M42 and Solihull office market research — quarter 3 2018

Q3 2018 saw the M42 and Solihull office market achieve 112,889 sq ft over 14 transactions – the same number of deals as the previous quarter but double the square footage. The quarter’s grand total was the product of larger transactions throughout the market as some of the final pieces of available high quality office space were snapped up.

Solihull town centre

The third quarter of this year saw six transactions at c.10,000 sq ft and above – with the inclusion of Galliford Try and Taylor Wimpey at close to 10,000 sq ft – showing the continued strength of interest in the area at the top of the market. These six deals total 83,763 sq ft and represent the erosion of some of the final pieces of available, high quality office space in Birmingham’s out-of-town office market.

31 Homer Road had the most take-up in Q3, with 38,050 sq ft across two lettings. With Birmingham Business Park now at just 7% vacancy, Blythe Valley Business Park has secured many of the larger lettings in recent quarters, and Q3 is no exception with 35,924 sq ft across three lettings. Blythe Valley Business Park is now full.

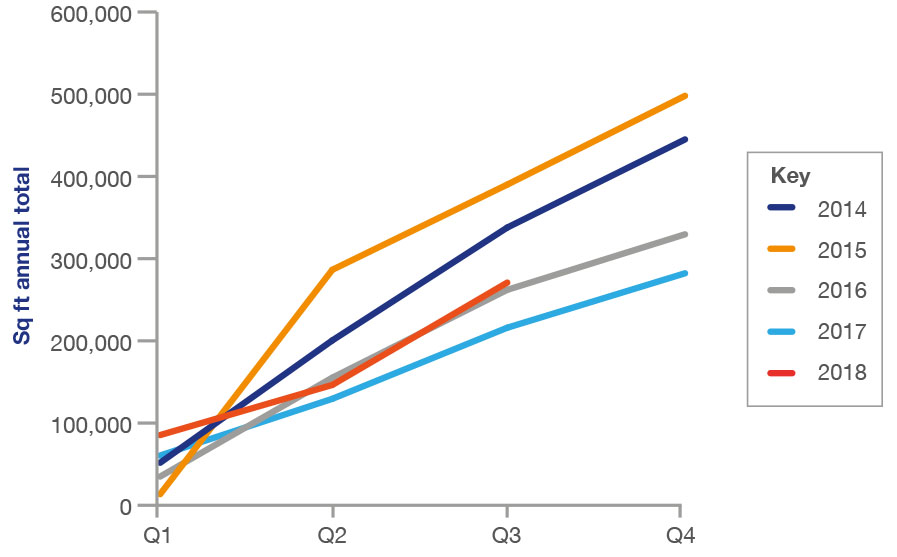

The total achieved in Q3 2018 was the largest amount of space secured in a single quarter since Q2 2015. Q2 2015 is often referenced in office market discussions due to the 247,473 sq ft that was transacted and the landmark pre-let of 113,657 sq ft at International House to Interserve.

| Office building | Location | Size (sq ft) | Occupier |

| 31 Homer Road | Solihull town centre | 21,217 | Serco |

| 31 Homer Road | Solihull town centre | 16,833 | CGI |

| FIRST | Blythe Valley Business Park | 15,081 | Jerroms |

| One Central Boulevard | Blythe Valley Business Park | 11,450 | GKN Aerospace |

| Bromwich Court | Coleshill | 9,789 | Galliford Try |

| One Central Boulevard | Blythe Valley Business Park | 9,393 | Taylor Wimpey |

Notable transactions include:

- Jerroms Accountants – took 15,081 sq ft at FIRST, the only new speculative space in the Solihull office market and was transacted during construction. The letting represents a relocation and expansion for Jerroms, which was previously located at The Exchange on Haslucks Green Road, Solihull.

- CGI – the IT consultancy has relocated from its offices at 2 Trinity Park, where it was a sub-tenant and was required to relocate at the end of the head lease.

- GKN Aerospace – the letting to GKN Aerospace is the result of GKN’s decision to separate off its aerospace division, which now functions as a separate company.

Healthy deals

The market for office space sub 10,000 sq ft also enjoyed healthy-sized transactions. In Q1, we highlighted a gap in the middle of the market – where lettings were not occurring between 3,500 and 10,000 sq ft. This was subsequently also true of Q2. Q3, however, yielded seven deals in that size bracket – totalling 44,142 sq ft with an average size of 6,306 sq ft.

This also means that space in this bracket has been further depleted, limiting the options for other occupiers, as with any flurry of deals of a certain size in a market that is suffering from lack of supply. Properties, such as 39 Dominion Court – which saw a 4,092 sq ft letting to residential developer, Hayfield Homes in Q3 2018 – injected much-needed space in recent years, but have been quickly snapped up. Whilst 2 The Courtyard and The Exchange offer opportunities to rent or buy offices in Solihull town centre, they won’t be around for long.

Dominion Court, Solihull

Instant Offices provides Serco with a managed office solution

The largest letting of the quarter went to public services outsourcing group, Serco, taking space through Instant Offices, which is providing Serco with a managed office facility.

Serco has relocated from Laburnum House in Bournville, following the landlord’s decision to redevelop the property and repurpose it for residential.

Instant Offices’ first managed office solution in the Solihull office market follows hot on the heels of the success it has enjoyed in Birmingham city centre in recent quarters. A number of high profile occupiers have used Instant to secure substantial pieces of office space on terms that suit them. This has included HS2 contractors that required a location within the City to operate from for the duration of their contract – rather than being obliged to take a traditional lease that goes beyond their foreseeable need.

Instant’s managed office service hasn’t just been attractive for its flexibility – it’s the budgeting and lack of liability too. With a managed office, Serco is able to pay an all-inclusive figure, with no fit-out costs, no unexpected expenses and no liability for dilapidations – perfect for a business fulfilling a contract with a fixed length and a fixed income.

Office-to-residential appeal entices Solihull landlords

Adding further to the lack of supply of office space in and around Solihull is the conversion of office buildings to residential accommodation. Sapphire House, Princes Gate and Warwick House are all understood to be undergoing repurposing.

This has been very common in Birmingham city centre, where we have seen the conversion of many office buildings which – in their existing state – were not attracting lettings because they failed to meet modern office occupier requirements.

These decisions are strictly business. Converting a property to residential close to Solihull town centre will see it command higher sales figures per square foot than it would as office space, and so further stock has been taken out of the market – pushing availability down and office rents up.

Expansions

Though high quality, available office space is low in Solihull and the M42 corridor, businesses are still prospering, and growing. A number of transactions represent the expansion of businesses, demonstrating the continued prosperity that companies in this area tend to enjoy:

| Office building | Location | Size (sq ft) | Occupier | Business sector |

| FIRST | Blythe Valley Business Park | 15,081 | Jerroms | Accountancy |

| Friars Gate | Solihull | 7,979 | Linnaeus | Veterinary practice |

| Shadowbrook Court | Hampton-in-Arden | 1,552 | Seriously Fun Business | Marketing services |

The previously mentioned letting of 15,081 sq ft to Jerroms achieved a record rent and represented a significant expansion for the firm, which intends to increase its staff by 50% over the next three years.

Marketing company, Seriously Fun Business, took 1,197 sq ft of space in the previous quarter at Shadowbrook Court. Following the letting in Q3, Seriously has more than doubled its total occupancy to 2,749 sq ft.

Friars Gate, Solihull

Design & Build is the only option

The drought of available space appears to have finally come to a head. Recent years have seen companies struggle to find space of the right size and specification across Birmingham’s out-of-town office market – pushing them further down the M42 corridor to areas such as Warwick and Coventry, but now even those areas lack supply.

No new space has reached the market for a number of years, with the last office development to offer new space being FORE, which completed in 2010.

The solution? Build. KWB itself is now retained by a number of clients to seek high quality, prestigious space with freehold requirements between 10,000 and 40,000 sq ft and are in discussion with commercial property developers on pre-let opportunities to house these occupiers.

An important spot in Solihull

A site in Solihull that is earmarked for redevelopment, located on Homer Road and Station Road, has yet to progress but could provide the town centre with much-needed office stock. The triangular site, adjacent to Dominion Court, was a residential development consisting of a set of houses that were subsequently converted to offices.

Now unsuitable for occupiers, the site would be best redeveloped to provide office accommodation – to ease the office space drought and manage the balance between residential and commercial space in the area.

The decision for this lies with Solihull Council and KWB would encourage the council to consider the area for commercial use. From an income point of view, the rents which can now be achieved on new space mean that the council could expect to generate more funds from the development as office space – long term – in the form of business rates.

If approval for an office development were to materialise, this could ultimately be the first meaningful piece of speculative development in a long time – but the need for it is substantiated by the circumstances of the Solihull office market.

Churn in the main, but inward investment is around the corner

Though the majority of Q3’s lettings are considered to be the churn of the market, Q4 is expected to yield a number of expansions and inward investors.

Whilst lack of space continues to be a concern, it remains that the M42 and Solihull office market attracts inward investors because it has much to offer companies who operate in the Midlands or across the country.

Transport links and connectivity are huge selling points for the area. Close proximity to Birmingham Airport, Birmingham International train station and Junction 6 of the M42 is enjoyed by office parks such as Birmingham Business Park and Blythe Valley Park, as well as the variety of amenities nearby, most notably Resorts World, the NEC and the Resorts World Arena. With further, large scale development projects planned for the area, such as Interchange HS2 station, UK Central and Mercian Studios all expected to add to the appeal of property here.

HS2 Interchange Station, Solihull

Bromsgrove and Redditch

Bromsgrove has no land allocated for commercial use, for much the same reasons as Solihull, and the town council’s Five-Year Housing Land Supply outlines its focus and commitment to housing. Office properties, such as St Johns House, represent some of the area’s last remaining high quality office space. Lettings in the area are expected to continue to trickle through, but whilst there is no change to supply there will not be any meaningful increase in take-up – despite the significant demand within the market. Redditch finds itself in a similar situation, however, the Redditch office market is expected to yield a headline of note before the end of the year.

Outlook

Rental levels are on the rise – record rents have been achieved for new space in the region and rental levels have surpassed those of pre-recession. The letting to Jerroms achieved a record rent for the market, of around the mid-£20s per sq ft. With the construction of new space, we would expect these rents to continue if the current requirements remain in the marketplace.

The whole of the M42 is, at this moment, short on space in every size bracket, but particularly at certain sizes such as 10,000 sq ft where occupiers effectively have no options. Therefore, they have turned to Design & Build and, in the quarters to come, we are likely to see the announcement of such developments, but also the potential for speculative development.

See full details of the transactions featured in our M42 and Solihull office market research.

For more information, please contact Malcolm Jones on 0121 233 2330 or email mjones@kwboffice.com.

To register for future research updates, click here. See also our Birmingham office market research.