Birmingham office market 2021 review

Even against a background of continuing challenges, the 2021 Birmingham office market increased momentum to deliver a great year.

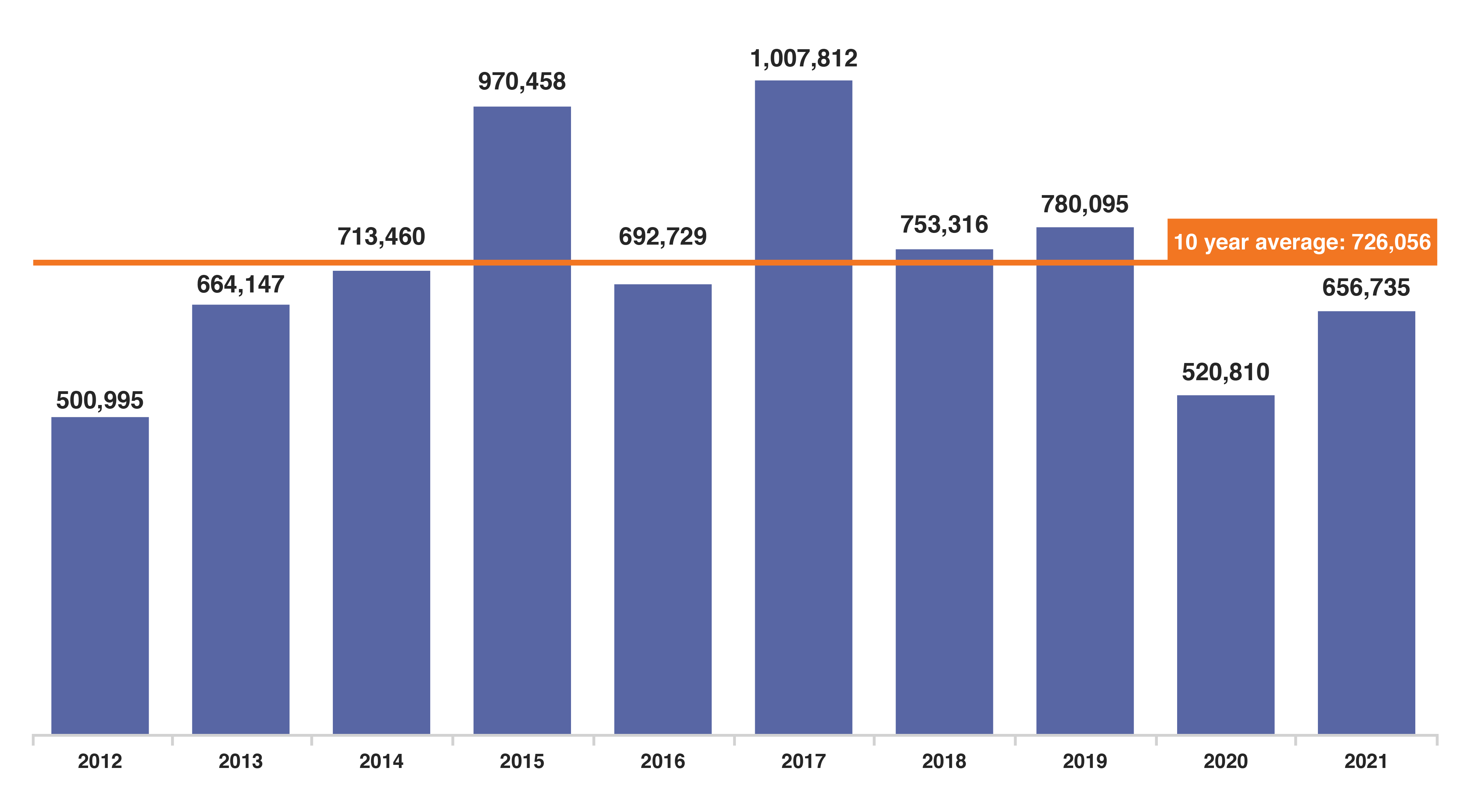

In the Birmingham office market in 2021, the number of office space transactions was almost double that of the previous year, and only 21% down on the 10-year average of 119. The total square footage was 26% higher than 2020, and only 10% down on the 10-year average.

2021 stats

6 5 6 , 7 3 5

total take-up (sq ft)

6 8 , 4 7 9

largest deal (sq ft)

9 4

total transactions

Birmingham office market annual take-up (sq ft)

Birmingham office market at a glance

- Key transactions – largest deal of the year relocates from Solihull

- Market is strong at the top – 20,000-50,000 sq ft size band delivers 39% of take-up

- A defiantly great year – 2021’s improvement impresses

- Flight to quality – occupiers seeking higher quality office space

- It’s all about ‘new’ – new builds attracting big lets

- The growing importance of ESG – the marketing value of these values

- The success of 103 Colmore Row – 60% of space already spoken for

- Shoosmiths takes largest space in Q4 – law firm chooses 103

- Taking less, wanting more – the occupiers downsizing but upgrading

- Rise in deals of 4,000-10,000 sq ft – sub 10,000 sq ft market perks up

- Public sector lettings – 11% of sq ft this year, with much more to come

- Outlook – what lies ahead for Birmingham city centre

Key transactions

2021 saw eight transactions over 25,000 sq ft – totalling 326,857 sq ft, half of the total square footage secured by the Birmingham office market in the year.

Birmingham office market transactions over 25,000 sq ft in 2021

| Office building | Sq ft | Occupier | Business sector |

|---|---|---|---|

| One Centenary Way | 68,479 | Arup | Civil engineering |

| The Mailbox | 50,000 | IWG | Serviced offices |

| Six Brindleyplace | 40,616 | x+why | Serviced offices |

| Two Chamberlain Square | 36,057 | Atkins | Civil engineering |

| Broadway | 36,038 | Binding Site | Medical technology |

| 103 Colmore Row | 34,500 | x+why | Serviced offices |

| 103 Colmore Row | 32,900 | Shoosmiths | Legal |

| Six Brindleyplace | 28,267 | Commonwealth Games | Public sector |

| Total | 326,857 | 50% of take-up, 8 transactions |

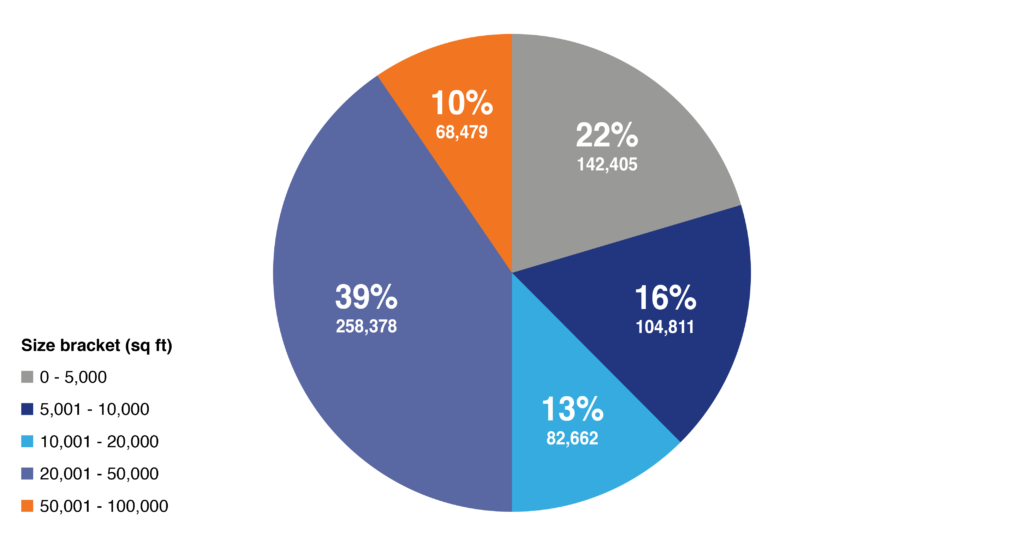

20,000-50,000 sq ft size band delivers 39% of take-up

Deals in the 20,000-50,000 sq ft size band represented nearly 40% of all take-up in the Birmingham office market during 2021 – with transactions in this bracket totalling 258,378 sq ft.

Birmingham city centre take-up by size bracket in 2021

The above chart demonstrates not just the size of the 20,000-50,000 sq ft bracket specifically, but the strength of the market across the board – from the 0-5,000 sq ft bracket achieving 142,405 sq ft (22% of take-up), upwards. This indicates that the market, and the businesses it represents, are healthily active.

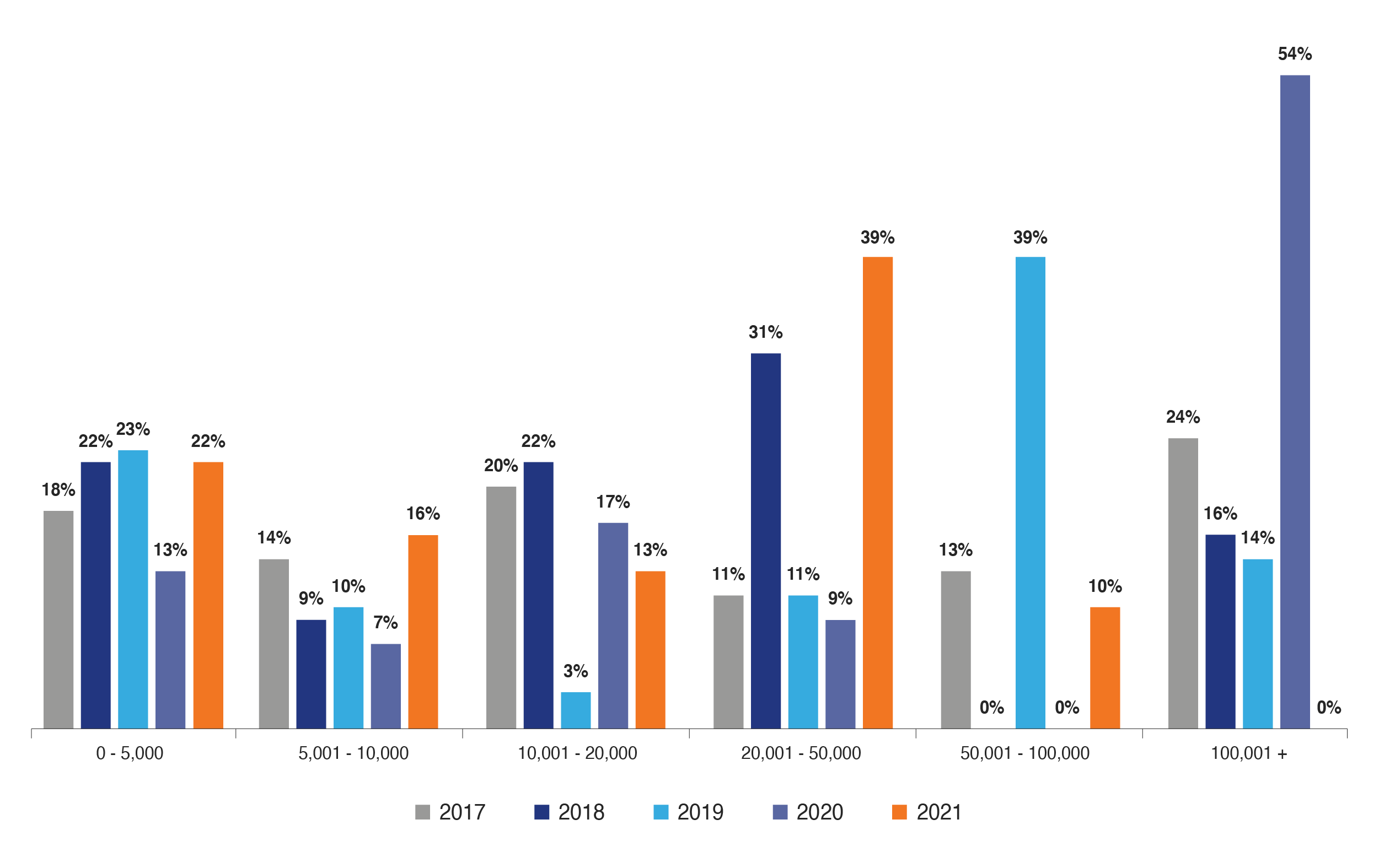

The graph below provides a breakdown of the percentage of square footage that size brackets have represented within each year’s total.

Comparing 2021 with 2020, we can see a noticeable recovery in the 0-5,000 and 5,000-10,000 sq ft size bands. Occupiers requiring space within this size bracket are moving again, which is why we see an 88% increase, on the previous year, in the number of transactions.

Birmingham office market by size band (sq ft)

At 39% of square footage, the 20,000-50,000 sq ft size band represented the largest size bracket in 2021 for take-up. 2021 also saw the highest proportion of take-up within this size band in the last five years. There are a few potential reasons for this, and it’s possible that the reality is a combination of all of these:

- Lease events: the higher number of lettings within this bracket are the result of agile moves by occupiers taking advantage of a lease break or lease end to relocate and respond to the marketplace by improving working conditions.

- Occupiers expecting more: the events of the last two years have driven occupiers to review their priorities and expectations of their office space.

- Availability of larger floor plates and higher quality space: for the past few years, since cranes returned to the city, a variety of developments have been under construction. Now, we can see buildings such as One Centenary Way, 103 Colmore Row and Two Chamberlain Square completing or taking shape – this draws out occupiers seeking new build space.

A defiantly great year for the Birmingham office market

In 2021, the Birmingham office market demonstrated its resilience. On the surface, we see that in 2020 the market achieved 520,810 sq ft and, in 2021, it was 656,735 sq ft – but the success of 2021 was far more than a 26% increase on the previous year and 90% of the 10-year average.

Comparison of Birmingham office market in 2020 and 2021

| 2021 | 2020 | |

|---|---|---|

| Total office space (sq ft) | 656,735 | 520,810 |

| Number of transactions | 94 | 50 |

| Average transaction size (sq ft) | 6,987 | 10,416 |

| Largest transaction (sq ft) | 68,479 | 283,073 |

| Transactions over 10,000 sq ft | 14 | 8 |

Considering that the BT transaction at Three Snowhill in 2020 totalled 283,073 sq ft, well over half of the year’s total square footage, we start to appreciate just how different the two years were. This contrast is underlined by the difference in the number of office space transactions – 50 in 2020, compared with 94 in 2021. 2021 secured almost double the number of office space transactions in Birmingham – 88% more to be exact – to that of the previous year.

Flight to quality

For quite some time, occupiers in Birmingham city centre have been seeking higher quality office space. In light of the pandemic, quality of office space has been driven further up the agenda for occupiers. Businesses are looking to attract staff to, and back to, the office and provide them with a workplace that is safer in its hygiene and more conducive to team wellbeing.

Over recent years, we have advised landlords to optimise the quality of their offering as occupiers have sought better space. Landlords that have conducted programmes of refurbishment on office stock have been rewarded with new occupiers.

Cornerblock, which underwent an £11.5m refurbishment by Bruntwood, would be a great example. The building received extensive modernisation throughout and, since then, has made frequent appearances in the Birmingham office market transaction figures – securing 19,071 sq ft across four lettings in 2021 alone.

The expectations of major occupiers for high quality M&E, aesthetic and a range of other factors are rising ever higher, and some can only be met by new builds and the best Grade ‘A’ refurbished space.

Consequently, Birmingham city centre accounted for an even larger share of take-up in 2021, compared with Birmingham’s fringe locations – Edgbaston, the Jewellery Quarter and Digbeth. These accounted for only 8% of take-up, the lowest figure since 2017, and a result of very limited office stock offering quality options, evidenced by five of the eight transactions in Edgbaston taking place at 54 Hagley Road.

It’s all about ‘new’

New office stock has been highly successful in attracting occupiers, as several new office buildings reach completion. Wellbeing, sustainability and flexibility are at the top of the agenda, and new build offices are the best placed to meet the needs of forward-looking occupiers.

However, these opportunities are only open to those that can afford new office space in Birmingham city centre, which is priced at as much as £37.50 per sq ft. Despite this, demand for these buildings is impressive and may even cause rental levels to be pushed on.

This year, new build office space accounted for almost a third of overall take-up, with lettings at 103 Colmore Row, One Centenary Way and Two Chamberlain Square totalling 203,251 sq ft combined.

2021 transactions at new build Birmingham office buildings

| New office buildings | Sq ft | Transactions |

|---|---|---|

| 103 Colmore Row | 95,992 | 5 |

| One Centenary Way | 68,479 | 1 |

| Two Chamberlain Square | 38,780 | 2 |

| Total | 203,251 | 8 |

The growing importance of ESG

Normally associated with sustainability, and gaining in prominence – not least since COP26 – ESG or ‘Environmental, Social and Governance’ is a growing, ethical priority for businesses, both large and small. It is becoming a central aspect of how businesses define themselves. Furthermore, occupiers are taking values of ESG into account when considering their next office. This means the ESG-related credentials of a building can ultimately be major selling points.

We discussed the importance of ESG for businesses today with Paul Callum, Associate Director of leading business advisory firm, RSM UK. Paul explained that “RSM has seen exponential growth in a requirement for businesses to show their ESG credentials through a detailed policy and a programme of continuous improvement. The ‘Wheel of Responsibility’ helps organisations start their discussions and identify their current gaps.”

The environment is an excellent example. The greener the building, in both its construction and its day-to-day carbon footprint when occupied, the better it will score on an ESG basis. Sustainable construction materials, energy-efficient features and design, and the promotion of green living are all elements an occupier may look for. For such businesses, these aspects can dictate whether a building aligns with their vision, mission statement and the expectations of their clients.

The largest letting of the year – 68,479 sq ft at One Centenary Way to civil engineering giant, Arup – is testimony to this trend. Arup stated that the move supported the next step in its sustainable development journey and was part of its global commitment to be net-zero carbon by 2030. Both the building itself and the green travel model provided by virtue of its excellent public transport links were key factors in the relocation decision.

For those landlords with existing office space who may be considering refurbishment work and repositioning of their property, we would recommend reviewing how your property performs – or could perform regarding ESG principles.

There are some elements that will, however, be harder to fix if they’re not right in the first place – location being one. Proximity to amenities, green spaces and public transport have always been considerable selling points but, increasingly, they are HR prerequisites for occupiers looking to serve the wellbeing of their team.

The success of 103 Colmore Row

The latest Grade ‘A’ office building to reach practical completion, 103 Colmore Row, has enjoyed an excellent start to its occupier marketing. 60% of the building is now said to be let or under offer.

103 Colmore Row will be the first commercial office building in Birmingham’s Central Business District to link up with Birmingham’s low-carbon District Energy Scheme. The scheme has also been awarded an EPC A rating, meaning it is one of the most energy-efficient commercial office buildings in both Birmingham and the UK.

Constructed on the site of the old NatWest building, 103 stands at 26 storeys tall, offering 230,084 sq ft of Grade ‘A’ office space and featuring a four-storey winter garden. In the second half of 2021, 103 secured 95,992 sq ft of lettings across 5 transactions:

| Occupier | Sq ft | Business sector | |

|---|---|---|---|

| Q3 | x+why | 34,500 | Serviced offices |

| Q4 | Shoosmiths | 32,900 | Legal |

| Q3 | Tilney Smith Williams | 12,146 | Financial planning |

| Q4 | Grant Thornton | 12,146 | Accountants |

| Q4 | Knight Frank | 4,300 | Commercial property agents |

| Total | 95,992 |

Whilst three of these lettings took place in Q4, the first and largest of 103’s lettings was to flexible office provider, x+why, taking 34,500 sq ft. As part of the letting strategy, the team behind the marketing of 103 Colmore Row sought a serviced office operator to establish a flexible offering within the building and selected x+why.

Paul Pritchard, director at Tristan Capital Partners, which co-owns the development, said: “We shortlisted a number of flex space operators, but x+why has broken the mould in this market. They are true disruptors, and we are excited to set a new benchmark for office occupiers and to address the undersupply of flex space in Birmingham.”

Following these transactions, there is 134,092 sq ft remaining at the property. However, given that 60% of the building is said to be effectively spoken for, we can say that approximately a further 42,000 sq ft is currently under offer.

James Howarth, Managing Director at Sterling Property Ventures, said: “The exceptionally strong level of interest in 103 Colmore Row proves that a flight-to-quality is well underway in Birmingham.

“Since the outbreak of COVID-19, businesses are continuing to take stock of their workplace arrangements and are increasingly looking to Grade ‘A’ schemes like 103 Colmore Row to help them better compete in an intensifying war for talent.

“There remains significant demand for high quality office space and our own research informs us that employers and employees alike still place enormous value on being able to access a workplace.”

Shoosmiths takes largest space in Q4

Q4 2021 saw law firm, Shoosmiths, take 32,900 sq ft at 103 Colmore Row on a 15-year lease in what was the largest office space transaction of the quarter for the Birmingham office market.

The legal firm, which first launched in Birmingham in 2003, is relocating from its current Birmingham offices at 2 Colmore Square. Shoosmiths has been based there for about 10 years, having taken 40,000 sq ft at the building in 2012 in the largest office space transaction of that year for the Birmingham office market.

With 103, Shoosmiths is relocating its 300 legal advisers and support staff into one of the most prominent office buildings in the Colmore Business District offering some of the best office space in Birmingham city centre. The amount of space taken is 20% less than they are currently occupying. However, given the level of 103’s proposition, it is likely that their occupancy cost – at least from a rental point of view – will have increased.

What has also increased is Shoosmiths’ team. In 2012, the Birmingham office was said to have 180 staff and the 40,000 sq ft that the business signed up for was to house the expansion of the business. Now, with a team of c.300, but taking less space, Shoosmiths is embracing hybrid working in a way that allows them to streamline their office space requirement. We see a similar story with Atkins in its move to 36,000 sq ft at Two Chamberlain Square for a team of 850 people. Both are key Birmingham examples of businesses now implementing a hybrid model, and we are likely to see more.

Beth McArdle, partner and co-head of the Birmingham Shoosmiths office, added: “As an ambitious and growing firm, we are very much looking forward to curating a new destination office space, perfect for a hybrid environment where clients and colleagues can do business – and in that process, we will seek to use as many local businesses as possible for the fit out.”

Taking less, wanting more

Grant Thornton took 12,146 sq ft on the 17th floor at 103 Colmore Row in what equated to a halving of its Birmingham office stake, as they currently occupy 22,000 sq ft at Colmore Building. This relocation will represent a 45% reduction in the accountancy firm’s footprint in Birmingham, but the Birmingham team is understood to be around 400 people. This ratio of 1 person per 30 sq ft would indicate that the office is unlikely to host its whole Birmingham team at any one time.

We are seeing larger companies take less space, in favour of high quality office accommodation and a hybrid working model. As mentioned in the above section, Shoosmiths has also chosen to both relocate to 103 and reduce their office stake, although not as severe a reduction – around 18%.

Like Shoosmiths, Grant Thornton will also be paying significantly more now per square foot. However, with the level of reduction in their footprint, their overall occupancy cost is likely to have reduced somewhat.

Rise in deals of 4,000-10,000 sq ft

In 2021, the number and square footage of transactions of office space between 4,000 and 10,000 sq ft was the highest since 2017 – with almost half (11) of these lettings taking place in the fourth quarter.

Five-year comparison of office space transactions of 4,000-10,000 sq ft

| Year | 4,000-10,000 sq ft size band (sq ft) | % of total sq ft | 4,000-10,000 sq ft (deals) | % of all deals |

|---|---|---|---|---|

| 2021 | 140,588 | 21% | 23 | 24% |

| 2020 | 33,951 | 7% | 5 | 10% |

| 2019 | 114,719 | 15% | 19 | 16% |

| 2018 | 105,130 | 14% | 18 | 16% |

| 2017 | 203,647 | 20% | 34 | 26% |

This wide variety of properties, as shown in the table below, confirms that there are many locations for this size of requirement, where previously options may have been limited.

Q4 2021 lettings of 4,000-10,000 sq ft

| Office building | Sq ft | Occupier | Business sector |

|---|---|---|---|

| 11 Brindleyplace | 8,832 | Crawford & Company | Claims management |

| Interchange | 8,748 | Randstand (Training) | Training |

| Mailbox | 8,724 | Castle Fine Art | Art gallery |

| Centre City | 6,769 | Reed (Training) | Training |

| 154 Great Charles Street | 6,404 | Pearson Vue | IT certification |

| 4 Brindleyplace | 5,192 | SLC Rail | Transport infrastructure |

| 10 Temple Street | 5,028 | Maximus UK | Training |

| Edmund House | 4,678 | First Intuition | Accounting school |

| Griffin House | 4,559 | GM Construction | Housebuilder |

| 103 Colmore Row | 4,300 | Knight Frank | Commercial property agents |

| Interchange | 4,123 | Gleeds | Construction consultants |

| Total | 67,357 | 11 transactions | Average 6,123 sq ft |

Across these lettings we see only one building’s name more than once, Interchange on Edmund Street. These lettings follow major renovation work of the building, which took place throughout last year. ESG has been “at the heart of the refurbishment works”, which have delivered an enhanced entrance and exterior, three passenger lifts and a range of on-site wellbeing facilities including new showers, gym-quality changing and storage facilities, cycle parking, a cycle repair hub and 24-hour security.

Public sector lettings

Lettings to government and public sector organisations are once again prominent in the year’s transactions – accounting for 11% of total square footage, which is significant. In Q2, public sector delivered a trio of deals that totalled 56,313 sq ft, 28% of the total quarter’s square footage.

| Office building | Sq ft | Occupier | Quarter |

|---|---|---|---|

| Six Brindleyplace | 28,267 | Commonwealth Games | Q2 |

| Baskerville House | 17,885 | British Transport Police Authority | Q2 |

| B1 Summer Hill Road | 16,499 | DWP | Q1 |

| Victoria Square House | 10,161 | Office of the Public Guardian (OPG) | Q2 |

| Total | 72,812 | 11% of take-up |

There are, however, other lettings that are – beneath the surface – government related. For example, the lettings of 8,748 sq ft at Interchange to recruitment and training company, Randstad and 5,028 sq ft at 10 Temple Street to training company, Maximus, are both understood to be to facilitate government retraining contracts for reskilling sectors within the workforce.

In Q4, it was also revealed that the Government Property Agency is close to signing a pre-let on 200,000 sq ft at 5 Centenary Square. Designed by architects, Make, 5 Centenary Square is the third office building to be developed at Kier Property’s Birmingham city centre Arena Central.

This forthcoming deal demonstrates the longstanding trend for prominent transactions to government occupiers within the Birmingham office market.

Outlook

We expect to see an ongoing trend of improvement in the Birmingham office market in 2022. More businesses are starting to make their moves, having held off during the periods of lockdown and uncertainty. The city centre will continue to drive that improvement with its ease of access for recruiting staff.

The letting at 5 Centenary Square is likely to appear in the figures in the coming quarters, ultimately making for a healthy year-end total and reiterating the significance of government occupiers.

With the flight to quality, the focus of occupiers – where this is affordable – will be on large new office buildings, but well-refurbished space will also most definitely have its place.

Whilst potentially downsizing their office footprint by 25-30%, occupiers that are looking to upgrade to high quality office space are seeking:

- Great looking workspace

- Promotion of wellbeing

- Flexibility for fit-out

- Excellent energy efficiency

- Sustainability in all areas

Headline rents on the best quality office space in Birmingham are likely to be pushed on – as businesses look to upgrade their space and increase the appeal of working from the office.

See full details of the transactions featured in our Birmingham office market research, comprising office space in Birmingham city centre and Edgbaston.

For more information on the Birmingham office market, please contact Nigel Tripp on 0121 233 2330 or email ntripp@kwboffice.com.

To register for future research updates, click here. See also our M42 and Solihull office market research.

Want to know more?

Contact Nigel Tripp

0121 212 5981