M42 and Solihull office market research — Q4 and 2019 annual review

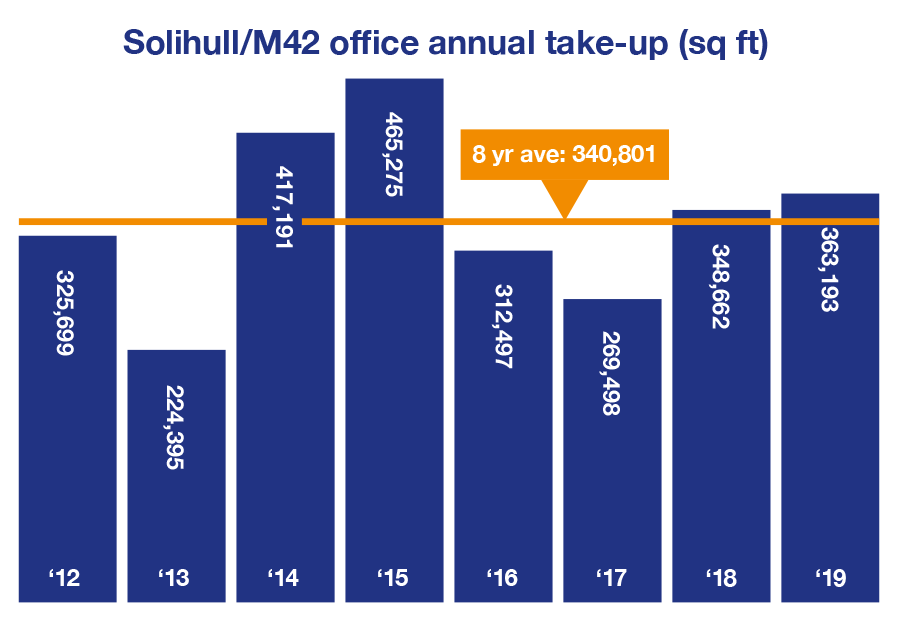

The Solihull office market in 2019 demonstrated outstanding resilience to a testing economic environment and lack of supply. The 363,194 sq ft achieved was made possible, in part, due to significant pre-lets on new build space.

Solihull office market at a glance

- Strength of M42 corridor – market shows defiance during an uncertain year

- Year of the pre-lets – larger occupiers left with no ‘standing stock’ options

- Expansions – expanding businesses reflect prosperity in Solihull

- Birmingham Business Park dominates – Park leads lettings of standing stock

- Stock goes down, rents go up – supply and demand pushing up rents

- Speculative development inches closer – strength of market merits the investment

- Drop in sub 5,000 sq ft lettings – smaller occupiers sat on their hands last year

- Redditch and Bromsgrove on the up – stock snapped up as it comes to market

- Outlook for 2020 – we take a look at the year ahead

Strength of the Solihull office market

In 2018, deals over 10,000 sq ft accounted for 210,016 sq ft of the office space transacted in the Solihull office market. At 210,991 sq ft, this year’s total is remarkably similar. However, as we can see from the table below, there were just 8 deals over 10,000 sq ft this year – compared to 13 last year. The pre-let to ZF of 90,001 sq ft in 2019 enabled the market to achieve this.

Pre-lets were present in the figures last year but are far more apparent this year, accounting for over half of the square footage in this 10k+ sq ft bracket and three out of the top four deals. For more information on the topic of pre-lets in 2019, see ‘Year of the pre-lets’ below.

| Transactions for office space in Solihull over 10,000 sq ft in 2019 | |||

|---|---|---|---|

| Office building | Size (sq ft) | Location | Occupier |

| Plot A | 90,001 | Blythe Valley Business Park | ZF |

| 2010 The Crescent | 27,764 | Birmingham Business Park | MSO Workspace |

| 3 Fore Business Park | 25,820 | Solihull, J4 M42 | UTC |

| Plot A2 | 17,101 | Blythe Valley Business Park | To be announced |

| Eagle 2 | 13,300 | Solihull, J6 M42 | Perfect Homes |

| 2100 The Crescent | 13,172 | Birmingham Business Park | GKN |

| 2100 The Crescent | 12,740 | Birmingham Business Park | IPS |

| Pegasus House | 11,093 | Shirley | Llamasoft |

| Total | 210,991 | ||

Year of the pre-lets

With fewer and fewer options left available to occupiers seeking larger office space, pre-lets have become virtually the only option. In 2019, pre-lets accounted for 132,922 sq ft (37%) of take-up.

The largest transaction of the year was to global technology manufacturer, ZF. The company took a pre-let at Plot A on Blythe Valley Park that represents 90,001 sq ft of office space alone, with the overall stake understood to be more than double that with manufacturing space. ZF is relocating from The Green, in a move that will consolidate all of its Shirley operations into a single building.

The pre-let of 25,820 sq ft to UTC at 3 Fore Business Park was the third largest transaction of the year and the only pre-let in recent quarters not to take place at Blythe Valley. It’s understood that this location will feature a laboratory and will be involved in research into the life sciences.

Lastly, in Q4, the largest deal of the quarter was to an occupier that has yet to be announced but the deal represents a pre-let of 17,101 sq ft of office space at Plot A2 on Blythe Valley Park.

Blythe Valley Park, Solihull

Expansions in the Solihull office market

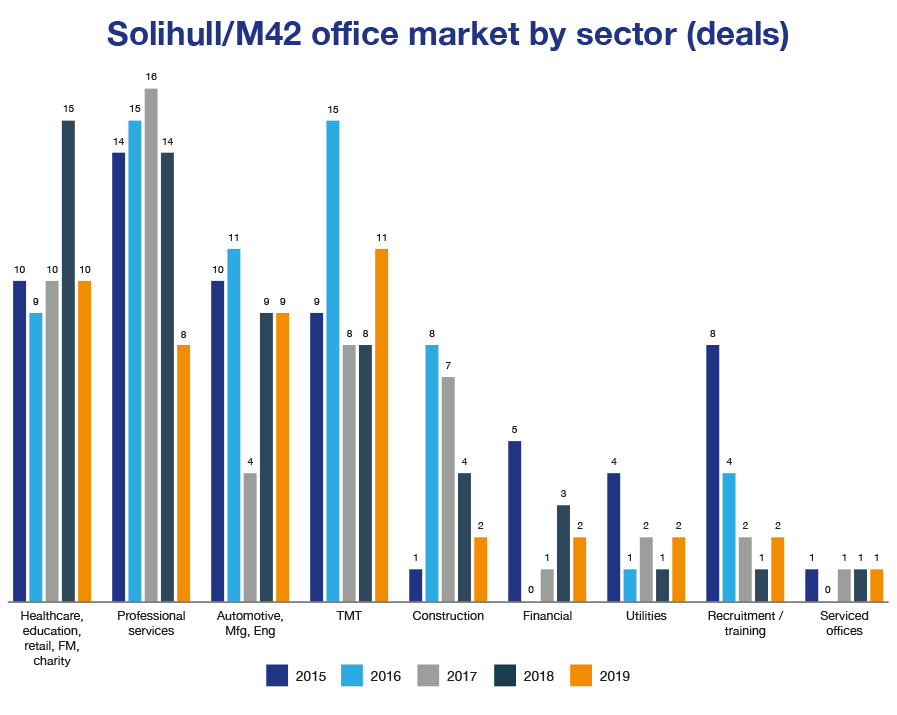

Whilst 2019 was the year of the pre-let for the Solihull office market, it also saw a significant number of deals that represented the expansion of occupiers. Below is a table of some of the businesses we know to have expanded in 2019. As you can see from the list, the expansions include occupiers from a variety of sectors, but with a particular emphasis on Technology, Media and Telecoms (TMT). TMT businesses have done particularly well in the area over recent years, with a strong presence in the take-up figures, both in business parks and town centres.

| Companies that expanded in Solihull office market in 2019 | ||||

|---|---|---|---|---|

| Office building | Size (sq ft) | Location | Occupier | Sector |

| 2100 The Crescent | 12,740 | Birmingham Business Park | IPS | Engineering consultancy |

| Pegasus House | 11,093 | Shirley | Llamasoft | Software / TMT |

| Compton House | 9,854 | Birmingham Business Park | British Heart Foundation | Charity |

| Yorke House | 9,365 | Solihull, J4 M42 | Secure Trust Bank | Financial |

| St Johns House | 5,925 | Bromsgrove | Clay Knox | Tax consultants / Professional services |

| 6220 Bishops Court | 4,335 | Birmingham Business Park | 4PS | IT / TMT |

| 2030 The Crescent | 3,354 | Birmingham Business Park | NTT Data | IT / TMT |

| 43 Dominion Court | 1,601 | Solihull town centre | Phoebus Software | Software / TMT |

Expansions are a reliable indicator of the prosperity of an area. Businesses that are expanding in the region are flourishing and the area is a catalyst for growth due to its central location within the country, proximity to the UK motorway network and the business clusters that reside within it.

Birmingham Business Park dominates lettings of standing stock

In 2019, Birmingham Business Park achieved a total of 124,142 sq ft across 18 transactions. That’s 34% of the year’s total take-up across 38% (18 out of 47) of the transactions. When you consider only the transactions that represent standing stock, i.e. excluding pre-lets, the story is even more impressive. 54% of take-up of standing stock on the M42 corridor took place at Birmingham Business Park. In Q4, in fact, Birmingham Business Park accounted for 77% of standing stock transactions.

| Transactions on Birmingham Business Park in 2019 | ||

|---|---|---|

| Office building | Size (sq ft) | Occupier |

| 2010 The Crescent | 27,764 | MSO Workspace |

| 2100 The Crescent | 13,172 | GKN |

| 2100 The Crescent | 12,740 | IPS |

| Compton House | 9,854 | British Heart Foundation |

| 2480 The Crescent | 8,750 | Vector GB |

| 6230 Bishops Court | 8,325 | Vaisala |

| 2800 The Crescent | 6,858 | Veolia Water Technologies UK |

| 6260 Bishops Court | 6,159 | Kallik |

| 1760 Birmingham Business Park | 4,464 | OSC |

| 2660 Kings Court | 4,383 | GP Strategies |

| 6220 Bishops Court | 4,335 | 4PS |

| 6180 Knights Court | 3,846 | EQ Technologic |

| 2030 The Crescent | 3,534 | NTT Data UK |

| 6140 Knights Court | 3,057 | Unielectronics |

| 2675 Kings Court | 2,180 | Altus Group |

| 6240 Bishops Court | 1,837 | ECAS |

| 2040 The Crescent | 1,584 | Steelplate |

| 6110 Knights Court | 1,300 | Glencar |

| Total | 124,142 | |

The ‘downside’ to this take-up is that Birmingham Business Park now finds itself at its lowest ever vacancy rate – 3.9%. It’s testament to the appeal of the Park that it has managed to secure such transactions with so little stock left to offer – but it can’t last if the total office stock is finite.

Birmingham Business Park

Stock goes down, rents go up

2018’s Q3 pre-let to Jerroms was agreed at a rent in the mid £20s per sq ft. Since this, and with office stock ever-decreasing, high quality refurbished office space has followed suit. As such, offices that would have commanded a rent of around £18.50 per sq ft as recently as 2018, can now achieve around £22 per sq ft. The level of refurbishment, including replacement of M&E, has also helped to make such an increase possible. This indicates that rents could increase further still, as supply diminishes.

This growth in the potential yield of new office space in the area should also be a motivator for landlords and developers considering construction of new office properties.

Speculative development inches closer

With pre-lets appearing to become more common and supply undeniably diminished, the argument for speculative development has strengthened. It’s being given proper consideration too, with landowners understood to be taking tangible steps forward in improving the office space drought in Birmingham’s out-of-town office market.

At this moment in time, demand has effectively created a one-in-one-out situation, where an occupier vacating a property gives another occupier a chance to take office space.

However, the proposals now being considered could add over 100,000 sq ft to the available office stock. This would give businesses, who have been seeking office space for some time, a foreseeable option for occupancy. KWB welcomes the prospect of new-build office space in Solihull and the M42 corridor.

Drop in sub 5,000 sq ft lettings

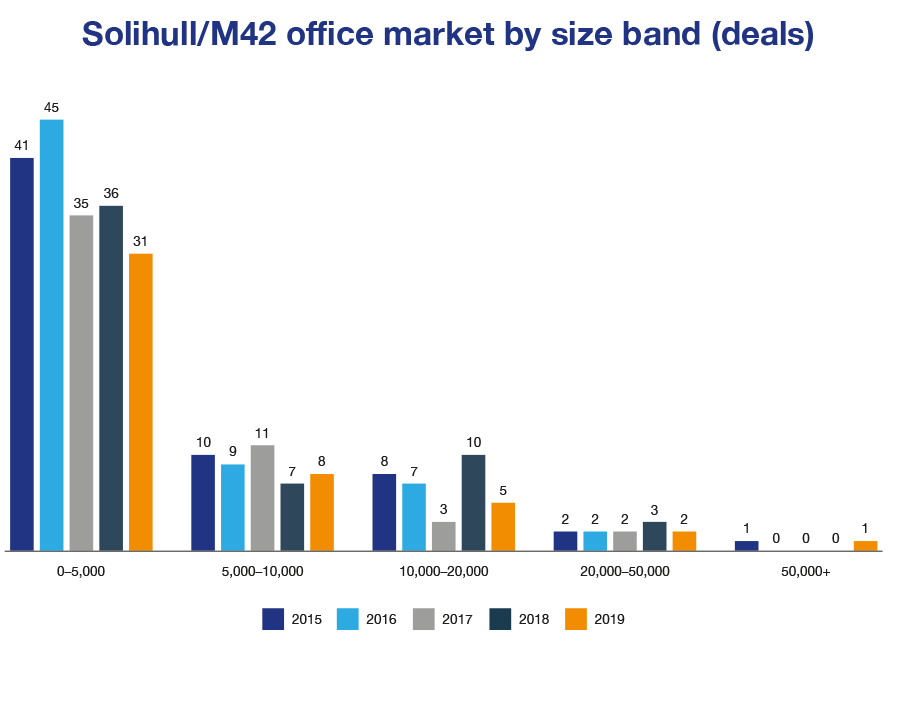

Over recent years, we have seen what appears to be a decline in the number of transactions taking place in the 0–5,000 sq ft bracket. From a high of 45 transactions in 2016, 2019 saw a low of just 31 transactions in this size bracket.

There are potential reasons for why this may have happened. Firstly, Brexit. It’s hard to ignore in a review of 2019. We would suggest that many smaller businesses will have sat on their hands in 2019, awaiting a more certain direction of travel, in regard to Britain’s departure from the EU. What this means, as far as property decision making is concerned, is occupiers have been staying put.

We would expect to see an increase in activity in this part of the market during 2020 – not least for space in this bracket being more readily available.

The second potential reason is serviced offices. In Birmingham city centre, where there has been major growth in the amount of serviced office space available, we have seen a drop in 0-5,000 sq ft transactions in both 2018 and 2019, but this has yet to be replicated on the M42.

In four out of the past five years, we have seen a serviced office operator take space in Solihull – the most recent of which was 2019’s letting to MSO Workspace at 2010 The Crescent on Birmingham Business Park. This 27,764 sq ft letting was the second largest transaction of the year. The other serviced office operators on Birmingham Business Park are IWG (formerly Regus) and UBC, both of which are understood to be full or thereabouts.

Redditch and Bromsgrove on the up

Over recent years, the Redditch and Bromsgrove office markets have been incredibly quiet. We have said repeatedly that this is not due to lack of demand, but lack of supply. It is very encouraging to see in 2019 a far more active contribution from these two areas – particularly Redditch. In Q4 2019 alone, Redditch delivered three transactions – totalling just under 6,000 sq ft.

| Office building | Size (sq ft) | Location | Company |

|---|---|---|---|

| St Johns House | 5,925 | Bromsgrove | Clay Knox |

| Unit 10 Empire Court | 3,869 | Redditch | Lighting Consultants |

| 12/13 The Oaks | 2,890 | Redditch | LLCMA |

| 12 & 13 Clews Road | 2,890 | Redditch | Private SIPP |

| Unicorn Hill | 2,040 | Redditch | Perfect Person |

| Unit 8 Chestnut Court | 1,575 | Redditch | Plan B Ventures |

| Unit 3 Chestnut Court | 1,575 | Redditch | XYZ |

| Total | 20,764 |

This year, the office space transactions in Redditch and Bromsgrove totalled 20,764 sq ft and, in 2020, we expect to see at least 13,000 sq ft in Q1 alone. What has made this possible are leases ending and occupiers choosing to relocate, freeing up space. Once an occupier has left, the landlord will typically refurbish the space and bring it back to market.

St Johns House, Bromsgrove

Every time an office property is brought to market in this area, it is met with significant interest. As such, the deals we are seeing are taking place after a relatively short period of time on the market.

It is also worth noting that many of these transactions are on a freehold basis, rather than a letting. We often see this along the M42 corridor in areas of short supply and high demand. Many offices of around 5,000 sq ft or less have been purchased rather than let.

Outlook

We anticipate growth at the lower end of the market in 2020. Companies that have been putting off relocation decisions are expected to move, and with good availability in the 0-5,000 sq ft size bracket, they have options to choose from.

Those seeking larger office space, however, will continue to struggle to find space, with only 3 or 4 options available over 10,000 sq ft. Whilst pre-lets may well continue, and they help alleviate the situation, they’re not a long-term solution – the market needs more stock. As such, we would hope to see investors and developers moving further forward with speculative development.

HS2, which recently released the latest images of its Interchange station design (pictured below), could also act as a catalyst for the construction of new office stock in the coming years.

See full details of the transactions featured in our M42 and Solihull office market research.

For more information, please contact Malcolm Jones on 0121 233 2330 or email mjones@kwboffice.com.

To register for future research updates, click here. See also our Birmingham office market research.