M42 and Solihull office market research — quarter 2 2018

Office take-up within the M42 and Solihull office market in the second quarter of this year has achieved 55,287 sq ft across 14 office space transactions. A somewhat lacklustre quarter indicates that lack of supply is taking its toll on a market where demand for high quality office space is high, yet availability is low. At the halfway point, total take-up is 44% of the average annual take-up (based on the last six years).

Furthermore, the cyclical ways of the office market would indicate that 2019/20 should be bumper years, with many lease events set to occur five years on from the peaks of 2014/15. However, can the M42 and Solihull office market find a solution to the increase in demand, at a time when it is already struggling to meet current requirements?

CSI takes the most space, but does HS2 present a problem for property?

British cloud services provider and cybersecurity giant, CSI, has taken a lease on 15,965 sq ft of Solihull office space at 2940 Trident Court on Birmingham Business Park. This represents a relocation from its current headquarters in Coleshill to higher-profile office space on one of the foremost business parks in the region.

The primary reason for the company’s need to relocate is due to its existing Coleshill office space being earmarked for demolition to allow the HS2 rail infrastructure to be constructed on the site.

CSI has taken the opportunity to upgrade its office space. This is an excellent progression for CSI, but other companies facing the same situation may not have an office to relocate to that is of equal or better quality.

2940 Trident Court

In an office market in which space is both severely lacking and failing to meet demand, commercial property being demolished adds further pressure in the short term to the current lack of availability. The amount of space available is further eroded every quarter, and CSI’s new offices represented one of the few remaining, larger pieces of high quality office space on Birmingham Business Park.

The most obvious solution to this is for the speculative development of new office space. Longer term, the plans for UK Central and Arden Cross will help to address this.

In the medium term, whilst there are some plans for potential new developments across Solihull and the M42 corridor, at this point — save for the c.15,000 sq ft office, ‘First’, speculatively developed on Blythe Valley Business Park — no other developments have moved any further forward than the planning stages.

Prologis decides to build its own

Following closely behind CSI is Prologis, which took 15,288 sq ft at Blythe Valley Business Park. Reports regarding the pre-let of this space had been in the headlines for some time, but now it has appeared in the market’s completed transactions.

The UK-based, internationally operating developer and owner of logistics property is relocating from its existing offices on Stratford Road, Shirley to Blythe Valley — effectively moving just around the corner — next to the plot on which ‘First’ is being speculatively developed by IM Properties. This will make Prologis’ former premises available for redevelopment within the ‘motor alley’ stretch of the A34 Stratford Road.

Plenty of smaller deals

Whilst the overall total take-up may be unimpressive, the M42 and Solihull office market did see transactions for office space below 3,500 sq ft account for 11 of the 14 lettings of Q2.

At the smaller end of the market, there is sufficient quality and choice to attract occupiers – where office space is available, deals are taking place. Locations such as 43 Dominion Court and The Courtyard in Solihull, and Curdworth House in Coleshill have all seen a flurry of lettings so far this year, and we expect to see more of these in the rest of 2018.

Dominion Court, Solihull

The frequency and variety of smaller occupiers taking space provide reassurance for the office market. Lettings to businesses such as Fabric Developments – which took 594 sq ft at 6 The Courtyard, PERI – which took 1,736 sq ft at 2625 Kings Court and Total Computer & Network Support (TCNS) – which took 691 sq ft at Curdworth House, show us that the out-of-town office market’s broad occupier base is very much active, and the local economy is prospering.

A lacklustre quarter and the cyclical office market

Q2 was a fairly unspectacular quarter, when considering the volume of transactions and the size of office space taken up. The average annual level of take-up is 335,759 sq ft and, at the halfway point, 2018 has seen 146,342 sq ft of space transacted — putting the year c. 13% shy of the long-term average, after a strong Q1. The quarter itself only achieved 55,287 sq ft — 35% short of the average quarter of 83,940 sq ft. The predominant reasons for this shortcoming are two-fold.

The first, is the frequently reported lack of supply within the Birmingham out-of-town office market. With so few options for occupiers to consider in Solihull and the M42 corridor, businesses are deciding to stay put — or relocate further down the M42 — at a rate which is higher than would be expected if supply wasn’t an issue.

Furthermore, the office market here may also be losing out on inward investment from companies that are not presented with sufficient, viable properties and instead choosing to take office space outside of this area. We have seen examples of this in recent months, with more occupiers gravitating to areas such as Warwick.

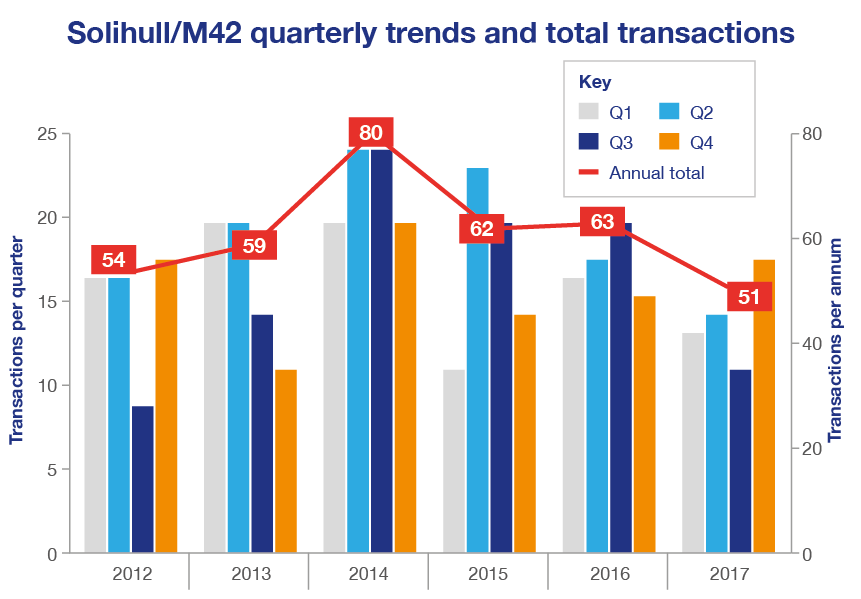

The second, is a commonly occurring and unavoidable symptom of the cyclical nature of the office market — we are in a lease event lull. In previous years, we have noted that – aside from inward investors and occupiers acting upon lease breaks – that, by virtue of the cyclical market, there are regular peaks and troughs of office space activity in accordance with lease events.

In 2014, we cited the strong level of transactions owing to a high number of lease events falling within the 12-month period. With the average lease length in the current market being around 5 years, it comes of little surprise given that the previous lull took place in 2013. Going into 2014, the long-term average annual level of take-up was only 220,000 sq ft — owing to the recession which had taken place over the prior 5-year period.

2014 managed to achieve a total of 417,191 sq ft, almost twice the average annual level of take-up at the time. This was due to the high number of lease events, the post-recession recovery of the office market and the increased appeal of areas such as Birmingham Business Park. The latter two of which are largely behind the 50% growth of the market’s average annual level of take-up to 335,759 sq ft.

Subsequently, we would then expect 2019 to be a comparatively active year to 2014. However, the state of office space availability in 2014 was far different to what it is now and will be in 2019. The lack of office space availability could well inhibit what would otherwise be an eventful year for the office market.

Lack of office space

The key business parks in the region, such as Blythe Valley Business Park and Birmingham Business Park, continue to appeal and do well but they suffer from lack of supply. Indeed, this is quite indicative of the rest of the out-of-town office market, where we see a very similar level of enquiries as we did last year, but there are so few options for occupiers. All the while, Birmingham city centre is building and securing transactions.

There is a fair amount of availability now within Solihull town centre, where there wasn’t in previous years, and although we haven’t seen a great number of lettings in the town centre as yet, we expect to see far more in the second half of the year.

Lack of speculative development

As the market cries out for office space, the prospect of speculative development remains fairly unchanged. So far, commercial property developers have taken the line that they will only build new offices in Solihull and the M42 corridor in the event of a substantial pre-let, along the terms of a 10 or even 15-year lease. This is at a time when occupiers across the country have never wanted more flexibility, putting the market in somewhat of a stalemate.

This contrasts substantially to Birmingham city centre, which is currently enjoying its highest ever level of commercial property development, twice that of pre-recession levels.

In light of the above, perhaps it is time for developers to give new consideration to speculative development. Much of the sort of vacant office stock which KWB called to be refurbished in recent years has been fixed up and subsequently secured an occupier — diminishing supply and demonstrating demand.

Birmingham Business Park

Outlook

The prosperity of the Birmingham out-of-town office market now seems to hinge on whether supply can meet demand in a meaningful way, so as not to prevent transactions from taking place.

The serviced office trend in Birmingham city centre continues to evade the surrounding out-of-town office market. The difference in the occupier base between the City and out-of-town is likely to be the reason for this, with businesses not seeking the same level of flexibility as has come to be expected in Birmingham city centre.

The letting to Bizspace in Q1 2018 did provide a necessary injection of flexible office space, but this one-off letting to a serviced office provider cannot be compared to the substantial serviced office take-up in the city centre.

However, could it be the case in the future that a serviced or managed office operator could provide the market with that all-important pre-let commitment to get new office space to be built? It’s a lateral concept, but the market could certainly do with some lateral thinking to retain and attract occupiers within Solihull and the M42 corridor.

See full details of the transactions featured in our M42 and Solihull office market research.

For more information, please contact Malcolm Jones on 0121 233 2330 or email mjones@kwboffice.com.

To register for future research updates, click here. See also our Birmingham office market research.