Birmingham office market 2022 review

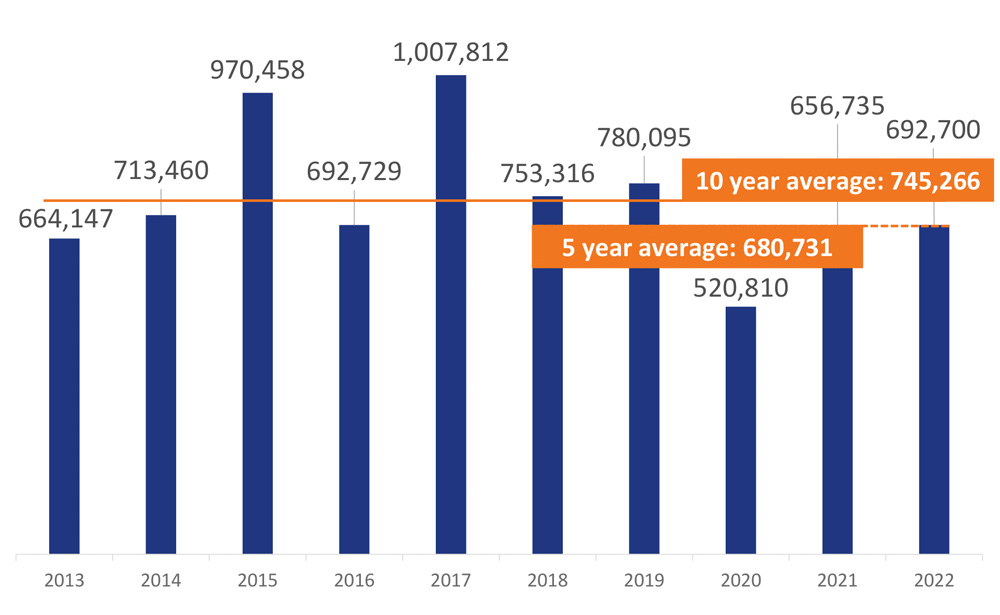

Birmingham office market in 2022 demonstrated resilience, with Q4 delivering highest quarter of the year and annual take-up totalling 692,700 sq ft across 115 deals.

With its performance in both 2021 and 2022, the Birmingham office market has shown itself to be highly resilient against a backdrop of national and global economic challenges. Q4 delivered a great quarter, the strongest of the year and higher than expected.

The two largest transactions of the year went to banking giant, Goldman Sachs and higher education provider, Global Banking School, making finance and its affiliated services a key sector this year.

2022 stats

6 9 2 , 7 0 0

total take-up (sq ft)

1 1 0 , 0 0 0

largest transaction (sq ft)

1 1 5

total transactions

Birmingham office market annual take-up (sq ft)

Birmingham office market 2022 at a glance

- Key transactions: 8 deals over 15,000 sq ft provide 44% of take-up

- 20,000-50,000 sq ft delivers again: large space being snapped up

- Top 3 sectors deliver over 70%: ‘bedrock’ city centre occupiers dominate the deals

- Global Banking School signs largest deal of Q4: city’s skills to get a boost

- Goldman Sachs’ strategy unfolds over 2022: banking giant sets up its future in Birmingham

- Rising education sector to raise skills: education sector highly active in 2022

- Recruiters answer the call: recruitment businesses addressing skills shortage

- Serviced offices have reasons to smile: back on form and in demand

- Brindley could be the place: buildings here could offer the next high quality office hotspot

- ESG dominates decision-making: quality is at the top of the occupier’s agenda

- ESG – 103 gets it right: playing to market demands pays off

- STOP THE PRESS… and bang the Drum: former John Lewis store to deliver 200,000 sq ft of offices

- Outlook for 2023

Key Birmingham office transactions

In 2022, transactions over 15,000 sq ft represented almost half of the total square footage transacted. The eight deals totalled 304,147 sq ft, 44% of the space transacted in the Birmingham office market 2022. Three-quarters of these were in the second half of the year.

| Qtr | Office building | Size sq ft | Occupier | Business sector |

|---|---|---|---|---|

| Q3 | One Centenary Way | 110,000 | Goldman Sachs | Financial |

| Q4 | Norfolk House | 43,766 | Global Banking School | Education |

| Q4 | 10 Livery Street | 30,811 | Mott MacDonald | Civil Engineering |

| Q1 | Victoria Square House | 27,132 | Office of the Public Guardian | Government |

| Q4 | 10 Brindleyplace | 25,731 | Spacemade | Serviced offices |

| Q1 | Two Chamberlain Square | 24,297 | Cubo Work | Serviced offices |

| Q2 | The Colmore Building | 22,928 | Department for Transport | Government |

| Q4 | Louisa House, Quay Place | 19,482 | University of Wales | Education |

| Total | 304,147 | 44% of take-up, 8 transactions |

20,000-50,000 sq ft delivers again

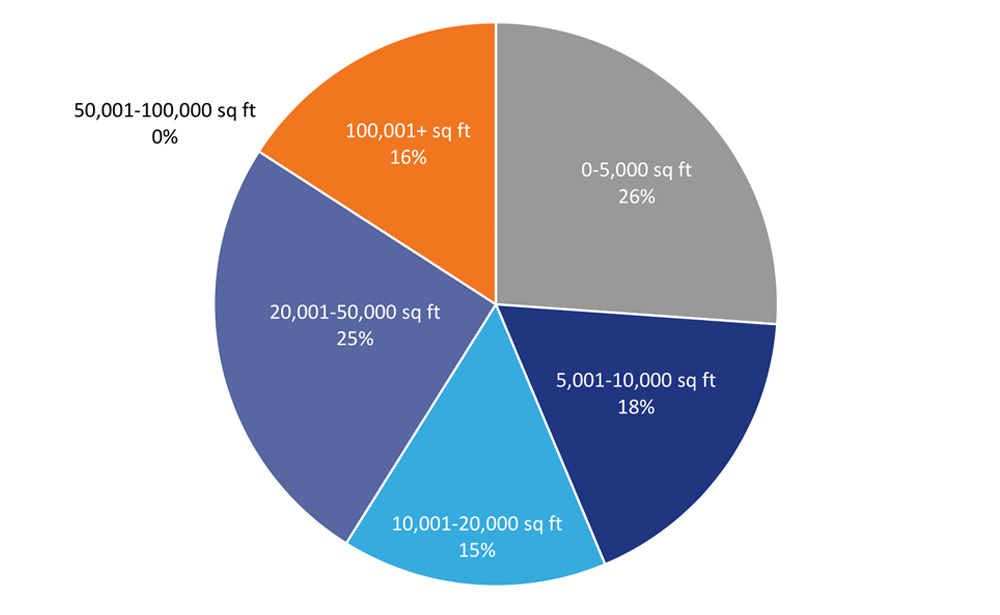

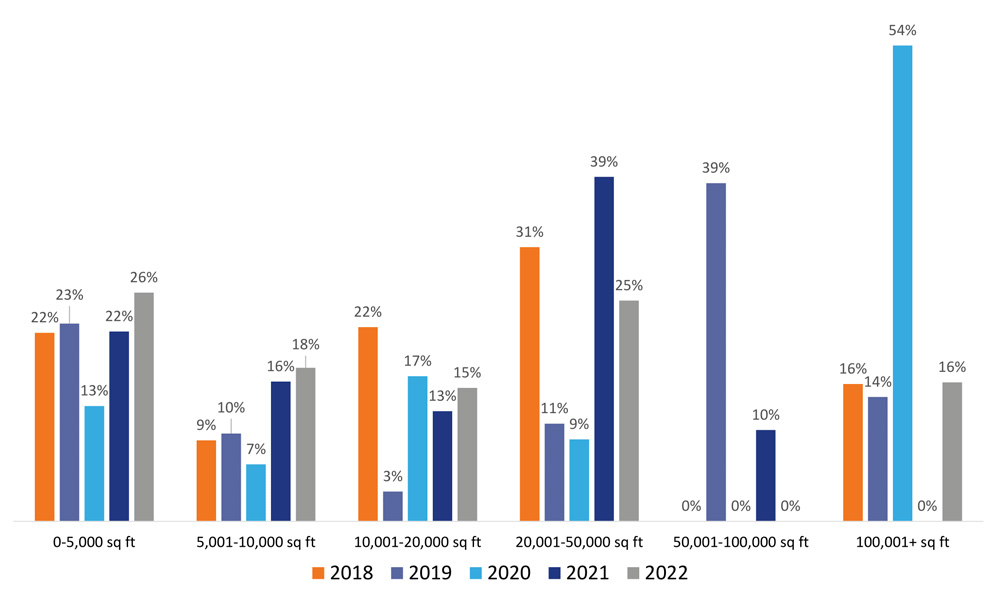

A significant part of the Birmingham city centre office market’s success in 2022 can once again be attributed to the 20,000-50,000 sq ft size bracket, which accounted for 174,665 sq ft, 25% of take-up.

With a severe lack of space in Birmingham’s out-of-town office market, the city centre is proving itself to be the place to go for larger office space of very high quality.

Birmingham office market 2022 take-up by size bracket

In 2021, the 20,000-50,000 sq ft size band totalled 258,378 sq ft, representing nearly 40% of all take-up in the Birmingham office market.

The largest size bracket in 2022 was 0-5,000 sq ft, which usually represents around a quarter of take-up. These ‘bread and butter’ deals, which any city centre office market depends on, represented 26% of 2022 take-up, and achieved nearly 40,000 sq ft more than it did in the previous year.

Birmingham office market 2022 take-up by size band

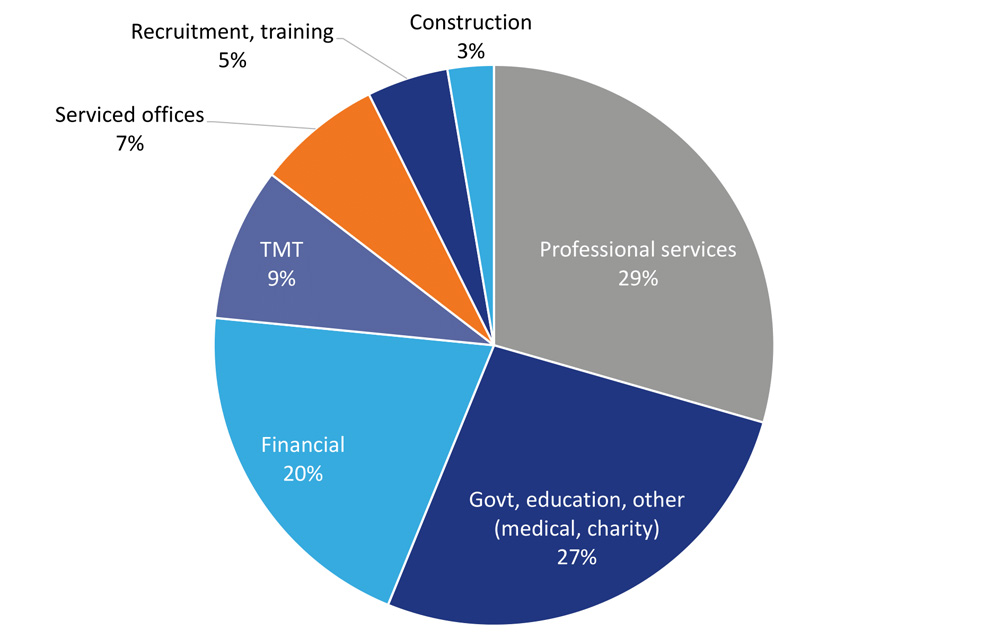

Top three sectors deliver over 70%

Over 70% of take-up in 2022 can be attributed to just three business sectors – professional services, financial and government/education. These are staple sectors for the Birmingham office market and the transactions of 2022 demonstrate the extent of their importance.

Landmark office lettings to government departments have become a trademark of Birmingham city centre over recent years. In 2022, government lettings accounted for two notable deals in Birmingham city centre that were the largest transactions of their quarter:

- Office of the Public Guardian – in Q1’s largest letting, the Office of the Public Guardian expanded at Victoria Square House by 27,132 sq ft. This letting nearly quadrupled their overall stake here, bringing it to 37,284 sq ft.

- Department for Transport – in Q2’s largest letting, the Department for Transport took 22,928 sq ft at The Colmore Building.

Birmingham office market 2022 take-up by business sector

Global Banking School signs largest deal of Q4

The largest letting of the 2022’s final quarter was to Global Banking School (GBS), which took 43,766 sq ft of space at Norfolk House. 89,681 sq ft of this 115,780 sq ft building is office space and this underwent substantial internal refurbishment between 2017 and 2018.

GBS is a private higher education provider offering a range of sector-relevant courses. Having started in 2010 as a specialist training centre for finance and investment banking, the company has been enjoying strong growth, now with other academic disciplines added to its portfolio and eight campuses across the country.

Given the nature of the business, GBS and organisations like it, are playing a vital role in nurturing the talent pool to address the skills shortage that is impacting many sectors. When we then factor in the strength of the banking sector in Birmingham and the rollout of Goldman Sachs’ strategy to launch in the city, the school’s presence will be of great value to many recruiters.

Stephen Inglis, CEO of London & Scottish Property Investment Management and Asset Manager for Norfolk House, said: “GBS was attracted to the high-standard refurbished property due to its ideal location, adjacent to Birmingham New Street railway station, and it being one of the few properties in Birmingham offering flexible floor plates in excess of 10,000 sq ft”.

Goldman Sachs’ strategy unfolds over 2022

American multinational investment bank and financial services company, Goldman Sachs, provided the largest transaction of the year. In Q3, it took 110,000 sq ft at One Centenary Way, a deal representing 16% of the year’s total.

At the time of the announcement, Gurjit Jagpal, Managing Director and Head of the Birmingham office at Goldman Sachs, said: “This new office space will be perfectly suited to our collaboration, flexibility and growth requirements in the years ahead. We are excited to cement and grow our position as an important employer and member of the business community in the city and the region.”

However, this is not the full story for the banking giant, which initially established a temporary base of 7,551 sq ft at 55 Colmore Row in 2021.

Birmingham city centre offices let to Goldman Sachs in 2022

| Location | Size | Quarter |

|---|---|---|

| 55 Colmore Row | 7,090 | Q1 22 |

| One Centenary Way | 110,000 | Q3 22 |

| Two Chamberlain Square | 11,000 | Q4 22 |

| Total | 128,090 | 18.5% of year total |

In Q1 2022, Sachs expanded by 7,090 sq ft at 55, taking its total occupancy at the property to 14,641 sq ft. Here, the bank occupied serviced offices delivered by WeWork – providing the flexibility required to play out its strategy to cement itself within Birmingham.

Since the announcement in Q3 of its landmark letting at One Centenary Way, Goldman Sachs has now taken 11,000 sq ft at Two Chamberlain Square. We assume this is designed to help facilitate the expansion of Goldman Sachs’ Birmingham team, prior to relocating into its permanent home.

Rising education sector to raise skills

The education sector was responsible for 8 of the year’s 115 transactions, totalling 94,149 sq ft – 14% of the year’s take up. The largest of these lettings was the previously mentioned letting to the Global Banking School but, notably, the University of Wales also took space in both Q1 and Q4, as the institution has expanded its online learning services.

At the start of the year, the university took 3,172 sq ft at Vincent House at Quay Place, a transaction that was then dwarfed by its securing of 19,482 sq ft at the nearby Louisa House in Q4. Demand for remote learning was driven through the pandemic, changing the education landscape. Organisations that offer remote learning have seen a significant increase in demand for their services, even with students of all ages now having returned to the classroom.

Education sector lettings in 2022

| Location | Size (sq ft) | Occupier | Qtr |

|---|---|---|---|

| Norfolk House | 43,766 | Global Banking School (GBS) | Q4 |

| Louisa House, Quay Place | 19,482 | University of Wales (UWTSD) | Q4 |

| Interchange | 9,968 | Teacher Active | Q4 |

| 35 Waterloo Street | 9,769 | Elizabeth School of London (ESL) | Q1 |

| 2 Colmore Square | 4,192 | College of Medicine & Dentistry | Q1 |

| Vincent House, Quay Place | 3,712 | University of Wales (UWTSD) | Q1 |

| The Flaghouse, JQ | 1,700 | Academy of Contemporary Music (ACM) | Q2 |

| 21 Bennetts Hill | 1,560 | Diverse School Travel | Q1 |

| Total | 94,149 | 14% of take-up, 8 transactions |

Recruiters answer the call

Addressing the skills shortage that many businesses now face requires not just training, but specialised recruitment too. Recruitment accounted for 8% of transactions in the Birmingham office market 2022, as recruiters saw a boom in demand for their services.

| Location | Size (sq ft) | Occupier | Qtr |

|---|---|---|---|

| Interchange | 9,968 | Teacher Active | Q4 |

| Edmund House | 6,321 | Gleeson Recruitment | Q1 |

| 40 St Pauls Square | 2,985 | Team Support Healthcare | Q3 |

| The Southside Building | 2,570 | First Active 365 | Q4 |

| 31 Temple Street/Northspring | 2,041 | Rethink | Q4 |

| 148 Great Charles Street | 1,935 | Anderslite | Q4 |

| 21 Bennetts Hill | 1,557 | Live Recruitment | Q2 |

| 172 Edmund Street | 1,439 | G2 Recruitment | Q2 |

| 21 Bennetts Hill | 1,250 | Stride Resource Management | Q4 |

| Total | 30,066 | 4% of take-up, 9 transactions |

Serviced offices have reasons to smile

The third largest transaction of Q4 was to serviced office provider, Spacemade, which took 25,731 sq ft at 10 Brindleyplace. This was the year’s second transaction to a serviced office operator, with the first taking place in Q1 – Cubo Work securing 24,297 sq ft at Two Chamberlain Square.

Combined, these two deals total 50,028 sq ft – 7% of the year’s take-up. In previous years, serviced office operators have represented a far larger share of the market, as the serviced office provision bloomed in the city to meet the demand for flexible offices.

The pandemic hit serviced offices hard. With flexibility at the heart of the serviced office proposition, occupiers were able to easily terminate their occupancy. This contrasts with traditional occupiers, most of whom will have continued to pay for their office space, even if their entire team was working from home, in compliance with their lease agreement.

However, whilst lockdowns had this devastating impact on the sector, the en-masse return to serviced offices post-lockdowns has been extraordinary. 2020 and 2021 will have been tough on operator balance sheets, but we expect that 2022 will have been markedly better for all.

In January 2023, Cubo Work has announced that its space at Two Chamberlain Square, which was only let to the provider in 2022, is now full. The announcement also reveals that the provider is taking a further c.24,000 sq ft – doubling its stake to nearly 50,000 sq ft.

Marc Brough, co-founder of Cubo, which was only established in 2020, said: “Location, great space to work from and flexibility are the main drivers for ambitious businesses. Two Chamberlain Square is a fantastic building, which is an integral part of the city’s premier civic square.

“Cubo has quickly become an established part of the city’s business community and we look forward to expanding our presence here in the coming months.”

It’s not just Cubo enjoying such success either, as many of the city’s serviced office locations are well occupied. Given the substantial amount of Birmingham serviced office space that has been created over the past 5 years or so, this will have had a fundamental impact on the transaction figures. This is because it is fair to assume that some occupiers that would otherwise have taken traditional space have instead chosen managed or serviced office space.

It’s testament to the importance of flexible space that virtually every new office building has secured a serviced office operator. Flexible space in such buildings may serve multiple purposes, including providing useful overflow space for other occupiers within the building – for fixed term projects, for example.

The latest serviced office space to come online will be at Louisa Ryland House. Previously secured and then released by WeWork, Louisa Ryland House – which has been comprehensively refurbished to an incredibly high standard – will provide both serviced and traditional space. Due to launch in Q2 2023, the 81,000 sq ft building will provide serviced offices of up to 8,000 sq ft – or 80 desks, with serviced office operator, Redefined, in place to manage.

ESG dominates decision-making

‘Wheel of Responsibility’ for developing ESG credentials (Source: RSM)

Although not a new concept, ESG (Environmental, Social and Governance) has become a key driver for occupiers looking to relocate. This is in no small part due to the need to retain and attract skilled staff, as employee expectations of the workplace have greatly increased following the pandemic.

Throughout 2021 and 2022, the lion’s share of larger and high-profile transactions have taken place at brand new buildings, buildings currently coming out of the ground, and a select number of properties that have undergone extensive refurbishment. Whilst this office space will almost certainly represent a significant increase in cost per square foot for these occupiers, we have also seen many of them taking less space – thus offsetting some of this increase in overall expenditure.

The reason for a smaller requirement is much the same as that for higher quality space – the pandemic. With lockdowns transforming how many people work, flexible working is now very much the norm for a wide range of office-based businesses. The result is that full teams are rarely, if ever, all on-site at once, with an increased number of fully remote roles instead, as well as some staff blending working from home with time on-site.

At the end of last year, we explored the ESG trend in detail with Paul Callum, Associate Director of leading business advisory firm, RSM UK. You can read this here.

ESG – 103 gets it right

The desire for well-located, high quality, sustainable office space has been of great benefit to new office buildings such as 103 Colmore Row – now thought to be close to having all its space let or under offer. 103 has been a superb success story for the city. Built on the former location of the NatWest Tower, it has seen a steady flow of lettings to an impressive range of occupiers since marketing of the property began.

In 2021, it secured five transactions totalling 95,992 sq ft with lessees including legal firm Shoosmiths taking 32,900 sq ft, financial planners Tilney Smith Williams taking 12,146 and accountants Grant Thornton taking 12,146 sq ft. These are all examples of high-profile occupiers within staple sectors of the Birmingham city centre office market.

In 2022, the deals continued at 103 and the diversification delivered this year saw the building become a veritable vertical business park. The six new deals in 2022 totalled 69,921 sq ft – bringing its confirmed occupancy to 165,913 sq ft – 72% income-producing. Whether the remaining 28% is under offer at this moment in time or not, we expect it won’t be long before the building is fully occupied.

2022 lettings at 103 Colmore Row

| Occupier | Size (sq ft) | Business sector | Qtr |

|---|---|---|---|

| Facepunch Studios | 12,178 | Gaming / TMT | Q3 |

| Gallagher | 12,132 | Insurance | Q1 |

| Browne Jacobson | 12,132 | Legal | Q1 |

| RSM | 12,132 | Accountants | Q2 |

| Arcadis | 12,132 | Civil Engineering | Q2 |

| Colliers | 9,215 | Commercial property agents | Q3 |

| Total | 69,921 | 10% of take-up, 6 transactions |

Brindley could be the ‘place’

The new build office space across the city has been snapped up over recent quarters, as businesses have sought to find high quality, long-term homes for their teams. As availability of newly completed and still-under-construction properties has diminished, it’s natural to consider where the next opportunity is. Brindleyplace is a location that has potential to offer some of the best office space in Birmingham city centre.

The proposition that Brindleyplace offers has changed significantly over recent years, with the development of the Metro system along Broad Street into Edgbaston, and the transformation of Broad Street itself into a residential hotspot. Not only this, but the likes of Arena Central and Chamberlain Square have extended the office market’s focus and expanded the geographical spread of Birmingham’s business community. Brindleyplace is very much the next area along, with its adjacency to Paradise – making it a logical site of interest for investment.

The buildings at Brindleyplace provide the right size and location for major occupiers and, if space can be refurbished to compete with the likes of the new builds at Paradise, they will attract significant interest.

A range of activity is expected to take place at Brindleyplace over coming quarters that will highlight the site within the marketplace.

STOP THE PRESS… and bang The Drum

The Birmingham office market started the year off with a bang when it was announced that the vacated John Lewis building, which forms part of Grand Central, will be converted to deliver 200,000 sq ft of new office space. The redevelopment of the unit is being spearheaded by the building’s landlord, Hammerson, and will see the creation of a new restaurant, food market and gym, in addition to Grade A office space.

The four-floor unit, which will become known as The Drum – in a nod to its short cylindrical shape – originally opened as a flagship store for John Lewis in 2015. The department store closed for good however in 2020, in response to the struggle of high street retail – driven not least by the pandemic.

These offices will certainly have enviable communication links, being situated directly above New Street Station – providing commuters with access to a platform within a few steps. As such, The Drum will greatly serve the ESG priorities of the modern occupier – encouraging sustainable travel. The extensive car parking on-site will also be of great benefit to any business.

Outside of the office space provision, planners have ring-fenced c.40,000 sq ft of leisure space on the ground floor to deliver a combined hospitality zone with restaurant, bar and food market, a grocery store, gym and other wellbeing space, events area and a cycle hub with changing rooms. There will also be a rooftop garden and green walls on each level.

Such a significant amount of high quality office space within the retail element of Birmingham city centre creates an exciting proposition. This offering competes with the likes of 103 Colmore Row and Centenary Square, yet falls outside the Colmore Business District, potentially extending the territory for the very best Grade A office space in Birmingham – whilst also, uniquely, shaving a few precious minutes off the train commute.

Outlook for Birmingham office market 2023

In the year to come, ESG will continue to be a primary force for relocation. Given the Birmingham office market’s performance in 2021 and 2022, we can expect its resilience as a marketplace to continue.

Occupiers are looking to move, as they endeavour to create a better working experience for their teams through environment. The importance of doing this has become paramount in recent months given the cost of living crisis, which has motivated people to seek better salaries and conditions of work. At the same time, the cost of living crisis has also encouraged some to return to the workplace to lower costs at home – particularly this winter. Many have also cited the role that working on-site plays in their social and mental health as reasons for why they have reduced or ceased to work from home.

See full details of the transactions featured in our Birmingham office market research, comprising office space in Birmingham city centre and Edgbaston.

For more information on the Birmingham office market, please contact Malcolm Jones on 0121 233 2330 or email mjones@kwboffice.com.

To register for future research updates, click here. See also our M42 and Solihull office market research.

Want to know more?

Contact Malcolm Jones

0121 233 2330