M42 and Solihull office market research — Q3 2020

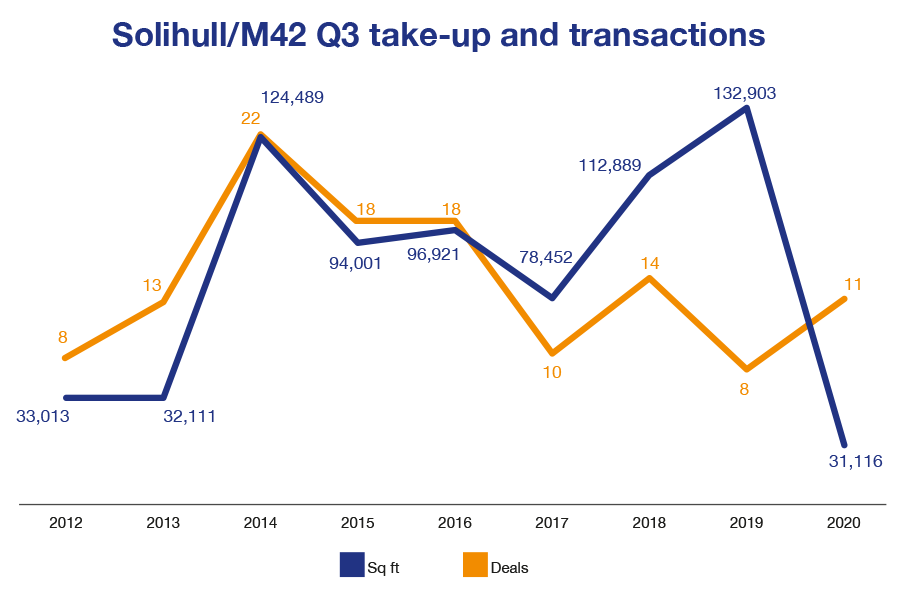

Quarter 3 was a much healthier quarter for the M42 and Solihull office market, with 11 transactions. However, with larger office space so scarce, the total square footage was only 31,116 sq ft, 35% of the long-term quarterly average for Q3.

Following Q2, the ‘COVID quarter’, in which the Solihull office market saw just 3 transactions totalling 12,000 sq ft, the figures for Q3 show a significant improvement in terms of the number of transactions, which was only slightly below the long-term average for the quarter.

Solihull office market at a glance

- Q3’s largest deal secured at Birmingham Business Park – ‘pulling power’ attracts Colas

- No exodus on the horizon – occupiers wary of giving up space

- Supply choking the market – lack of supply reduces average transaction size

- Any office stake reduction is the market’s gain – downsizing would free up space

- Seeking large Solihull offices in the future? – larger office requirements need to plan ahead

- Out-of-town could have more appeal during COVID – more occupiers are on-site

- The value of smaller office space – a good investment and self-contained

- Further new developments planned for Solihull town centre – and now there’s Eastgate

- HS2 gathering pace in Solihull – preparations well underway

- Outlook – the best of 2020 is yet to come

Q3’s largest deal secured at Birmingham Business Park

The largest office space transaction in the Solihull office market during Q3, and the only deal over 10,000 sq ft, was the letting of 11,602 sq ft at 6210 Bishops Court on Birmingham Business Park.

The letting to civil engineering and infrastructure contractor, Colas, represents inward investment for Solihull, although the company has several offices related to its rail division in and around Birmingham. However, Colas is no stranger to Solihull, having delivered the £55m runway extension at Birmingham Airport and A45 ancillary works back in 2015.

The transaction demonstrates the continuing ‘pulling power’ that a location such as Birmingham Business Park commands, as it regularly welcomes companies that are new to the area.

For a number of years now, Birmingham Business Park has dominated office space transactions in Solihull and the M42 corridor. This is primarily due to the size and quality of the office space it comprises, the impressive business community it is home to, as well as its superb location close to the M42, Birmingham International Station and Airport.

For now, the Park continues to secure many of the larger office space transactions in the Solihull office market. However, the fact remains that stock on the Park is dwindling. The vacancy rate at Birmingham Business Park currently stands at only 5-6%.

6210 Bishops Court, Birmingham Business Park

No exodus on the horizon

There have been numerous and varied reports over recent months of occupiers considering major and fundamental adjustments to their operations, including changes that would lead to a significant reduction in their office space requirements. As a result, some have wondered whether we would see occupiers vacate their offices en masse. However, in the M42 and Solihull office market, no such exodus appears to be taking place – so far.

Quite the opposite in fact, with office space being in such short supply, the lion’s share of occupiers – particularly those in larger space – will do their best to hold onto the space they have. This is, in part, because they know that if they were to give it up for the short or medium-term, they would struggle to find it again in the future.

Additionally, key business locations such as Birmingham Business Park host large national and international companies. Any decisions that these companies make in response to a changing marketplace will most likely be made considering the full, national – indeed global – picture and taking a long-term view.

Supply choking the Solihull office market

A lack of larger deals, and consequently this year’s small quarterly totals, is due largely to a chronic shortage of available stock.

Supply issues aren’t just apparent at Birmingham Business Park, they can be seen across the entire Solihull office market. It’s also true of office space within virtually every size bracket and level of quality too. However, it’s the lack of larger space that’s having the most noticeable impact on the quarterly figures, with average transaction size coming in at just 2,829 sq ft in Q3 and 3,478 sq ft for the year so far. Only two quarters in the last 8 years have achieved a lower average square footage – Q1 2015 and Q3 2013.

Any office stake reduction is the market’s gain

In Q3, some of the lettings do represent downsizing, either to accommodate a change in an occupier’s remote working policy, or a reduction in staff within the business.

Office space transactions such as the letting of 3,356 sq ft at Friars Gate to testing, inspection and certification services provider TUV Rheinland, and 2,953 sq ft to Bank of Ireland also at Friars Gate, both represent a reduction in office stake.

Whilst on the face of it, this may seem purely negative, it creates rare new opportunities within the market. Such is the thirst for office space in this area, that when an occupier moves into smaller offices, they free up their larger former premises and provide a new opportunity for an occupier to take space.

Friars Gate, Stratford Road, M42 J4

Seeking large Solihull offices in the future?

The drought of Solihull office space is most pronounced in the size bracket of 10,000-20,000 sq ft. Occupiers already in space of such a size are highly unlikely to give it up, even if their operations are changing due to the pandemic.

It’s possible that some of the larger office occupiers in the region could look to sublet part of their space in the near future. Businesses may need to allow for changes in their on-site and remote working arrangements, but if and when these occur, it’s highly likely that the vacated ‘grey space’ will be snapped up quickly.

As ever, if your business needs to relocate into space of this size in the next two years, now is the time to start looking.

Out-of-town could have more appeal during COVID

When we compare offices within Solihull and the M42 corridor with those of Birmingham city centre, it’s apparent that out-of-town, it’s busier – with more occupiers working in their offices.

As both the virus and government rules continue to impact businesses in every sector, companies are looking for the best ways to do right by their employees and ensure productivity. With out-of-town office locations set away from the nearby busy metropolis, you can see that such office space could have more appeal, providing staff with fewer opportunities to come into contact with people.

Additionally, these locations are typically a lot more car-friendly, with less traffic and more parking. For those wanting to avoid public transport, out-of-town offices, particularly those situated on business parks, certainly have their own appeal.

The value of smaller office space

Garden Unit 6, Coleshill Manor

From what we’ve seen over recent years, when Solihull freehold office space under 5,000 sq ft enters the market available to buy, it doesn’t hang around for long. This is because larger SMEs, or SMEs with an excess of working capital, see office space as both a good investment opportunity and also a chance to secure their occupancy in the area, long term. The fact that they can also secure self-contained office space has also taken on its own importance this year.

In Q3, two of the office space transactions represented freehold purchases by private investors. These purchases were:

- 2,044 sq ft at 15 The Courtyard, Coleshill

- 1,432 sq ft at Coleshill Manor, Coleshill

Freehold space has been very popular in the M42 and Solihull office market, in part because overall availability of office space, freehold or leasehold, is so low. This, combined with unabating demand, makes for an attractive investment opportunity.

Further new developments planned for Solihull town centre

Last quarter, we received our first glimpse of Westgate, the proposed new Grade ‘A’ office development at 21 Homer Road.

At the opposite end of Homer Road, plans were revealed in August for Eastgate – the potential redevelopment of the current Council House and Civic Buildings. The 5.66 acre site is located in the town centre next to the High Street and is being promoted as part of a ‘Business and Commercial Quarter’ within the town.

The vision for this site includes “delivering new homes, business spaces, public squares and civic accommodation while creating the potential for an enhanced cultural and arts offer.” Whilst Westgate is clearly the business end of these new developments, Eastgate brings new amenities to enhance the town centre’s offering for office occupiers of the future.

CGI of Eastgate, Solihull town centre

HS2 gathering pace in Solihull

In July, designs were unveiled for how Birmingham International Station will be redeveloped to accommodate the increase in passengers expected by the arrival of HS2.

CGI of Birmingham International Station

August saw the installation – in just two days – of a brand new bridge across the M42 close to junction 6 to accommodate HS2 trains. The site is close to where the new Interchange Station is to be constructed and represents the first permanent structure to be installed along the HS2 route.

West Midlands Mayor Andy Street commented: “Seeing major construction activity like this in Solihull is hugely encouraging as it shows HS2 is now truly underway. In just a few years, the HS2 station at Interchange and further investments in public transport will help make Solihull one of the best connected places in the UK.

“This work also comes at a critical time for the West Midlands as we look to bounce back economically from the coronavirus crisis.”

We’ve already witnessed and commented on the impact of HS2 on the Birmingham office market. The letting to Colas at Birmingham Business Park may well also be related to infrastructure works currently underway in relation to HS2.

Outlook for the M42 and Solihull office market

The best of 2020 is yet to come. At KWB, we’re already aware of a number of deals that narrowly missed the end of Q3 and will be seen in the Q4 stats. With three transactions already totalling over 15,000 sq ft, we would anticipate the final quarter being larger than Q3 and, therefore, the largest quarter of the year.

Beyond Q4, we would expect to see the market continue to return to normality – virus permitting. However, in order to see the kind of activity and quarterly totals that we have come to expect in Solihull and the M42 corridor, significant progress will need to be made on the availability of stock.

See full details of the transactions featured in our M42 and Solihull office market research.

For more information, please contact Malcolm Jones on 0121 233 2330 or email mjones@kwboffice.com.

To register for future research updates, click here. See also our Birmingham office market research.