Birmingham office market research — Quarter 1 2023

Despite economic challenges, the Birmingham city centre office market delivered a respectable total of 153,550 sq ft but activity is quieter. As Birmingham’s Grade A office stock hits an all-time low, how will the city meet demand?

Continuing a streak of lettings to educational organisations in the Birmingham office market, the largest letting of the quarter saw QA Higher Education take 45,180 sq ft of excellent quality office space at the newly refurbished Louisa Ryland House.

Despite the flurry of crane activity in the city over recent years, the market finds itself with few options for occupiers looking for the very best office space.

Q1 2023 stats

1 5 3 , 5 5 0

total take-up (sq ft)

4 5 , 1 8 0

largest transaction (sq ft)

1 8

total transactions

Birmingham office market 2023 at a glance

- Key Birmingham office transactions – 78% of take-up over 10,000 sq ft

- Education top of the class – two largest lettings go to education sector

- Everyone loves an upgrade – occupiers continue upgrading en masse for ESG

- Louisa Ryland House and refurbishment – fit outs pay off but costs rise higher

- Grade A stock availability – what’s available? And what’s coming?

- A renaissance for Brindleyplace? – Reach Media takes space and large deals could be ahead

- Civil engineering and HS2 – civil engineering businesses prominent as HS2 advances

- Outlook – government requirements to find a home and BBC moves forward

Key Birmingham office market transactions

Q1 2023 saw five deals over 10,000 sq ft totalling 119,036 sq ft. This represents a stunning 78% of the quarter’s overall take-up of 153,550 sq ft. This compares with an average of 56% in the whole of 2022.

| Office building | Size (sq ft) | Occupier | Business sector |

|---|---|---|---|

| Louisa Ryland House | 45,180 | QA Higher Education | Education |

| The Citadel | 27,006 | Aston University | Education |

| The Colmore Building | 22,709 | AON | Insurance |

| 103 Colmore Row | 12,158 | Weightmans | Legal |

| 3 Brindleyplace | 11,983 | Reach Media | Media / TMT |

| Total | 119,036 | 78% of take-up, 5 transactions |

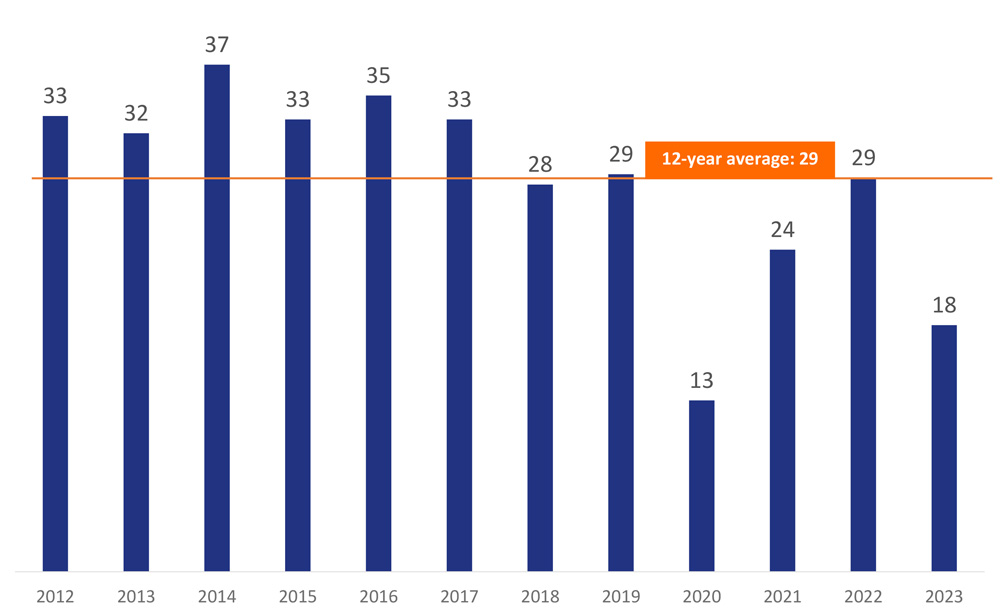

The number of office space transactions is noticeably low this quarter, with just 18 deals taking place. However, the total square footage achieved is in line with average take-up for the Birmingham office market. What this shows us is that deals at the lower end of the market were fewer this quarter. Reasons behind this include the growing popularity and availability of serviced office space, as well as the economic uncertainty created last September by the Budget, which may have paused plans for some businesses.

Average quarterly transactions compared with Q1 2023

Education top of the class

The top two transactions in the Birmingham office market in Q1 were to education sector occupiers, accounting for almost half of the market’s take-up for the 3-month period.

These are the latest in a string of lettings to the sector over recent quarters. Skills shortages and The Great Resignation have shined a spotlight on the talent pool. This has driven growth in the sector and we can see this in the uptick in educational organisations taking office space in Birmingham city centre.

In 2022, the education sector was responsible for 14% of all Birmingham office market take-up, with eight transactions that totalled 94,149 sq ft. Considering this year’s Q1 figures, it’s fair to assume the sector will achieve even more in 2023.

| Office building | Size (sq ft) | Occupier |

|---|---|---|

| Louisa Ryland House | 45,180 | QA Higher Education |

| The Citadel | 27,006 | Aston University |

| McLaren | 1,088 | Roeducation |

| Total | 73,274 | 48% of take-up, 3 transactions |

The largest deal saw QA Higher Education (QAHE) take 45,180 sq ft at Louisa Ryland House – considered some of the highest quality refurbished office space available in the market following its multi-million-pound refurbishment. The property had previously been set to form part of serviced office giant WeWork’s foray into the Birmingham office market. However, the company subsequently reversed its plans for the building.

QAHE, which is understood to have taken the space on a 15-year letting, works in partnership with universities around the UK. In collaboration with seven different institutions, QAHE recruits and delivers more than 100 foundation, undergraduate and postgraduate degree programmes. The transaction represents a significant upgrade in quality of office space for the organisation that is currently located at Centre City.

The second largest letting of the quarter was to Aston University, which took 27,006 sq ft at The Citadel, a building only a stone’s throw from the university campus. In 2022, the building – which is currently being refurbished, secured two pre-lets, to The Church of England Birmingham and criminal barristers chambers, Citadel Chambers. The deal to Aston University sees the office space at the building now fully let.

Louisa Ryland House and refurbishment

The 80,000 sq ft of offices at Louisa Ryland House have been comprehensively refurbished to an incredibly high standard, providing both serviced and traditional space. QAHE has taken the traditional space in its entirety and serviced office operator, Redefined, is in place to manage the remainder. Due to launch in Q2 2023, the building’s serviced offices will offer up to 8,000 sq ft – or 80 desks.

Theo Holmes, Head of Office Agency at CBRE in Birmingham, which markets the building, said: “The letting to QAHE means the building completes with an anchor tenant and flex service provider in place.

“For QAHE Ltd, in addition to the quality of the space and the teaching environment it will provide for students, on a practical level the ability to occupy at high density and having its own entrance to the building were key factors in its decision to relocate to Louisa Ryland House.”

This approach to the letting of the property quickly secures income following the substantial investment in refurbishment. With the strong trend for office refurbishment and high quality fit out post-COVID, it’s unsurprising that there have been a number of reports on the rising costs incurred. These stories have even reached the mainstream press, with headlines that fit out costs have risen by 9% across Europe over the last year and Birmingham finds itself the most expensive city in Europe behind London and Manchester.

Everyone loves an upgrade

Relocating to upgrade your office space, frequently referred to as the flight to quality, continues to be a major trend within the Birmingham office market. This is because ESG (Environmental, Social and Governance) has become a key driver for occupiers in their decision-making, as they look to retain and attract the talent their business needs.

Whether brand-new build or comprehensively refurbished, high quality office space is being snapped up fast.

This quarter saw a range of companies upgrading their office space, most notably the largest letting to QA Higher Education. Other occupiers moving to better space include:

- Insurance company AON took 22,709 sq ft at The Colmore Building. The letting sees them relocate just a few steps from their existing offices at Colmore Gate. More on Colmore Gate in the next section.

- Legal firm Weightmans took one of the last remaining floorplates at the massively popular 103 Colmore Row, in a move from St Phillips Point that sees them upgrading yet taking less office space.

The popularity of high quality office space has also led to the erosion of Grade A stock in Birmingham city centre, with much of the new space under construction pre-let before completion.

Grade A stock availability

High quality office stock has reached an all-time low in the Birmingham office market, despite strong levels of construction over the past 5 years.

New landmark office buildings, such as 103 Colmore Row and Two Chamberlain Square, are already all but fully let – with much of the remaining space under negotiation. 103 has attracted many high quality office space enquiries in the past couple of years, and only a couple of floors now remain at the property. With strong demand still evident within the market, what’s left to choose from? And where will occupiers go when these options have been snapped up?

The quickest solution will be to deliver more refurbished office space and, fortunately, there are commercial property landlords and investors already planning the next flurry of refurbished space. The most recently announced, and sustainably ambitious example is Colmore Gate. The 171,834 sq ft building was purchased by Ashtrom Properties in September 2021 for £39.5m and the owners are now looking to refurbish the building inside and out. The proposed design will recycle and extend the property, delivering a sustainable low/zero carbon structure.

Elsewhere, we have the plans for space at Grand Central vacated by John Lewis. Drum’s designs were revealed earlier in the year and the proposal sees the creation of 200,000 sq ft of high quality office space. Also included within the plans is a hospitality zone with a restaurant, bar and food market, a grocery store, gym and other wellbeing spaces, as well as an events area. The communication links of Drum would be second to none, being situated moments from New Street Station’s platforms.

As for new-build projects, construction giant, Lendlease revealed plans at the start of the year for a £1.9bn regeneration project for the Smithfield site between New Street Station and Digbeth. Phase one of the proposed development would deliver 330,000 sq ft of new office space in the form of the new ‘Ariel’ building.

A renaissance for Brindleyplace?

Reach Media has put Brindleyplace in the headlines. One of Britain’s biggest newspaper groups, which owns The Daily Mirror and Ok! Magazine amongst many other publications, has taken just shy of 12,000 sq ft at 3 Brindleyplace. Brindleyplace is one of few apparent sites, particularly in the medium-term, that may be able to provide the size and quality of space that occupiers are looking for in the Birmingham office market.

The idyllic courtyard and the many restaurants and bars on-site provide a lifestyle offering that will greatly appeal to employers looking to enhance wellbeing for their teams. Not only this, but it has benefited from a range of recent investments in the surrounding area, with the development of the Metro system along Broad Street into Edgbaston, and the transformation of Broad Street itself into a residential hotspot.

Civil engineering and HS2

It’s not just the education sector making itself known within the Birmingham office market. Though smaller lettings, Q1 saw 22% of its deals to civil engineering businesses.

Civil engineering occupiers taking space in Q1 2023:

| Office building | Size (sq ft) | Occupier |

|---|---|---|

| Bank House | 7,063 | Stantec |

| 4 Temple Row | 3,526 | Richter |

| 148 Great Charles Street | 1,089 | Waldeck |

| 11 Waterloo Street | 1,040 | CPC Civils |

| Total | 12,718 | 8% of take-up, 4 transactions |

Demand for civil engineering within the city has escalated steadily over recent years, particularly driven by HS2. Since the team behind the UK’s future high speed rail network took a landmark letting at Two Snowhill, there has been a variety of associated businesses taking space.

Latest figures from HS2 reported by the Greater Birmingham Chambers of Commerce has highlighted how the project’s tier two subcontracts are strengthening around 2,000 businesses across the country to the tune of £7.9bn. Impressively, £3.6bn of this is benefiting the bottom lines of SMEs (including micro businesses) – that’s 45% of the overall funding.

Outlook for the Birmingham office market

Whilst diminishing immediately-available grade A stock will have some impact on take-up, we can most certainly expect to see some larger office deals throughout this year. There are already known government requirements – such as that for the Department of Transport – which should find their home within 2023. It was recently reported that the Government Property Agency’s 150,000 sq ft requirement will likely find its home at either 10 Brindleyplace or Three Snowhill. These two properties top the shortlist of office buildings with the necessary quality and capacity.

In the meantime, Q2 will report another deal completing at One Centenary Way with Birmingham commercial property agents JLL agreeing to move 150 of its staff into just over half a floor after signing a ten-year lease for 13,815 sq ft of space. JLL will be joining Arup, an employee-owned built environment consultancy, along with global bank Goldman Sachs at the site.

Plans for Typhoo Wharf, the BBC’s new base in Digbeth, which is expected to create nearly 500 jobs, are taking important steps forward. Birmingham City Council’s cabinet met recently to consider the full business case for the institution’s proposal for the Typhoo Building redevelopment. The project’s works involve the partial demolition of the existing factory building, removal of the roof, removal of bridge links, and demolition of boiler house, along with refurbishment of what is retained.

At the lower end of the market, it is likely that – as flexibility increases in popularity – the number of smaller deals will reduce over the years to come, as smaller occupiers choose instead to go for serviced office space. The positive side of this is that we will continue to see serviced office operators taking considerable amounts of space in a range of office buildings – even those offering the newest, highest quality space.

See full details of the transactions featured in our Birmingham office market research, comprising office space in Birmingham city centre and Edgbaston.

For more information on the Birmingham office market, please contact Malcolm Jones on 0121 233 2330 or email mjones@kwboffice.com.

To register for future research updates, click here. See also our M42 and Solihull office market research.

Want to know more?

Contact Malcolm Jones

0121 233 2330