M42 / Solihull office market 2021 review

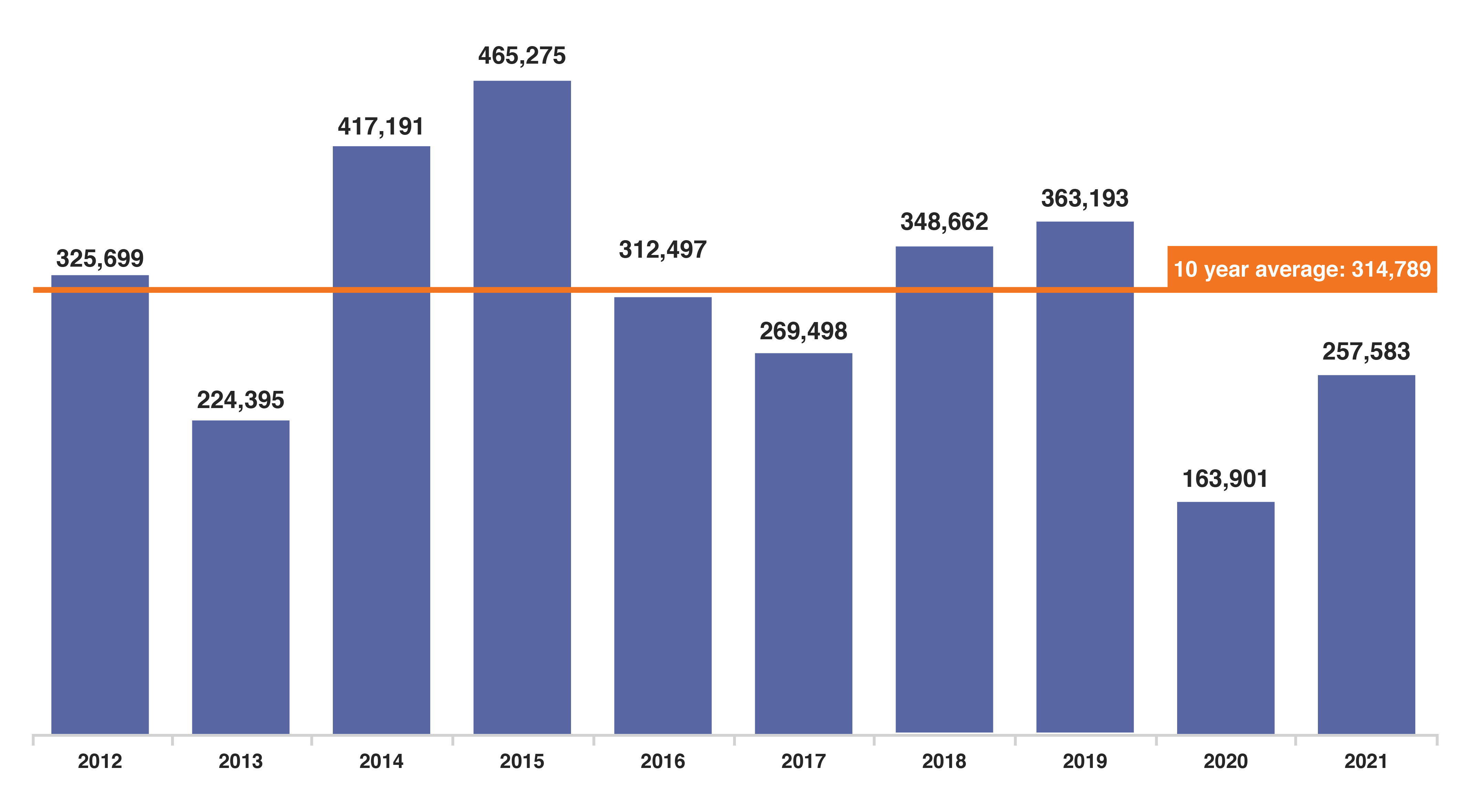

The M42 / Solihull office market achieved 257,583 sq ft – 57% higher than 2020. Stock remains in short supply, but the NEC Masterplan gives reasons to be cheerful.

A substantial improvement on the figures of 2020, the M42 / Solihull office market secured more transactions and significantly more office take-up, but there are still occupiers unsure of their next step.

2 5 7 , 5 8 3

total take-up (sq ft)

3 2 , 8 4 8

largest deal (sq ft)

4 3

total transactions

M42 / Solihull office market annual take-up (sq ft)

Solihull office market at a glance

- Construction central – demand for industrial space visible in office market

- MSO’s dropped locations picked up – serviced offices taken on by new operators

- BBP secures 57% of Q4 – park securing good numbers despite low stock

- Stock drought pushes rents on – headline rents rise by 10-15% in 12 months

- NEC Masterplan – NEC Campus is credible office stock saving grace

- Taking smaller space – the occupiers embracing hybrid working and lowering sq ft

- Redditch and Bromsgrove – the two M42 towns secure 8% of take-up

- On the fence – some occupiers yet to ‘make their move’

- Outlook – stock still an issue but the long term looks bright

Key Solihull office transactions

Following an extremely quiet year in 2020, this year shows a marked improvement with double the number of transactions over 10,000 sq ft, representing 46% of total take-up.

M42 / Solihull transactions over 10,000 sq ft in 2021

| Office building | Location | Sq ft | Occupier | Business Sector |

|---|---|---|---|---|

| T2 Trinity Park | J6 M42 | 32,848 | Mitie | Facilities management |

| 2010 The Crescent | Birmingham Business Park | 27,764 | Citibase | Serviced offices |

| Jago House | Solihull | 20,577 | Private | N/A |

| Radcliffe House | Solihull | 14,952 | Chadwick Business Centres | Serviced offices |

| 2620 Kings Court | Birmingham Business Park | 11,701 | Rivus | Fleet management |

| Bromwich Court | Coleshill | 10,201 | Lasercare Clinics | Health & Beauty |

| Total | 118,043 | 46% of take-up, 6 transactions |

The largest letting of the year went to the facilities management arm of Mitie, who took 32,848 sq ft, relocating just a stone’s throw from their previous offices at Ingenuity House, next to Birmingham Airport.

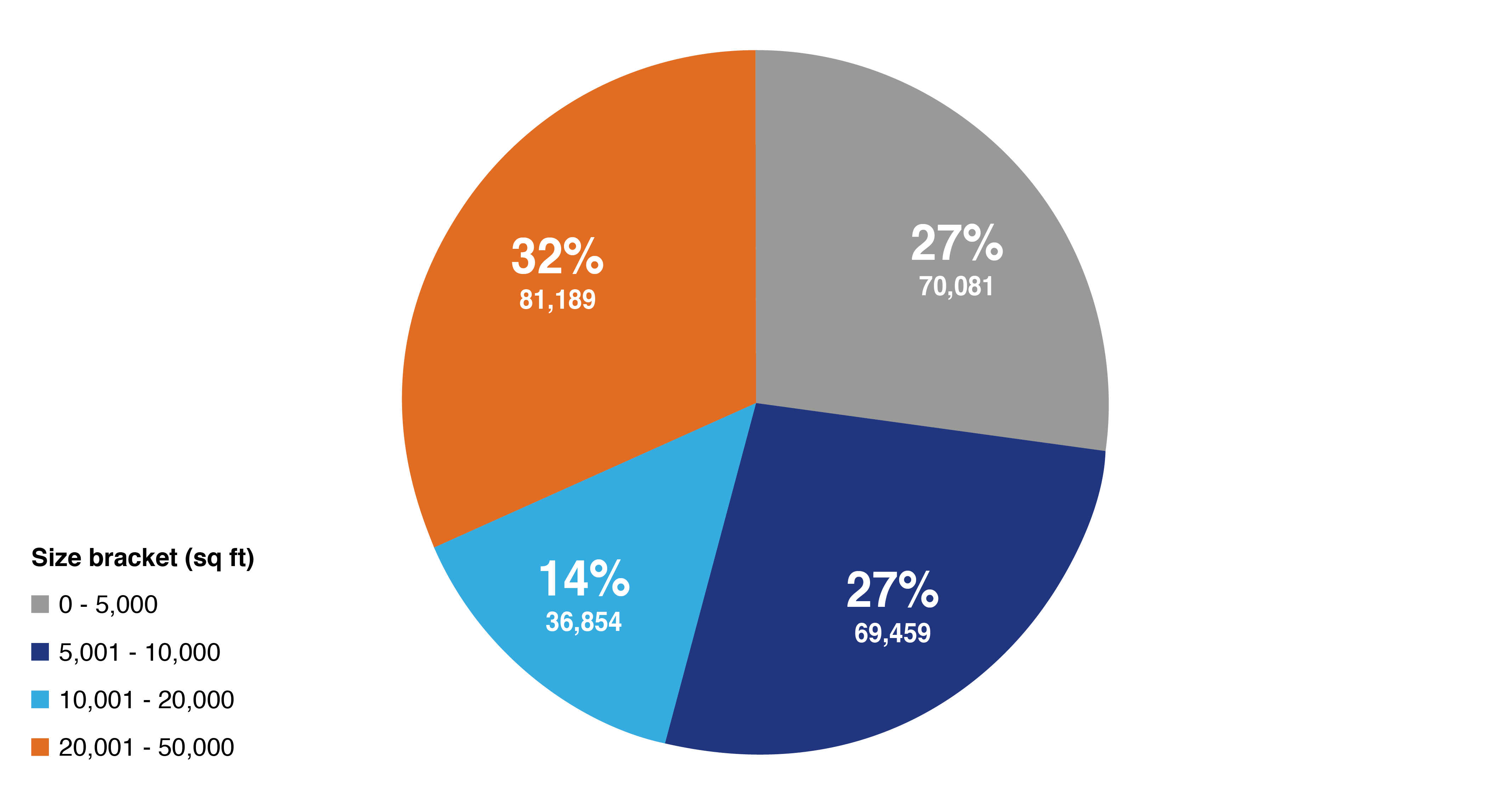

M42 / Solihull take-up 2021 by size band (sq ft)

Analysing the year by transaction size band, it’s a fairly even spread – with 54% of take-up in the first two bands, up to 10,000 sq ft. Office space transactions within these bands regularly represent around 50% of the year’s take-up in this out-of-town office market – underlining the importance of this size of space along the M42 corridor.

Construction central

With demand for industrial property at an all-time high, construction is booming. We can see evidence of this in the number of businesses in construction and related industries taking space in 2021.

With changes in consumer behaviour accelerated by the pandemic, growth in online retail has driven requirements for warehousing and logistics space. The Midlands is a prime location in the country to base e-commerce logistics and stock. With its links to the UK motorway network and its central location, distribution reach and efficiency is optimised.

In the table below, you can see transactions by a range of property-related businesses, such as construction, facilities management, building services, architects and more. All of these businesses can support the growth in industrial stock, as speculative developments and design and build opportunities – such as Diamond – spring up in the area.

| Office building | Location | Sq ft | Occupier | Business Sector |

|---|---|---|---|---|

| T2 Trinity Park | J6 M42 | 32,848 | Mitie | Facilities management |

| 3100 Park Square | Birmingham Business Park | 9,499 | Galliford Try | Construction |

| 3160 Park Square | Birmingham Business Park | 8,241 | Imtech Inviron | M&E / Facilities management |

| T3 Trinity Park | J6 M42 | 7,003 | Tilbury Douglas | Construction |

| Ravens Court | Redditch | 5,754 | Santec UK | Civil engineering |

| Units 9 & 10 Quartz Point | J6 M42 | 5,296 | Briggs & Forrester | Building services |

| Unit 10 Empire Court | Redditch | 3,869 | Wates | Construction |

| 31 Homer Road | Solihull | 3,405 | Glencar Construction | Construction |

| The Lodge | Coleshill | 3,114 | STOAS Architects | Architects |

| One Cranmore Drive | J4 M42 | 2,646 | MJ Fitzpatrick | Construction |

| Unit 4 Quartz Point | J6 M42 | 2,508 | Dodd Group | M&E |

| Total | 84,183 | 33% of take-up, 11 transactions |

In supporting the booming logistics market, you can also look at companies like Vanderlande UK with their automation processes for logistics, and Vigo Software with their fleet and warehouse management software – together accounting for a further 11,000 sq ft of take-up.

MSO’s dropped locations picked up

At the end of 2020, serviced office operators, MSO Workspace – with locations in the Solihull office market – went into administration. In February 2021, the company was bought out of administration, although MSO’s portfolio was significantly reduced going forward.

During 2021, we subsequently saw MSO locations that were destined to close, be picked up by other serviced office operators. These sites had existing occupiers with licences for office space in place, so where new operators stepped in, the operation was taken on, allowing occupiers to continue within the serviced offices.

In Q3, Chadwick Business Centres took 14,952 sq ft at Radcliffe House, Blenheim Court in Solihull town centre – a former MSO Workspace location, still with occupiers attached. The space was taken in the form of a 10-year management agreement. This represented one of only three transactions in Solihull town centre in 2021, where lack of high quality office stock resulted in the town centre accounting for just 15% of annual take-up – and the majority of transactions taking place within the out-of-town business parks.

In Q4, the quarter’s largest letting was also a previous MSO location. Serviced office operator, Citibase, took 27,764 sq ft at 2010 The Crescent on Birmingham Business Park. Together, the two transactions total 42,716 sq ft – representing 17% of the year’s take-up, which is considerable.

BBP secures 57% of Q4

Birmingham Business Park secured 36,690 sq ft (57%) of the 64,323 sq ft transacted in the Solihull office market in the fourth quarter of 2021. As for the year as a whole, transactions on Birmingham Business Park represented 77,345 sq ft (30%) of the annual take-up.

The Park often achieves a significant proportion of the office space transacted in Solihull and the M42 corridor. The Park is home to an impressive range of high-profile occupiers, and it is one of the few locations in Birmingham’s out-of-town office market that can support large relocations, expansions or consolidations. Occupiers are also attracted by its strategic connectivity – it’s close to J6 M42 and J4 M6, with Birmingham Airport and Birmingham International train station right on the doorstep.

However, lack of available space on the Park will restrict activity, although in 2022, we can expect some stock to come back to the market. This will be in the form of 60,000 sq ft at 4520 Solihull Parkway, which will push up availability to 7-8% of the Park. The property vacated by BT-owned EE, will be the largest available office space on Birmingham Business Park by some margin and will, therefore, represent a unique opportunity for larger occupiers with an eye on the location.

Rents pushed on and refurb pushes again

Office rents within the Solihull office market have been rising consistently over recent years, as the supply of office stock is driven down further. Due to this and other factors, headline rents have risen by 10-15% in the past year.

The wrestle between supply and demand has enabled landlords to command higher rents, but they’ve also been able to push those rental values higher still.

The better quality the space, the higher the price tag – and landlords have been refurbishing space to meet occupier demand for high quality office space in a market that’s not building new stock. Landlords that do invest in high quality refurbishment can both raise their rents and reasonably expect to let their vacant office space quickly, particularly if it enables flexibility of occupation and fit out.

NEC Masterplan

In November 2021, the NEC Group revealed its Masterplan for the NEC Campus. We believe that this gives the commercial property market much to get excited about, as the area is so in need of new office stock. This ambitious project, as it is set out, will deliver:

- 5,000 homes

- 3,500 local jobs

- 376,736 sq ft of commercial space

- 14,000 sq m of outdoor event space

- A hotel, restaurants and cafés

- A primary school

- A greener and more sustainable environment on the NEC Campus

The Masterplan represents one of the most credible known prospects to deliver new space – credible in the sense of likelihood, timescales and potential of long-term success.

Here are some reasons to be cheerful about the NEC Masterplan:

- Planning consent will be easier than for others: the proposal is to develop on over 27 hectares of surface-level car parking and surplus land owned by the NEC Group. Other proposed developments in the area that are seeking, for example, to build on green space will represent more complex cases, regarding planning consent, that will be more difficult to approve.

- The NEC site itself: as it stands, it offers a conference centre, a major entertainment venue, a theme park attraction and Resorts World, a leisure destination filled with outlet shops, restaurants, a cinema and a casino. The existing established amenities here strengthen the business case for commercial development of the NEC site, and the creation of the Campus.

- Transport: another element that makes this site so viable for such development is its incredible transport links. Birmingham Airport and Birmingham International train station are in the immediate vicinity and the site is close to junctions of both the M6 and M42.

- HS2: building on the theme of transport, HS2 is set to substantially enhance the area – with the upcoming Interchange Station so close by. Not only this, but an ‘automated people mover’ is part of the HS2 designs, connecting the new station with the NEC Campus, Birmingham International Station and Birmingham Airport.

Taking smaller space

More office occupiers have started to make property decisions and move once again. Many businesses have taken time during the past two years to review their office space requirements, work policies and overall property strategy.

Consequently, some occupiers are downsizing. We also see this in Birmingham city centre, where some businesses have taken less space, but of a higher quality. Legal firm, Shoosmiths and financial business, Grant Thornton, both relocated to smaller space at 103 Colmore Row, representing a substantial increase in price per sq ft, but a rise in office specification. These businesses have taken the decision to embrace a hybrid working model, and we see that out-of-town too.

In Q1 2021, Adecco took 9,114 sq ft at T3 Trinity Park. Whilst some staff relocated to surplus space in Adecco’s Birmingham city centre offices, this transaction still represented significant downsizing for the recruitment company, which was relocating from 25,000 sq ft at the IM building. Adecco was drawn to T3 by the quality of its Grade ‘A’ space, which had undergone comprehensive refurbishment. The works included sustainability improvements, such as the installation of energy-efficient air heating, cooling and LED lighting, improving the EPC from D100 to B28.

Adecco appeared to be putting its own recommendations into practice. The recruitment specialist has published a number of its own studies on hybrid working since the start of the pandemic, as the topic has risen up the agenda.

Redditch and Bromsgrove

Redditch and Bromsgrove secured 20,680 sq ft of the M42 office market in 2021 – 8% of take-up.

The two towns are key business locations for occupiers looking to be close to the M42. Office space in Bromsgrove and Redditch benefits from excellent transport infrastructure, yet is significantly more cost effective than Solihull and the major business parks.

However, owing to low levels of available office stock, lettings have been fairly thin on the ground in recent years. Often, space that is brought to market following office refurbishment is let promptly – as the demand is always there.

| Office building | Location | Sq ft | Occupier | Business Sector |

|---|---|---|---|---|

| Ravens Court | Redditch | 5,754 | Stantec UK | Civil engineering |

| Unit 2 Topaz | Bromsgrove | 5,067 | Vigo Software | Fleet and warehouse management software |

| Unit 10 Empire Court | Redditch | 3,869 | Wates | Construction |

| Units 9 & 10 Chestnut Court | Redditch | 3,150 | Wider Plan | Workplace benefit schemes |

| Unit 20 Chestnut Court | Redditch | 1,575 | 321 Corporate Payroll | Payroll services |

| Unit 7 Empire Court | Redditch | 1,265 | Johnson Cars | Car dealership group |

| Total | 20,680 | 8% of take-up, 6 transactions |

The variety of business in the table above demonstrates the broad appeal of these locations. Indeed, it is very like that of Solihull itself and its nearby business parks.

On the fence

Whilst the M42 / Solihull office market figures are significantly better than the previous year – 57% more take-up – market behaviours are not back to normal. There are still occupiers holding off, where they can, to enable more time to evaluate their options and decide – not just on their property requirements – but on their working policies, too.

To facilitate this need for more time, landlords have also been willing to move break clauses and hold over on leases. However, this is a short-term fix. At some point, occupiers in this situation will need to decide whether to renew at their existing premises or relocate. Undoubtedly, the availability of attractive and practical options for relocation will be one of their key considerations.

Outlook for Solihull office market

For many businesses, there is a sense that entering the office needs to be a more rewarding experience, to be more appealing for staff than working from home. This can take the form of increased breakout and collaboration areas, and better facilities.

Consequently, occupiers are seeking new, high quality offices to attract their staff back to the office. If that stock isn’t available in the size and location that they need, then that leads to more businesses staying put and approaching landlords to push back lease events.

We would expect to see a continued improvement in market activity – as seen between 2020 and 2021. However, the market will be held back by lack of stock and, by and large, there is no high quality office stock of a considerable size coming back to the market – apart from the previously mentioned, formerly BT-occupied, 4520 Solihull Parkway.

However, looking longer term, the announcement of the NEC Masterplan, especially when combined with projects such as Arden Cross, paints a bright future for the M42 / Solihull office market.

See full details of the transactions featured in our M42 and Solihull office market research.

For more information, please contact Malcolm Jones on 0121 233 2330 or email mjones@kwboffice.com.

To register for future research updates, click here. See also our Birmingham office market research.

Want to know more?

Contact Malcolm Jones

0121 233 2330