Office space Solihull and M42 corridor – quarter 3 2015 take-up

A good quarter with plenty of activity – at 94,000 sq ft, more so than Birmingham city centre – sees the market for offices in Solihull on course to exceed last year’s excellent annual total of nearly 417,000 sq ft.

Another healthy quarter for Birmingham’s out of town office market

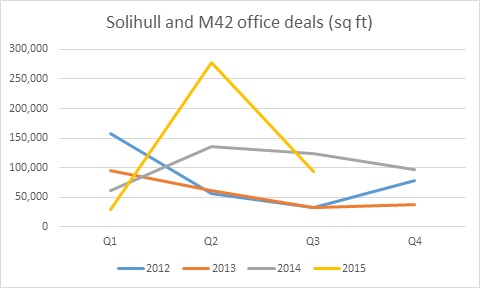

Activity continued at a steady pace this quarter, with 94,001 sq ft of offices in Solihull and the M42 corridor, across 18 deals. As the table and chart below illustrate, the resulting year-to-date of nearly 400,000 sq ft means that the region is well on target to surpass last year’s total and come in significantly above the long term annual average.

| Year | Annual take up (sq ft) |

| 2015 (Q1 -3) | 399,778 |

| 2014 | 417,191 |

| 2013 | 224,395 |

| 2012 | 325,699 |

Notable transactions

The largest deal this quarter was almost double the size of the largest achieved for offices in Birmingham city centre. BT relocated from their offices in Coventry to 19,625 sq ft at 4520 Birmingham Business Park, to take a sublease from EE.

Other notable deals included IT consultants Edenhouse, who took nearly 11,000 sq ft at Quartz Point, and training and consultancy organisation GP Strategies took over 8,000 sq ft at Birmingham Business Park.

Lack of office space supply pushes occupiers north along the M42

Whilst Shirley and junction 4 of the M42 remain popular, the lack of supply of available office space at this location, means that occupiers have to graduate north along the M42 to satisfy their requirements. Consequently, nearly two-thirds of the region’s take-up this quarter was at Birmingham Business Park, Quartz Point Office Park and Coleshill, as illustrated in the table below:

| Area | Sq ft | % mix |

| Coleshill | 12,159 | 13% |

| M42 J6 | 47,381 | 50% |

| Solihull town centre | 3,514 | 4% |

| M42 J4 | 15,798 | 17% |

| Redditch | 15,239 | 16% |

| Total | 94,091 |

With its excellent communication links and ability to provide larger amounts of office space, companies will continue to be attracted to offices at Birmingham Business Park as evidenced by BT, GP Strategies, Team Relocations and Create Health all taking office space at the Park this quarter, and accounting for 50% of the quarter’s take-up.

Refurbishment of offices in Solihull will push rents over £20 per sq ft

Following BlackRock’s recent purchase of Birmingham Business Park, three office buildings on the Park are about to be refurbished and repositioned with improved rental yield.

On Blythe Valley Park, IM Properties has now taken back the head lease from Centrica, which will enable them to refurbish the vacant space and increase rent above the £20 per sq ft mark – the first time in years.

Blythe Valley Park and Birmingham Business Park remain the key development opportunities within the area.

Consistent level of demand for offices in Redditch and Bromsgrove

Transactions for offices in Redditch was of a similar level to that of M42 J4, with the fourth largest deal of the quarter to sports fitness brand, Gym Shark, who acquired 7,814 sq ft of offices at 1 Brooklands.

The demand for office space in Redditch and Bromsgrove was consistent throughout the recession, with lease events enabling property owners to refurbish and press on. Any lack of deals in these areas (for example, there are no deals for Bromsgrove this quarter) is firmly down to lack of supply.

Most recently, we have seen this evidenced by companies located out-of-town considering office space nearer to Birmingham. USN relocated from offices in Bromsgrove to Seven House in Longbridge and Lorne Stewart has relocated from offices in Redditch to 4,100 sq ft at Imperial Court on Kings Norton Business Park.

Owners of below-par vacant offices in Redditch and Bromsgrove are strongly advised to refurbish and reposition their assets in order to meet the demand for office space in these regions – because we are clearly starting to see occupiers relocate out of the area as a direct consequence of the lack of high quality office space.

KWB achieves over 60% of Q3 2015 deals

KWB continues to account for the dominant share of lettings for office space in Solihull and the M42 corridor. 11 (61%) of the 18 deals and just under 54,000 sq ft (57%) were transacted by KWB, with an additional two further deals at Kings Norton Business Park. This is testament to the depth, range and strength of their instructions in the M42 area, as well as their local knowledge and ability to match occupiers with the right property.

See full details of the transactions for office space in Solihull and M42 corridor.

For more information, please contact Mark Robinson on 0121 212 5994 or email mrobinson@kwboffice.com.