the conveyor belt manufacturer transitioned to a flexible working model with many working from home. The 2,018 sq ft of office space that Spirotech secured in Q4 2022 at 2675 Kings Court on Birmingham Business Park represented a move back to the office.

Talent Hive’s story is equally insightful. The recruitment company moved out of traditional office space and into serviced offices to provide them with the desired level of flexibility, during times of uncertainty. Now, however, they have taken the decision to move back into traditional office space – taking 1,130 sq ft of high quality refurbished offices at 2 Stratford Court in Cranmore, an established office area of Solihull.

Whilst flexibility and mobile working have been key trends within both Birmingham city centre and its out-of-town office market over recent years, some now clearly want stability. Traditional office space provides long-term security for the company within its own space, supporting the development of their business as demand for their proposition increases.

For Talent Hive and other occupiers that have moved out of serviced offices, traditional office space offers a number of benefits. These include being more cost effective in the longer term, providing greater security of tenure and the opportunity to customise the office space to enhance their brand and team’s working environment.

A very different out-of-town ahead

The landmark development and infrastructure projects around Solihull that are currently in planning stages will transform the geographical and business landscape of the area. HS2 is certainly acting as a catalyst for such projects, which will capitalise on the growing level of investment that the high speed rail project represents.

Arden Cross, which Andy Street, Mayor of the West Midlands, describes as a “mini-town”, is one of the most impressive of these projects.

Arden Cross

The £3.2 billion vision for the 340-acre site will deliver thousands of new homes, millions of square feet of commercial space, and schools. At the end of 2022, it was announced that Arden Cross had appointed developer, Muse, as its delivery partner for the first phase of the site. Coinciding with this, Muse Midlands was established as a dedicated arm for delivering the project.

Maggie Grogan, Development Director for Muse, said: ‘This is a truly unique opportunity to bring forward a landmark destination for the UK that’s a beacon for growth in the Midlands, and we’re immensely proud to be joining the team.

“As a business, we’re committed to delivering sustainable regeneration at pace, while at the same time bringing real, tangible benefits to communities, and we can’t wait to get started.”

Ben Gray, Project Director with Arden Cross, said: “Arden Cross is focused on delivering sustainable growth for the region and the whole of the UK and we know Muse will help us achieve this. We’re committed to working together to capitalise on the masterplan principles and deliver transformational change for the region, while creating a world-leading economic hub for the UK in a unique public-private partnership that leverages the superb connectivity of Arden Cross.”

The NEC Masterplan

In 2021, the NEC revealed its “Masterplan”, representing one of the most credible prospects to deliver new office space. With some of the key infrastructure already in place and given its location, the NEC Masterplan is promising in terms of likelihood, timescales and potential of long-term success. Whilst 2022 didn’t provide any public updates on the project, we see this as a project that is several important steps ahead of others, as it has fewer obstacles to overcome.

Activity centres around M42 Junction 4 and 6

Solihull town centre, and other previously active areas of the M42 corridor, have quietened with most of the office market activity taking place at the region’s business parks. Junctions 4 (excluding Shirley) and 6 (excluding Coleshill) of the M42, where the parks are located, accounted for 78% of take-up.

As previously explained, Birmingham Business Park was a dominant force in 2022, with 20% of the deals and 37% of the space secured within the market for the year. The other major business park in the area, Blythe Valley Business Park, also secured 4 deals totalling 23,362 sq ft.

2022 office transactions at Blythe Valley Business Park

| Qtr | Building | Occupier | Size (sq ft) | Business sector |

|---|---|---|---|---|

| Q4 | Rhodium | Ridge & Partners | 8,874 | Civil engineering |

| Q4 | The Hub | Johnson Controls | 6,436 | Building systems & control |

| Q2 | Cornwall House | SpaMedica | 5,327 | Ophthalmology clinic |

| Q3 | Rhodium | GKN Powder Metallurgy Holdings | 2,725 | Manufacturing |

| Total | 23,362 | 11% of take-up, 4 transactions |

Outlook for Solihull office market 2023

2023 should deliver a strong performance from the Solihull office market for a number of reasons.

The first of these is availability. As reported in Q3, where the market has been struggling for several years to provide occupiers with available space for relocation, a flurry of newly refurbished office space is on the way. AIR, Portland House, One Central Boulevard and Blake House will, together introduce 228,000 sq ft to the market and we expect interest in these properties to be high.

Lack of availability has been a severely limiting factor for the market. However, with these buildings all coming on stream, the market will now have more manoeuvrability – and, in turn, will free up other currently occupied offices for refurbishment and future marketing.

| Building | Location | Size (sq ft) |

|---|---|---|

| AIR | Solihull | 70,000 |

| Portland House | Birmingham Airport | 61,000 |

| One Central Boulevard | Blythe Valley Park | 60,000 |

| Blake House | Eagle Court Business Park | 37,000 |

| Total | 228,000 |

A second factor that will drive the market in 2023 is lease events. The market’s cycle of lease events will come into play this year, with many companies reaching the end of their 5- and 10-year leases. The combination of this and new availability is well timed and, whilst some occupiers will undoubtedly decide to renew at their existing location, others will want to relocate.

See full details of the transactions featured in our M42 and Solihull office market research.

For more information, please contact Malcolm Jones on 0121 233 2330 or email mjones@kwboffice.com.

To register for future research updates, click here. See also our Birmingham office market research.

Want to know more?

Contact Malcolm Jones

0121 233 2330