M42 and Solihull office market research – quarter 4 and full year 2017

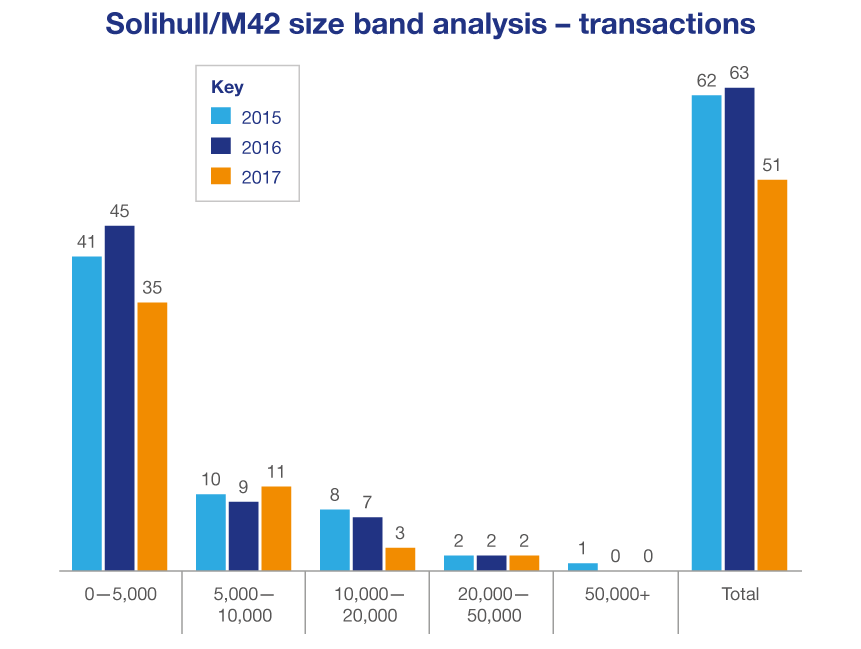

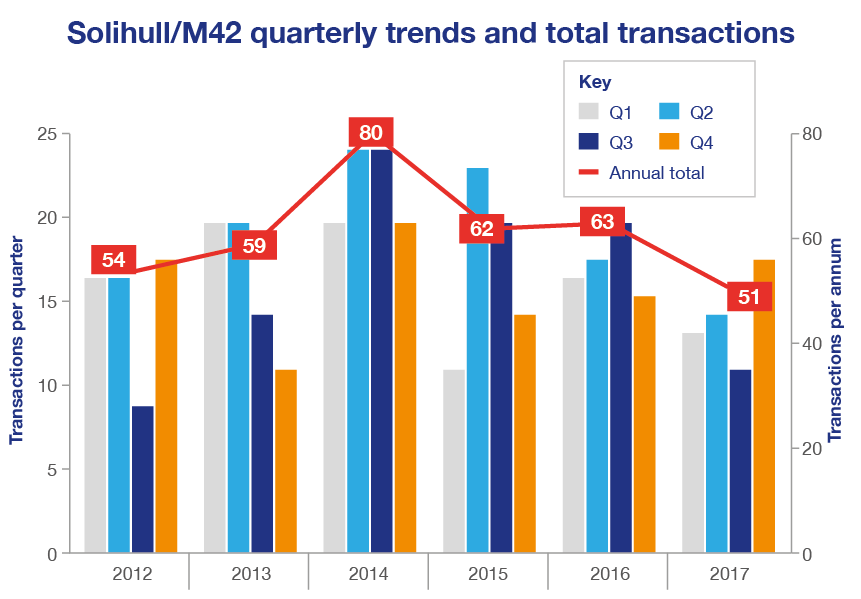

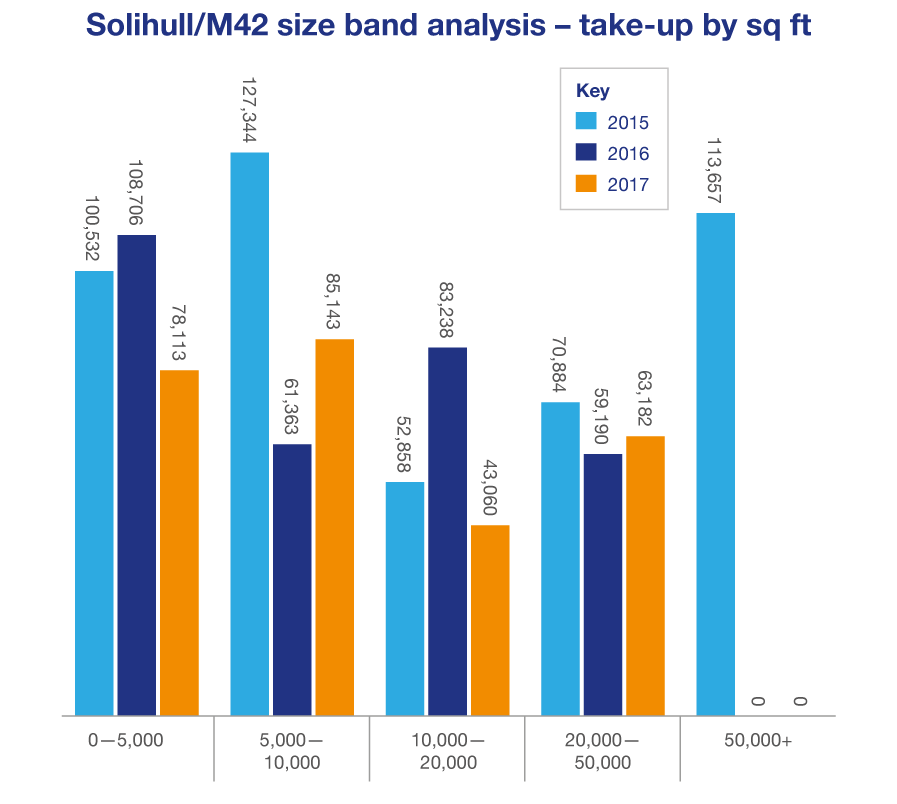

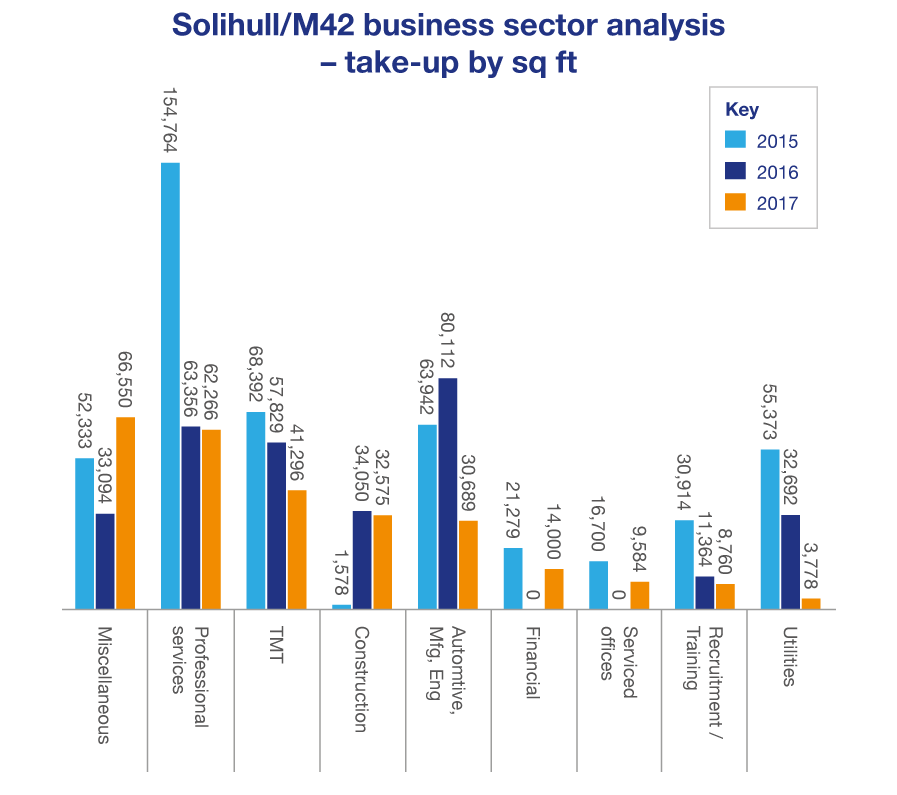

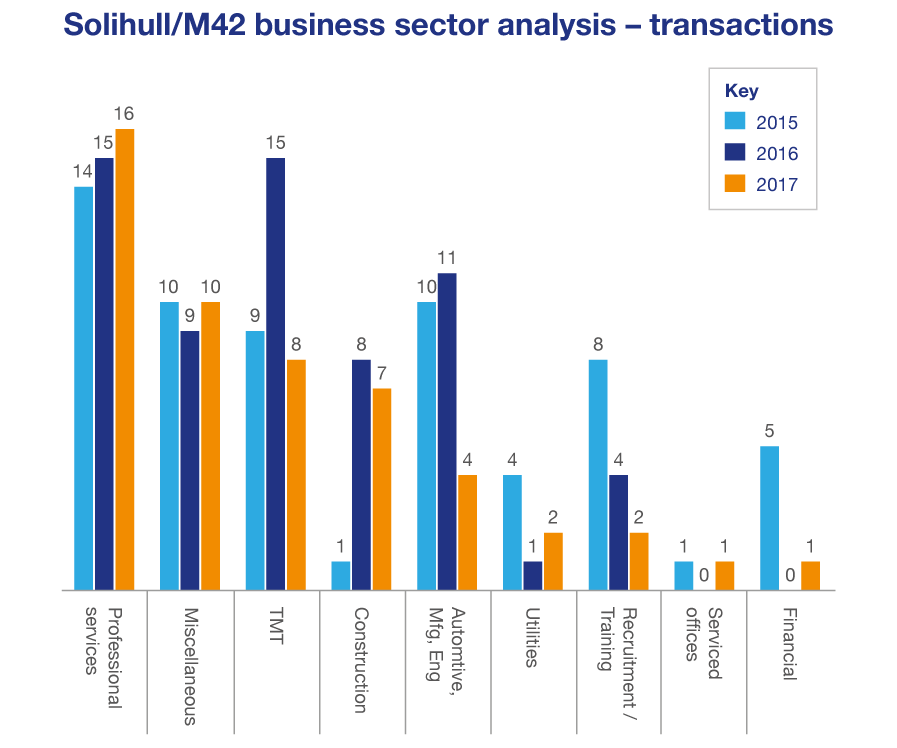

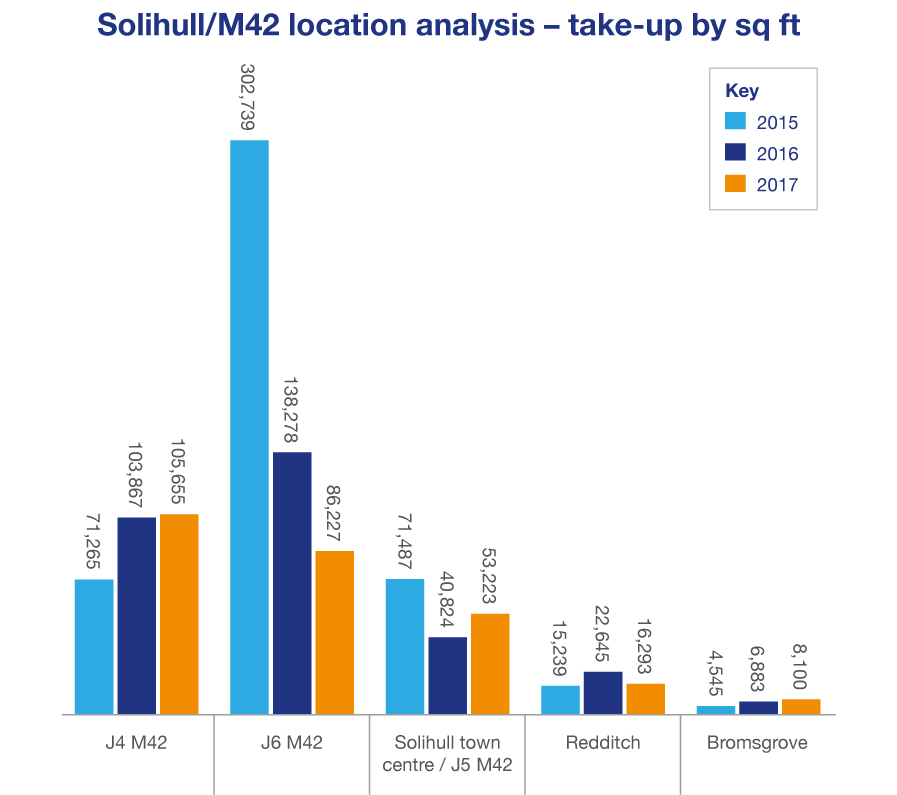

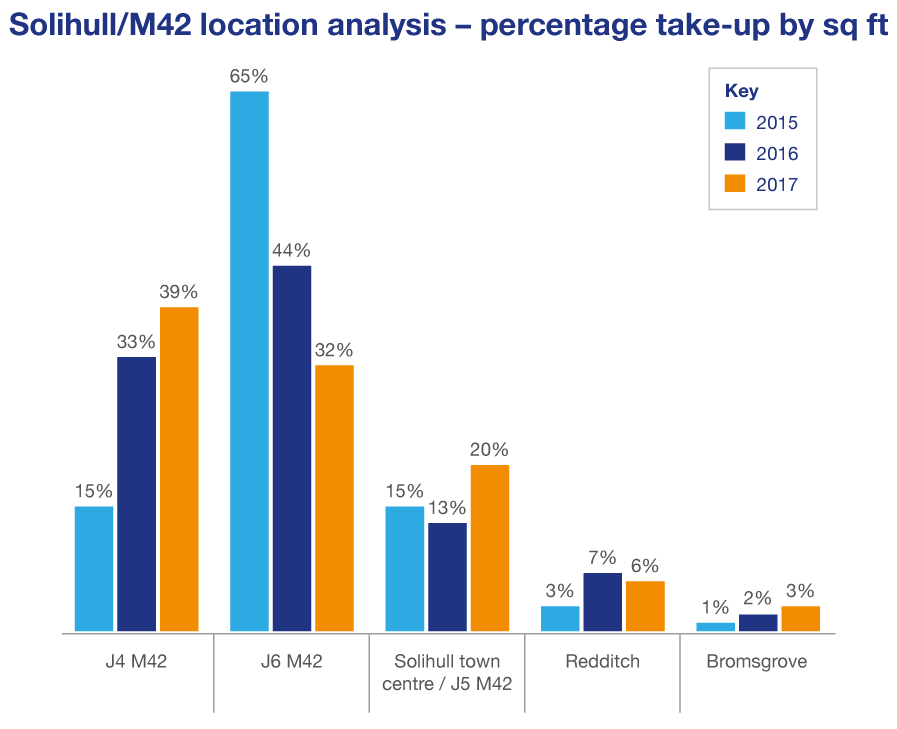

In a year that saw the Birmingham office market achieve its highest ever take-up in square footage, the M42 and Solihull office market was constrained by a shortage of supply and lack of landlord flexibility. As a result, we have the lowest take-up since 2013, with 51 transactions totalling 269,498 sq ft. However, whilst supply has been challenging, demand remains strong.

During 2017, Birmingham had far more available office space to meet its demands than the Solihull office market, and this is a primary reason behind a year which fell 20% short of the market’s long-term average.

Nevertheless, interest remains strong and, throughout the year, there have always been parties to talk to. However, product and location are paramount. If occupiers had found a building of the correct size, that they liked, and on terms that they were agreeable with, they would have gone for it.

Occupiers have taken a long time to make their decisions, in part because they’re considering space that may not fully meet their requirements, and this has stalled decision making. Lack of certainty and lack of choice has created the ‘perfect storm’.

Recent years have seen the Solihull office market go from strength to strength – delivering some excellent annual totals – but now, we see a dip. It’s not so surprising though, that the market finds itself in this position, with the lack of size and variety of space available, and terms being harder than potential occupiers would like. Occupiers are left feeling that they’re not being negotiated with fairly – when greater flexibility is being offered in Birmingham city centre.

Key transactions

| 1. | Gymshark | Trigen House | 42,408 sq ft |

| 2. | BCA Logistics | 1320 Solihull Parkway | 20,774 sq ft |

| 3. | PKF Cooper Parry | One Central Boulevard | 17,810 sq ft |

| 4. | Legal & General Home Finance | Chadwick House | 14,000 sq ft |

| 5. | Purplebricks | One Cranmore Drive | 11,250 sq ft |

| Total | 39% of annual take-up | 106,242 sq ft |