M42 and Solihull office market research — Q1 2021

Unsurprisingly, Q1 2021 delivered a particularly low level of take-up, with 20,326 sq ft across six transactions. However, the Solihull office market remains incredibly popular and an ideal location for investors and developers.

As with Birmingham city centre, the Solihull office market’s symptoms of the COVID year have continued into 2021, given the latest lockdown that came into place in January. Nevertheless, some decent-sized transactions are on the way, and the case to build new office space in Solihull and the M42 corridor is still relevant.

Q1 2021 stats

2 0 , 3 2 6

total take-up (sq ft)

9 , 1 1 4

largest deal (sq ft)

6

total transactions

Solihull office market at a glance

- Adecco relocates into smaller space

- Key transactions

- Junction 6 takes lion’s share on the M42

- Requirements in the marketplace

- HS2 starts to arrive in Solihull

- CREATE Fertility continues to prosper out-of-town

- Lack of stock and the case to build

- Outlook

Adecco relocates into smaller space

Adecco took 9,114 sq ft at T3, Trinity Park, in the largest transaction of the quarter. The transaction represents a significant downsizing of the business’s Solihull office space – with the recruiter currently occupying c. 25,000 sq ft at the IM building.

Following the pandemic, we are expecting downsizing of office space from some businesses who will move towards a more flexible or hybrid work model. With some staff working either occasionally or permanently from home, the requirement for offices is reduced and an occupier can operate with less space.

However, in the Solihull office market, this reduction in commitment could be seen as a good thing. Such is the thirst for office space here that, if an occupier vacates their space or moves into smaller offices, they free-up a new, rare opportunity for another occupier to take space.

Key transactions

The top 3 transactions include:

| Office building | Size (sq ft) | Occupier | Business sector |

|---|---|---|---|

| T3, Trinity Park | 9,114 | Adecco | Recruitment |

| Fairway House | 4,550 | Inspired Selections | Recruitment |

| Unit 4 Quartz Point | 2,508 | Dodd Group | M&E building maintenance |

- Recruiter, Inspired Selections, was behind the second largest letting of the quarter, taking 4,550 sq ft at Fairway House. The recruitment company specialises in the optical industry, placing skilled staff in opticians around the country. Inspired Selections has relocated within 5 miles of their previous base at Centre Court, Stratford Road, Birmingham. Situated on Lode Lane Industrial Estate, close to JLR’s manufacturing facilities, the hybrid nature of Fairway House suggests that the incoming occupier will be looking to adapt it to their own use.

- Dodd Group took 2,508 sq ft at Unit 4 Quartz Point at Junction 6 of the M42. Dodd Group is a notable family-run contractor based at Stafford Park in Telford with 20+ regional offices around the country. They deliver M&E contracting and building maintenance services. This latest regional base is driven by their contract with Solihull Council to install sprinkler systems into their residential stock.

Both transactions represent inward investment to the Solihull area.

Junction 6 takes lion’s share on the M42

Of the quarter’s six transactions in the M42 and Solihull office market, four took place at Junction 6 – showing that, even during the pandemic, this area continues to be a force to be reckoned with.

With business locations such as Birmingham Business Park at this part of the M42, this is one of the few places able to offer the size and quality of office space that businesses are looking for. In addition to this, it also offers an impressive business community, as well as a superb location close to the M42, Birmingham Airport and International Station.

Requirements in the marketplace

As we see in Birmingham city centre, Q1 may not have delivered a headline total, but there is a range of enquiries in the marketplace.

Requirements include one that is a relocation within the area for 25,000-30,000 sq ft, one for 18,000-20,000 sq ft and two for 4,000 to 6,000 sq ft. Unfortunately, whilst we do see stock between 2,500 sq ft and 3,500 sq ft coming back onto the market, supply of office space above this size is currently very low and without much set to come back in the near future. You can read more about the state of stock in the Solihull office market in the section ‘Lack of stock and the case to build’.

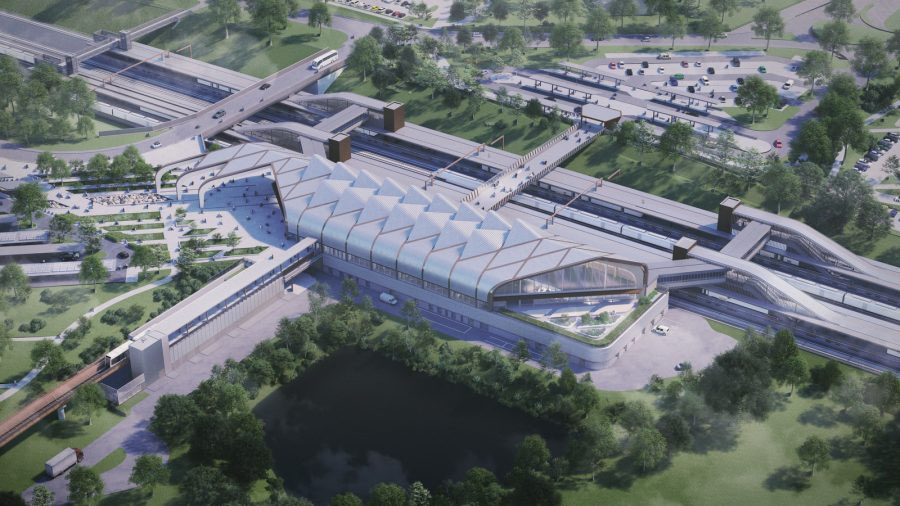

HS2 starts to arrive in Solihull

In 2014, HS2 took 97,958 sq ft of office space at Two Snowhill in Birmingham city centre to house its headquarters as plans for the country’s high speed rail network began to pick up pace. Over the following years, a number of contractors and service providers assigned to the project took space in the City, either within or close to Two Snowhill. These businesses included Laing O’Rourke, Galliford Try, Jacobs Engineering and, most recently, Carter Jonas.

Until now, we haven’t really seen HS2-related lettings in Solihull. However, this quarter, recruitment business, VGC, opened an office at Junction 4 of the M42. VGC has been instructed on assisting the HS2 project with its recruitment of skilled construction staff. Given the forthcoming HS2 Interchange Station, Solihull is a logical place for the recruiter to situate an office. VGC is clearly interested in Solihull specifically, as the nationally operating recruiter already has a Birmingham office.

Although VGC’s latest office is within the BizSpace serviced offices at Zenith House – and therefore not reported in the traditional sales and lettings transactions – it’s still an important step. Recruitment drives are moving full speed ahead for HS2 at present. In January, a drive was revealed to recruit 200 new employees for the construction of the network.

Going forward, we are aware of office requirements in the marketplace for 4,000-6,000 sq ft that relate directly to HS2 tenders – so it’s safe to say HS2 has arrived in Solihull.

CREATE Fertility continues to prosper out-of-town

Pioneers of Natural and Mild IVF treatment, CREATE Fertility has expanded its Solihull offices at the Bishops Court development on Birmingham Business Park. The business has taken a further 1,765 sq ft at 6270 Bishops Court, in addition to its existing 4,000 sq ft.

The business has clearly enjoyed success at this location, given the need to expand. CREATE originally selected Bishops Court on Birmingham Business Park back in Q3 2015 because it was seeking excellent transport links at an out-of-town location, in order to provide a degree of privacy.

Expansion stories, such as this, are testament to the impact that a site, as significant as Birmingham Business Park, can have on a business. The Park is home to a wide variety of occupiers, from global blue-chip brands to prospering SMEs.

Lack of stock and the case to build

Seeing expansions and inward investment still on the menu, despite the pandemic, the demand for offices in Solihull and the M42 corridor is evident. However, supply is still an issue, and there is a credible argument to build.

Whilst the largest office space available to let on the M42 is currently Ingenuity House, next to Birmingham Airport, this property stands on its own in terms of the size and quality of space it offers.

Consequently, once let, there will be no comparative offering available to an occupier.

Given the advancement of HS2, this lack of available space becomes more of a concern as infrastructure plans progress and demand for high quality office space increases.

Whilst the market has been consistent and resilient over the past few years, it is arguably not achieving its full potential due to the drought in available stock.

Record take-up at key areas, such as Blythe Valley Business Park and Birmingham Business Park, for several consecutive years has eroded high quality office stock.

In fact, the impact of this has been that occupiers are remaining within their existing premises rather than relocating, simply because there is a lack of alternative options. Demand has effectively created a one-in-one-out situation, where an occupier vacating a property gives another occupier an opportunity to take office space.

Given the gap between supply and demand, now is a good time to consider new build projects in Solihull.

Prior to the pandemic, we saw an increase in pre-lets, such as the 90,001 sq ft Plot A to ZF in 2019, and 15,081 sq ft at FIRST to Jerroms in Q3 2018, both on Blythe Valley Park.

These pre-lets strengthened the case for speculative development, with landowners taking tangible steps to address the office space drought in this area. Despite the pandemic, the gap between future demand and supply still exists. Consequently, the proposals that had been considered by landowners should be reignited.

Outlook

With a number of requirements currently seeking office space, we would expect to see an increase in take-up over the rest of this year, compared with the previous five quarters. Progress may be slow but, ultimately, the Solihull office market has repeatedly proven itself to be incredibly resilient and will soon be back to its usual self.

The element that will continue to be an issue for the market, however, is lack of supply. Until that is sufficiently addressed, the market will always be capable of more.

See full details of the transactions featured in our M42 and Solihull office market research.

For more information, please contact Malcolm Jones on 0121 233 2330 or email mjones@kwboffice.com.

To register for future research updates, click here. See also our Birmingham office market research.