Birmingham office market research — Quarter 2 2022

ESG-driven lettings show a flight to quality balanced by hybrid working. This is a forward-thinking city, about to host the Birmingham 2022 Commonwealth Games.

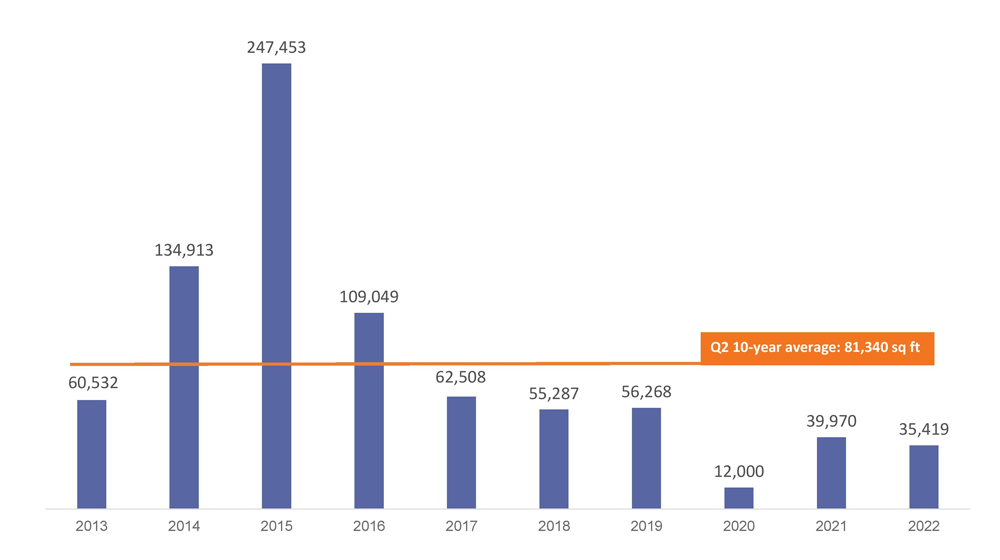

On the face of it, Q2 for the Birmingham office market looked a quieter quarter with 117,599 sq ft transacted – 43% down on the Q2 10-year average, but the number of deals at 28 was on a par with previous years.

Q2 2022 stats

1 1 7 , 5 9 9

total take-up (sq ft)

2 2 , 9 2 8

largest transaction (sq ft)

2 8

total transactions

Birmingham office market Q2 take-up (sq ft)

Birmingham office market at a glance

- Key transactions – all city centre deal overs 10,000 sq ft

- Commonwealth marathon in commercial property – take a run through the city’s officescape

- Department for Transport… moves – biggest deal of the quarter goes to government body

- ESG is everywhere – the trend dominating decision-making at the top end of the market

- 103 Colmore Row and the 10-15k bracket – the epicentre for corporate hybrid working

- Civil engineering makes a strong showing – the skills shortage is driving firms into better space

- New space: gone before it’s up – the best new build offices are being fully let during construction

- Fringe locations spark into life – after total silence in Q1, fringe markets have piped up

- Outlook – some notable deals ahead

Key transactions in the Birmingham office market

Birmingham city centre transactions over 10,000 sq ft in Q2 2022

| Office building | Size (sq ft) | Occupier | Business sector |

|---|---|---|---|

| The Colmore Building | 22,928 | Department for Transport | Government |

| 103 Colmore Row | 12,132 | RSM | Accountants |

| 103 Colmore Row | 12,132 | Arcadis | Civil engineering |

| Total | 47,192 | 40% of take-up, 3 transactions |

Commonwealth Marathon in commercial property

From 28th July – 8th August, the highly anticipated 2022 Commonwealth Games takes over Birmingham. In some respects, the games have been here for some time already. The team responsible for its organisation has had a strong presence in the Birmingham office market over recent years, taking 72,261 sq ft at One Brindleyplace in Q1 2019 and a further 28,267 sq ft at Six Brindleyplace in Q2 2021.

Birmingham 2022 has sparked excitement across the region, and Saturday 30th July will see one of the biggest events of the games, the Marathon representing a tour of the Second City. The day’s four races (men’s, women’s, men’s para and women’s para) will consist of two 17.4 km laps of a South Birmingham course and a 7.4 km city centre loop at the finish.

To mark this event, which will put the eyes of the world on many of Birmingham’s landmarks, we’ve put together the key offices that feature on this route. Whilst we’ve broken down the route into a number of stops, we’re sure the runners themselves will be trying to avoid stopping!

1 – Victoria Square House

The first office stop on the city centre loop for the Commonwealth Games 2022 marathon is Victoria Square House. In the past 12 months, Office of the Public Guardian (OPG) has taken 37,284 sq ft here. The building stands opposite Birmingham Town Hall, which has seen the likes of Led Zeppelin, Bob Dylan and Charles Dickens – to name a few – grace its stage.

2 – Two Chamberlain Square

Commonwealth Games 2022 stop 2 is Two Chamberlain Square, part of the Paradise regeneration project. This brand-new office building has been popular since it came to market, with accountants, PWC taking a 76,000 sq ft pre-let in Q4 2017, and law firms Knights – taking 17,835 sq ft in Q3 2020 and DLA securing 40,277 sq ft in Q4 2019. This quarter, MEPC, Paradise’s development and asset management team, also took 3,001 sq ft here.

3 – Centenary Square

Stop 3 is just a little further on from Two Chamberlain. From Centenary Square, you’ll see One Centenary Way – currently under construction – which saw Arup take a 68,479 sq ft pre-let in Q3 2021, the iconic Baskerville House – which drew in British Transport Police Authority in 17,885 sq ft in Q2 2021 and, just over the road, 2 Arena Central – wholly occupied by HSBC.

4 – The Jewellery Quarter

The marathon route then heads into the Jewellery Quarter, filled with smaller offices – some of which are converted jewellery workshops. Key streets in the Jewellery Quarter include George Street, Frederick Street, Warstone Lane and Caroline Street, and the city centre loop will take in all of these.

5 – KWB HQ!

As the runners head up from the Jewellery Quarter and head towards Colmore, they’ll run along Great Charles Street Queensway and Newhall Street, which will take them past Lancaster House. KWB Commercial Property Agents have been based at the building since 2004. In that time, the business has grown from an office agency into a comprehensive, multidisciplinary commercial property practice.

6 – Edmund Street

For stop 6, this street behind Colmore Row is filled with many notable office buildings, such as 120 Edmund Street and Rutland House, but at its end is a building with a particularly impressive story – Cornerblock. Since the building’s extensive refurbishment, it has welcomed a wealth of occupiers and secured 19,071 sq ft across four lettings in 2021 alone.

7 – Colmore Row

And finally, the finish line, of this 26-mile race, is in Birmingham’s primary business district of Colmore. Colmore Row specifically has been a hive of activity in recent years, with investors and developers making significant commitments to the area. This can be seen in the renovation and refurbishment of 55 Colmore Row, now home to WeWork and Goldman Sachs and 103 Colmore Row – the latest office tower in the city.

Our team is very excited for the games and KWB wishes all athletes for this year’s Birmingham 2022 Commonwealth Games the very best of luck!

Department for Transport… moves

The largest letting of the quarter was to the Department for Transport (DfT), which took 22,928 sq ft at The Colmore Building.

In March 2021, as part of the government’s levelling up commitment, the DfT announced its plans to redistribute 650 jobs for a better coverage of the country. This involved the relocation of these positions out of London and spreading them across offices in Birmingham and a Northern hub in Leeds.

This is the latest major letting to a government department, which feature regularly in the office transactions in Birmingham city centre. The city is popular with the public sector, and there has been a government programme of office space consolidation in the region. Birmingham’s central position within the country is an ideal strategic fit for such a department.

At the time of the decision, Andy Street, the Mayor of the West Midlands, said: “The West Midlands has undergone a transport revolution in recent years, with the reopening of old railway lines, expanded tram routes, and an upgraded green bus fleet, along with the rollout of e-scooters and a cycle hire scheme. The DfT will be right at home here, and I look forward to welcoming the team to the best-connected region in the UK.”

ESG is everywhere

ESG has become the word – or acronym – on everybody’s lips, be those of commercial property agents, landlords or occupiers. COVID has caused occupiers to take stock of the relationship they have with their teams, how they use their office space and how this should affect their property strategy.

Environmental, Social and Governance (ESG) has become an ethical priority for occupiers, enabling them to enhance their corporate decision-making and, as one of many benefits, make their organisations appealing to existing and potential talent.

This term, and all that it embodies, has rewritten what we would previously call a ‘flight to quality’. We are seeing many businesses upgrading their office space, often to brand new space or offices that have undergone extensive refurbishment.

To achieve the very best working conditions, M&E must be of the highest quality and floorplates need to be open plan – many existing office buildings cannot be adapted in this way. In some cases, these kinds of buildings will be converted to residential to achieve higher yields.

103 Colmore Row and the 10-15k bracket

103 Colmore Row, which sits on the former site of the NatWest building, has seen a consistent string of office lettings since marketing began. In Q2 2022, the building secured two lettings totalling 24,264 sq ft – two equal lettings of 12,132 sq ft – the 10th and 16th floors.

Demand for high quality office space of this size – namely 10,000-15,000 sq ft is now a rarity in the office market. This is because such high demand for this office space in recent quarters has eroded available stock, much of which was only in the process of being built when let.

Arcadis took 12,132 sq ft to house its 500 staff relocating from 22,000 sq ft five minutes’ walk away at Cornerblock. When we consider the rule of thumb for a traditional staff-to-office-space ratio of 1:100 sq ft, Arcadis contrasts starkly. However, the civil engineering firm is not shoe-horning its staff into 1:24 sq ft. Instead, this indicates a hybrid approach to working, with a considerable portion of its staff working from home or elsewhere at any one time.

Although the space is 45% less than their previous offices, with new, high quality office space achieving record rents, they will almost definitely be paying more. This is a popular trend in office strategies for occupiers – as the pandemic caused many businesses to re-evaluate their approach to office space and consider the role it plays in attracting and retaining talent.

RSM, accountancy firm, is also moving from 14,500 sq ft in St Phillips Point to 12,132 sq ft of space on the 10th floor in the new tower. This space will relocate RSM’s 300 staff (1:40 sq ft) and so, again, hybrid working is going to be central to the move.

As time goes on, and these strategies become commonplace, ratios for office occupancy may need to be revised. In any case, now, lettings for the highest quality space rarely represent a traditional approach.

Civil engineering makes a strong showing

Civil engineering firms featured highly in the office transactions this quarter, reflecting growth in infrastructure and indicating the sector’s response to the skills shortage. 21% of transactions and 33% of take-up was related to civil engineering businesses and their related specialisms:

| Office building | Size (sq ft) | Occupier | Business sector |

|---|---|---|---|

| 103 Colmore Row | 12,132 | Arcadis | Civil engineering |

| Cornerblock | 8,055 | Royal HaskoningDHV | Civil engineering |

| 1 Newhall Street | 6,419 | RPS Group | Civil engineering |

| 1 Newhall Street | 6,392 | Pegasus Planning Group | Planning consultancy |

| Lancaster House | 4,477 | RSK Group | Civil engineering |

| 10 Tenby Street | 1,401 | Webb Yates Engineers | Civil engineering |

| Total | 47,192 | 33% of take-up, 6 transactions |

The skills shortage is a widely-reported, pan-sector problem, but it’s very pronounced in civil engineering. Businesses in the sector are struggling to achieve the skill levels their businesses require. Their office space, and its location, can be powerful tools in a strategy to address this challenge.

ESG, as covered in the previous section, plays a vital part in corporate decision-making and in attracting and retaining talent.

Arcadis upgraded its office space and took a single floorplate at 103 Colmore Row this quarter. Marketing of the property has been focused around ESG, and the building is well-positioned to provide the level of wellbeing, sustainability and flexibility that is highly desired by forward-thinking employers.

Elsewhere, Royal HaskoningDHV is relocating from its 3,700 sq ft of offices at Newater House in Newhall Street to 8,055 sq ft at Cornerblock, more than doubling its office space and upgrading to better quality space. Additionally, RPS Group took 6,419 sq ft at 1 Newhall Street, which sits directly opposite 103 Colmore Row and provides a strategically ideal position that will also appeal to staff.

There are a number of aspects to consider when exploring this cluster of civil engineering lettings, and others, that have taken place in recent quarters.

Firstly, the relocation of some firms into the city from out-of-town. The reality for civil engineering businesses looking to recruit experienced talent, is they may need to take it from other businesses that already have it. This means that positioning yourself in proximity to other civil engineering businesses is going to increase your chances of recruiting the staff you need.

The second is the youth talent pool. The West Midlands is a prime location for civil engineering organisations, because of the strength of its educational institutions. Be it the University of Birmingham’s School of Engineering, University of Warwick or Coventry University – to name a few – the region is very successful in producing some of the country’s best engineers. This supplies fresh talent to the civil engineering hub of the West Midlands, and with HS2 coming down the track, demand for such expertise here is high.

We’ve seen similar peaks in take-up from other sectors within professional services – last quarter, legal firms were noticeably active.

New office space: gone before it’s up

With success stories such as 103 Colmore Row and Chamberlain Square, commercial property developers should be encouraged to build new Grade A office space. The strategies that have been employed in the letting of new build schemes in the city centre have seen them almost entirely pre-let during construction.

This thirst for new space, driven by ESG priorities, is a real fillip for organisations behind proposed schemes, those considering a new project and Birmingham City Council.

Fringe locations spark into life

Transactions for offices on the fringe areas of Birmingham have been few and far between in recent quarters, with activity focused very much on the core of the city. This has primarily been down to lack of office space in areas such as the Jewellery Quarter, Digbeth and Edgbaston.

Over recent years, many office buildings in the outlying areas of the city have been converted to residential. This could be because they were no longer able to meet modern office occupier requirements or simply because a conversion to residential would generate far more income.

In Q1, there were no transactions in any of the fringe areas, but activity has stepped up this quarter – with 8 transactions outside the core.

| Office building | Location | Size (sq ft) | Occupier |

|---|---|---|---|

| Lancaster House | Birmingham Jewellery Quarter | 4,477 | RSK Group |

| Camomile House | Edgbaston | 2,200 | Stepping Stone Care |

| Camomile House | Edgbaston | 2,1700 | Papyrus |

| The Flaghouse | Birmingham Jewellery Quarter | 1,700 | Academy of Contemporary Music |

| Cobalt Square | Edgbaston | 1,500 | HM Belgravia |

| 10 Tenby Street | Birmingham Jewellery Quarter | 1,436 | Webb Yates Engineers |

| 133 – 137 Newhall Street | Birmingham Jewellery Quarter | 1,140 | Twice as Narce |

| 30 St Pauls Square | Birmingham Jewellery Quarter | 467 | Lumosia |

| Total | 15,090 | 13% of take-up | 8 (29%) transactions |

Occupiers seeking more flexibility than ever in the Birmingham office market

Flexibility is appearing right near the top of many occupier agendas. Whether in the offices they currently occupy or the ones they are looking to relocate to, occupiers are seeking more flexibility than ever before, both in space and lease terms. This hunger for flexibility is evidenced by Goldman Sachs taking space within the WeWork flexible workspace operation at 55 Colmore Row in Q2 2021 and then and then almost doubling the space in Q1 2022.

Another example would be marketing firm, M3 taking space at Two Chamberlain Square within serviced office operator, Cubo’s flexible office hub. As a serviced office agreement, the transaction does not appear in the Birmingham office market figures but represents a relocation for 30 staff. In these cases, flexibility comes at a price, as serviced office space commands a far higher rate than a traditional lease.

Outlook

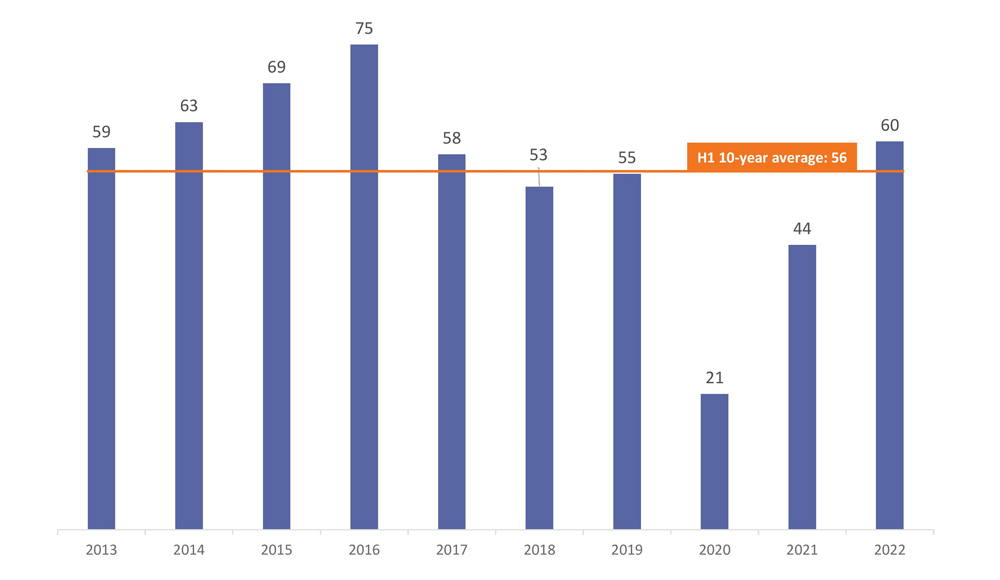

Whilst Q2 in itself is a smaller quarter in terms of square footage, there have been 60 office space transactions secured in the first half of the year, the highest number since 2016. The market is active and the reduction in square footage reflects, in part, hybrid working practices and changing office requirements, with companies choosing smaller, but higher quality office space.

Birmingham office market H1 transactions

Post-lockdowns, there has been a fair amount of latent relocation. However, many occupiers now have concerns surrounding national and global economic challenges that potentially lie ahead. With summer upon us, the market is understandably quiet, although this ‘summer’ could last longer if businesses decide to weather out the current high inflation rates and economic uncertainty.

But how can occupiers do that if their lease is up? With many landlords at this time wanting to retain their occupiers as much as they can, some will be open to pushing dates back. We are seeing examples of break clauses being rescheduled and shorter lease extensions being granted. Some businesses haven’t been back in the office very long and are only now adjusting to hybrid working and/or beginning to review their approach to their office strategy. Extra time to figure things out in these cases is a blessing.

Nevertheless, we can still expect to see a variety of transactions. Indeed, KWB is currently in the process of acquiring office space in Birmingham city centre for occupiers looking to upgrade their offices. There are ESG-conscious occupiers of all sizes looking to upgrade their space, and we are aware of multiple agent-led requirements for 10,000+ sq ft in the marketplace right now.

Another aspect that will drive consistency in market activity is the diversification of the city centre. With businesses that would previously have chosen out-of-town offices now considering the city centre, the Birmingham office market is seeing an even broader range of occupiers in the quarterly transactions. This can provide an office market with resilience, and we’ve seen this frequently in Solihull and the M42 corridor.

See full details of the transactions featured in our Birmingham office market research, comprising office space in Birmingham city centre and Edgbaston.

For more information on the Birmingham office market, please contact Malcolm Jones on 0121 233 2330 or email mjones@kwboffice.com.

To register for future research updates, click here. See also our M42 and Solihull office market research.