M42 and Solihull office market research — Quarter 2 2022

Stock in the Solihull office market is at its lowest level ever. So, it’s no wonder that rents are up, and transactions aren’t. Now is the time to build.

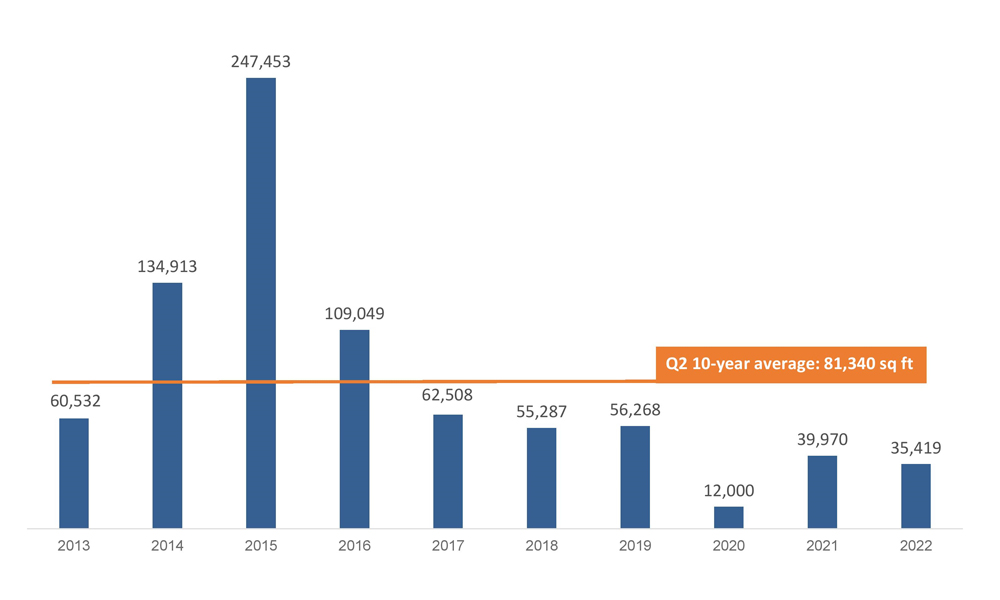

Securing 35,419 sq ft across seven lettings, the Solihull office market delivered a modest quarter, but that’s no fault of occupier demand, which remains high.

Q2 2022 stats

3 5 , 4 1 9

total take-up (sq ft)

1 1 , 2 4 4

largest transaction (sq ft)

7

total transactions

M42 / Solihull office market Q2 take-up (sq ft)

M42/Solihull office market at a glance

- Key transactions – Solihull office market deals over 5,000 sq ft

- Property dominates the property market – construction and housebuilders

- Office availability at all-time low – office stock along M42 down to unprecedented levels

- Office space coming to market – BT frees up space

- Rents and refurbs on the rise – the impact of the office drought

- A market you can build on – KWB’s John Bryce calls for construction

- One of the best prospects on the horizon – NEC Masterplan

- Outlook – deals ahead and challenges to overcome

Key transactions

Q2 transactions in the Solihull office market over 5,000 sq ft:

| Office building | Location | Size (sq ft) | Occupier |

|---|---|---|---|

| Cala House | Cranmore, Shirley | 11,244 | Hayfield Homes |

| Cornwall House | Blythe Valley Business Park | 5,327 | SpaMedica |

| Total | 16,571 | 47% of take-up |

Property dominates the property market

Deals this quarter are centred, almost exclusively, around the property sector. Development and construction businesses dominated Q2, with four of the seven lettings going to such businesses and a further one to Boden Recruitment, which specialises in the facilities and property management sector.

| Office building | Location | Size (sq ft) | Occupier | Sector |

|---|---|---|---|---|

| Cala House | Cranmore, Shirley | 11,244 | Hayfield Homes | Housebuilder |

| Barnsley Hall | Bromsgrove | 4,405 | BN Developments | Housebuilder |

| Queen Anne House | Coleshill | 4,228 | DC Construction | Construction |

| 2 Stratford Court | Cranmore, Shirley | 4,110 | Buckingham Group Contracting | Construction |

| Total | 23,987 | 68% of take-up |

With HS2 set to deliver major investment into the area and projects such as Arden Cross in the works, it’s unsurprising that companies such as this are on the up and taking an increased interest in the region.

The letting to Buckingham Group Contracting at 2 Stratford Court was secured by KWB. Ian Burford, Group Pre-Construction Director at Buckingham Group Contracting, said: “Thanks to KWB for assisting with our latest new offices in Solihull. They will accommodate our growing pre-construction team and enable us to expand our employment draw from our traditional base in Stowe. The new offices will be utilised by all parts of the business for internal and external meetings alike.”

Additionally, Daikin – manufacturer of heating and air conditioning systems – doubled in size, taking the other floor within their existing building, a letting of 4,705 sq ft at 2470 Regents Court. Examples of occupiers significantly expanding demonstrate the strength of confidence in the area and the prosperity of Solihull businesses.

Office availability at all-time low

Available, high quality office stock is now at its lowest level to date. KWB tracks office stock availability in Solihull, both ready for occupancy and in the pipeline, and we find that currently there is just 62,816 sq ft of vacant, high quality office space in the area. For a market that could quite easily let that amount of office space within a quarter, this presents a significant problem – but an opportunity also.

Some of the last remaining office space has been snapped up in recent months, as the market gained post-lockdown momentum. Just last quarter, Birmingham Business Park saw its largest letting in two decades, when an unnamed government department took 37,509 sq ft of Solihull office space off the table by acquiring 3010 & 3020 The Crescent. Lettings like this show how quickly the available stock can, and likely will, diminish.

Available Grade A office stock

| Office building | Location | Size (sq ft) | Availability |

|---|---|---|---|

| Nelson House | Blythe Valley Business Park | 14,792 | Immediate |

| Vienna House | Washington Square | 25,360 | Immediate |

| 6060 Knights Court | Birmingham Business Park | 13,430 | Immediate |

| Friars Gate | Shirley | 9,234 | Immediate |

| Total | 62,816 |

The 113,654 sq ft Ingenuity House also currently lies vacant. However, this incredibly unique building will require an equally unique occupier, at present. It was recently announced that the former Interserve building, regarded as one of the most sustainable buildings in the region – if not the country, has been put up for sale.

The property had been on the market to let for some time, but the layout of the building – and its impressive specification – make it a prospect primarily for a single, major occupier with a significant budget. Further investment into the property to make it more suited to multiple occupancy could potentially make the property accessible to more of the market. In its current circumstances, with the property on the market to purchase, we have excluded it from our office space availability figures.

Office space coming to market

There is more office space coming on stream, but the refurbished stock coming up ahead is few and far between.

Formerly occupied by BT, 4520 Solihull Parkway on Birmingham Business Park will soon come to market – following an office refurbishment programme – and will deliver c. 60,000 sq ft. The property vacated by BT-owned EE, is going to be a unique opportunity on Birmingham Business Park, being the largest available office space on the park, where the vacancy rate is currently just 4%.

Rents and refurbs on the rise

With a market lacking space so severely, the pushing on of rents is going to accelerate. New build space at Blythe Valley has commanded £26.50 per sq ft in recent months, a record rent level for Birmingham’s out-of-town office market.

This is a concern for occupiers either looking to relocate or approaching a lease event. The drought of available office stock will provide significant negotiating power on the side of the landlord, and it may be necessary for occupiers to work to mitigate an exaggerated increase in rental levels.

John Bryce, Director of KWB, said: “Current office market conditions, of high demand and low supply, are pushing rents one way – up.

“The Solihull office market, like any other, was challenged by the pandemic. However, lockdowns did not change the overall landscape. The market’s strengths, weaknesses and overarching trends either continued throughout or were suspended only temporarily.

“Demand is high – expansions and inward investment are on the menu, alongside the usual churn. The thirst for offices is driven higher still by the post-pandemic trend of refits and relocations. Businesses are looking to improve the quality of their office space – as ESG criteria and skills retention have risen up the agenda.”

With high quality stock being as low as it is, and the long timescales that would be involved for a new build office development project – even one that started tomorrow – more existing office buildings simply have to be refurbished.

We’ve already seen, over recent years, many buildings undergo extensive refurbishment works and these investments have been successful in prompting strong interest in the market. Now, however, there are fewer buildings that can be refurbished, so we may see even more properties that are c.20 years old being brought up to Grade A standard.

With landlords looking to refurbish and more occupiers seeking to enhance their existing space, the cost of office refurbishment is increasing too. Demand for these skills is high, and the companies that provide them are seeing material costs increase.

The M42’s excellent connectivity to the rest of the country, among many other selling points, will ensure demand for office space remains strong here – even if stock is low. The long-term requirement then, is for new build space.

A market you can build on

John Bryce has set out the urgent case for new build space: “Whilst we have seen commitments to creating new industrial space along the M42 responding to the delivery boom, office supply has not followed suit. Instead, we saw – and drove – a flurry of refurbishment, which delivered some much-needed high quality office stock. Pre-lets for new space then followed – namely those at Blythe Valley Park. However, such opportunities are now thin on the ground.

“Ongoing lack of supply now means that some occupiers are having to look elsewhere. These represent missed opportunities for commercial property investors and developers, underlining the strong case to invest. Solihull is regarded as a very prosperous area – having fared well during periods of recession – and continues to attract businesses to the area, making it a prime location for opportunities.

“Whilst development proposals, such as the NEC Masterplan and Arden Cross, are in the pipeline, the timescales cannot address the short and medium-term issue. We need to see projects that can deliver office space in a shorter timeframe. This requires proactive investors as well as suitable sites with a supportive approach to planning permission.”

One of the best chances on the horizon

The NEC Group’s NEC Masterplan is regarded in the market as one of the most credible prospects for new office space in the M42 market. The Group, which will host a number of Commonwealth Games events between 28th July and 8th August, has set out a plan to deliver:

- 5,000 homes

- 3,500 local jobs

- 376,736 sq ft of commercial space

- 14,000 sq m of outdoor event space

- A hotel, restaurants and cafés

- A primary school

- A greener and more sustainable environment on the NEC Campus

We see the need for projects like this to become a reality as more important than ever, with the market needing to keep one eye on the immediate future and the other much further ahead.

Outlook

HS2’s future presence within Solihull is becoming better understood, as architects’ designs drip through. The latest of these was the unveiling of plans for HS2 Interchange’s car parks, revealed as Urban Growth Company lodges its planning consent request.

As for the current property market, there are deals ahead. KWB is aware of lettings that only narrowly missed inclusion in this quarter’s figures and so we can expect to see them in Q3. However, as the availability of high quality space is so low, we can see occupiers that would otherwise place an enquiry in the Solihull office market, either remaining in their existing offices or considering other locations.

If they do choose to consider space elsewhere, we have seen businesses moving from out-of-town into the city. As for those that want to stay in their existing office space, they may decide to negotiate with their landlords on making adjustments to their existing arrangements. This could include refurbishment works, a re-planning of their workspace or tweaks to their lease.

KWB encourages landlords considering refurbishing their Solihull office space, or developers looking at opportunities in the out-of-town market to get in touch. KWB has an extensive understanding of the M42 office market, with a broad portfolio and track record in the area. This puts us in a prime position to advise you.

See full details of the transactions featured in our M42 and Solihull office market research.

For more information, please contact Malcolm Jones on 0121 233 2330 or email mjones@kwboffice.com.

To register for future research updates, click here. See also our Birmingham office market research.