Birmingham office market research — Q4 and 2019 annual review

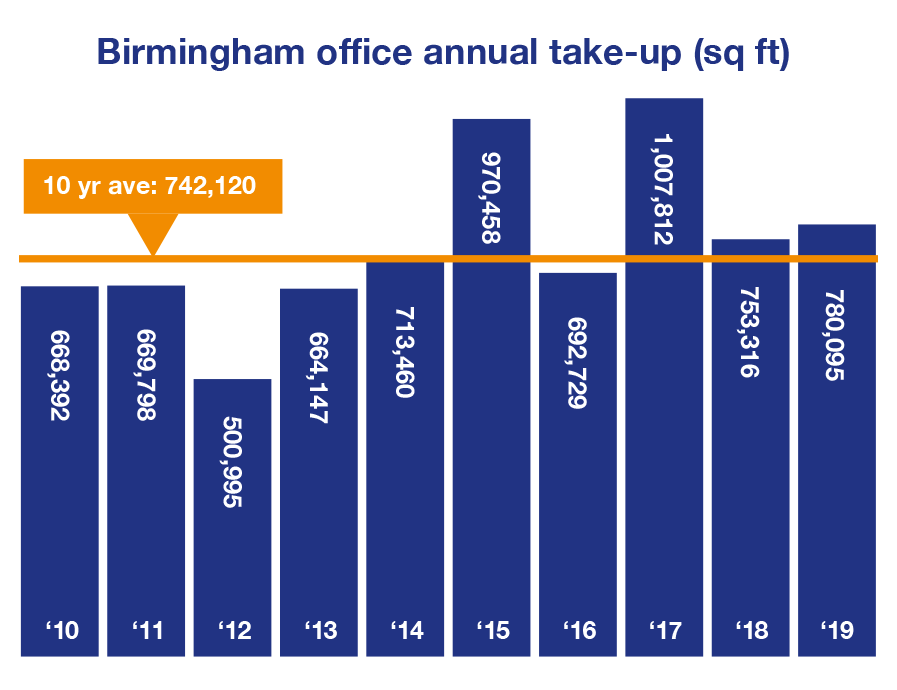

The Birmingham office market achieved a respectable 780,095 sq ft of transactions in 2019. This total was given a boost by the outstanding level of take-up from WeWork’s introduction to the Birmingham office market.

Birmingham office market at a glance

- Key transactions – deals over 20,000 sq ft total 499,910 sq ft

- WeWork cloud – the impact of the operator’s grand entrance

- Serviced offices and small occupiers – investigating the 0-5,000 sq ft bracket

- 5–20k sq ft to bounce back – mid-sized occupiers to get active

- Fringe locations – lack of supply causes fringe to fall silent

- Outlook for 2020 – we take a look at what’s ahead

Key transactions

This year, the key transactions in the Birmingham office market, which we typically view to be all those above 20,000 sq ft, total 499,110 sq ft – c. 64% of the market’s total take-up for the year. In 2018, that figure was 354,183 sq ft. This shows that 2019 was a year in which the top end of the market performed particularly well.

| Transactions for office space in Birmingham city centre over 20,000 sq ft in 2019 | ||

|---|---|---|

| Office building | Size (sq ft) | Occupier |

| Platform 21 | 110,780 | Secretary of State |

| 6 Brindleyplace | 92,670 | WeWork |

| Louisa Ryland House | 81,280 | WeWork |

| One Brindleyplace | 72,261 | Commonwealth Games |

| 55 Colmore Row | 55,092 | WeWork |

| The Colmore Building | 46,750 | Irwin Mitchell |

| 2 Chamberlain Square | 40,277 | DLA |

| Total | 499,110 | |

The largest transaction of the year was the pre-let of 110,780 sq ft at Platform 21 to the Secretary of State. The pre-let will welcome 1,700 public sector staff from various government departments, once the property is ready to open in 2021. It’s understood that not all of the nearly 2,000 staff will be based in the offices all the time, as a sizeable number will be using it as a hub and working remotely.

Q1 kicked things off nicely this year with the letting of 72,261 sq ft at One Brindleyplace to the team delivering the 2022 Commonwealth Games. The entire building has an existing lease to Deutsche Bank, which will run up until 2029.

One Brindleyplace, Birmingham

The second largest letting in Q1 2019, and sixth largest letting of the year, was to the solicitor firm, Irwin Mitchell, which took 46,750 sq ft at The Colmore Building. Irwin Mitchell had previously been located at Imperial House on Temple Street.

WeWork cloud

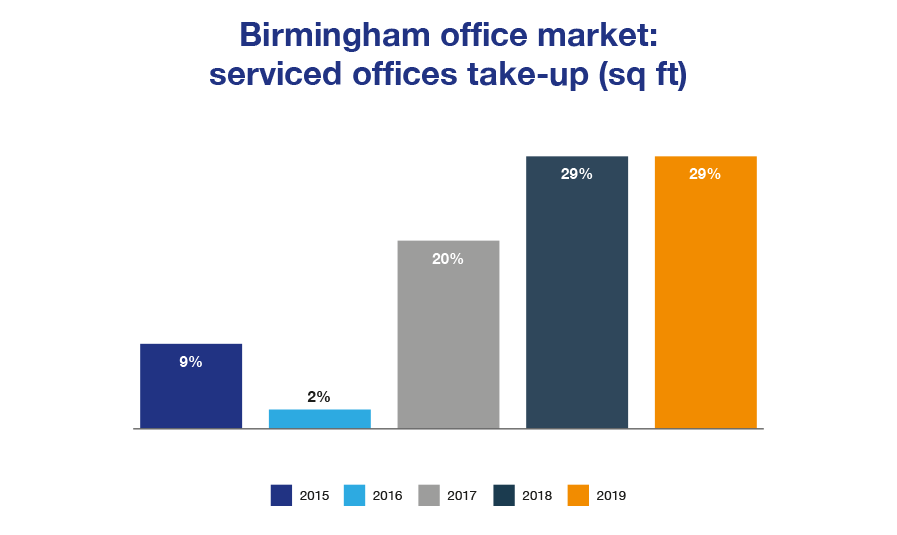

In Q2 2019, WeWork entered the Birmingham office market with a staggering take-up of 229,042 sq ft across three properties. The transactions by WeWork represent 29% of the overall take-up for 2019 in the Birmingham office market.

All three lettings were understood to have been undertaken on long-term leases of up to 15 years. They represent the largest commitment made in a quarter to the Birmingham office market by a single company since records began. However, this has now been superseded by the letting to BT at Three Snowhill, signed at the start of Q1 2020.

Louisa Ryland House, Birmingham

Reports at the end of the year stated that, following a rescue package, WeWork would be backing out of up to 100 of its locations worldwide. All of the locations in question were either yet to open or newly opened locations that either have been slow to fill or have required deep concessions to fill.

Given the above, it’s testament to the strength of the Birmingham office market that, as we understand, all three of the new Birmingham locations will be available in 2020.

| WeWork locations in Birmingham city centre | ||

|---|---|---|

| Office building | Size (sq ft) | |

| 6 Brindleyplace | 92,670 | |

| Louisa Ryland House | 81,280 | |

| 55 Colmore Row | 55,092 | |

| Total | 229,042 | |

With such a strong, global brand and having made such a grand entrance, competing serviced office operators could be concerned by WeWork – not necessarily those that are already in the marketplace, but certainly those that may have been considering the area. It would be surprising to see any further new players enter the serviced office market in Birmingham in the near future.

Serviced offices and smaller occupiers

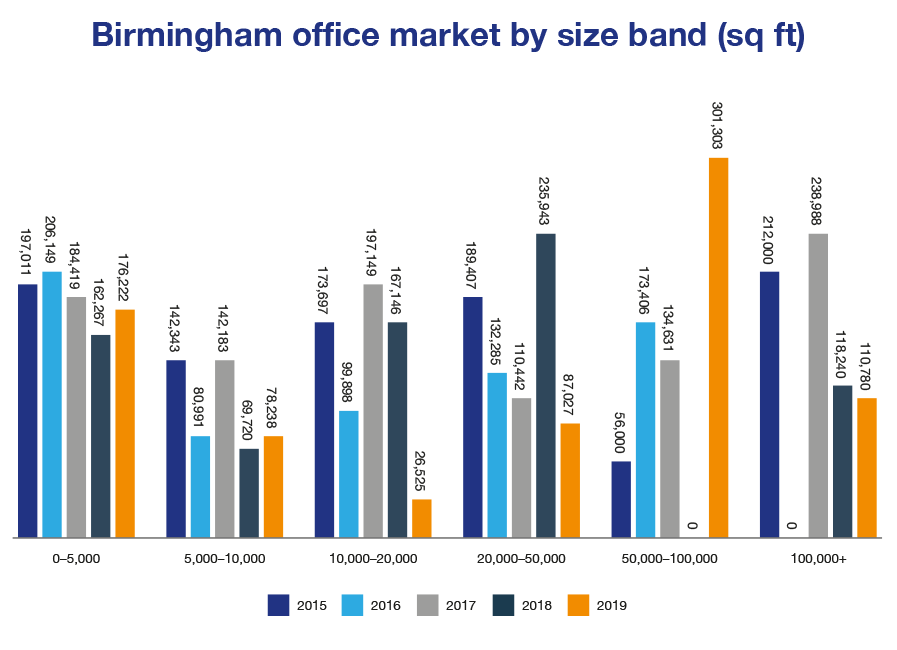

In 2018, we identified a drop in the size of lettings in the 0-5,000 sq ft bracket. Furthermore, the 162,267 sq ft this bracket achieved in 2018 was down around 20% on its average. We suggested that this drop was due to the growth in serviced offices, providing businesses, particularly those occupying 0-2,000 sq ft, with a flexible alternative to traditional office space.

This year, though up slightly on 2018 at 176,222, still falls noticeably short of the 204,814 sq ft average leading up to 2017 – indicating that we may be reaching a new baseline expectation for the market that is around 10% lower. However, there is reason to believe that there will be growth in this bracket over the coming quarters.

Flexibility has been a very popular trend over the past few years, not least because of the uncertainty that has followed the EU referendum. That flexibility offered by serviced offices, however, comes at a significantly higher cost. Serviced offices are around 2-3 times the cost of office space that is available on a traditional basis. For occupiers that are larger than 2,000 sq ft, these costs reach such a level that a traditional lease offers far better value-for-money, even though flexibility is compromised.

As the initial phases of Brexit come to pass, and occupiers are provided with more certainty, the value they place on flexibility may decrease. Occupiers will likely consider space on traditional terms, but it will pay to offer these occupiers a proposition that takes into account the offering to which they have become accustomed.

5-20k sq ft to bounce back in 2020

In 2019, the 5-10k sq ft and 10-20k sq ft brackets in the Birmingham office market are noticeably smaller than previous years. When we look at the total square footage of these two brackets combined over the past five years, the drop becomes very apparent.

| Birmingham office market take-up between 5,000 and 20,000 sq ft | |||

|---|---|---|---|

| Year | Size (sq ft) | Number of transactions | Average transaction size (sq ft) |

| 2019 | 104,763 | 13 | 8,059 |

| 2018 | 236,866 | 23 | 10,299 |

| 2017 | 339,332 | 34 | 9,980 |

| 2016 | 180,889 | 19 | 9,520 |

| 2015 | 316,040 | 31 | 10,195 |

The numbers show 2019 to be significantly quieter, in terms of transactions between 5,000 and 20,000 sq ft, than previous years. In addition, the drop in average transaction size shows that there were fewer deals at the top end of the 5–20k sq ft bracket than previous years. When we look at the transactions from the year, we notice two things in particular.

Firstly, within this bracket, there are only two deals above 10,000 sq ft: the letting of 15,608 sq ft at 125 Colmore Row to energy company, Npower, and the letting of 10,917 sq ft to the NHS at 1 Colmore Circus.

The second thing that becomes apparent is the gap between Npower’s 15,608 sq ft and the deal above it – DLA’s transaction of 40,277 sq ft at 2 Chamberlain Square. There were no deals between 20,000 and 40,000 sq ft – in 2018, there were seven.

125 Colmore Row, Birmingham

This paints the story that the middle of the market for Birmingham offices underperformed in 2019. The market was able to exceed its long-term annual average due to an exceptionally strong performance from the top end of the market. Deals over 50,000 sq ft totalled 412,083 sq ft in 2019 – that’s 53% of the year’s take-up, and the highest total it has achieved for some time, potentially since records began.

Post-Brexit we expect the middle of the market to return to form, given the latest demand and the hangover from last year.

Fringe locations of the Birmingham office market

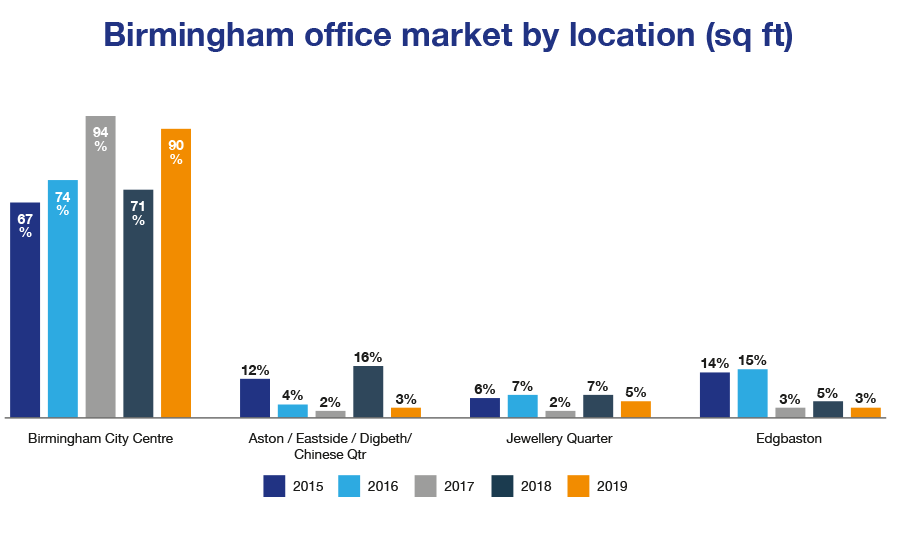

The core of Birmingham city centre accounted for 90% of office take-up in 2019, with the fringe areas becoming increasingly quiet.

Only 10% of Birmingham office space take-up took place in Birmingham’s fringe areas, compared with as much as 33% in 2015. In 2017, fringe areas represented just 6% and though 2018 may seem to show the fringe performing better, it’s not quite the case. This is because 2018 saw Birmingham City University take 118,240 sq ft at Belmont Works for the creation of the next phase of its STEAMHouse project – skewing the figures significantly.

The primary issue behind this is supply. During periods of good take-up in Edgbaston, the Jewellery Quarter and Digbeth, there was no significant pipeline of replacement office stock in these areas. Furthermore, many of the office buildings that have been available in the fringe have been converted into residential apartments and this has further diminished potential office stock.

Unfortunately, whilst there are mixed property schemes such as Beorma Quarter on the table, we have yet to see the progression that guarantees new office space in coming years. As such, we are unlikely to see a significant improvement in the volume of take-up in the fringe areas of the Birmingham office market.

A bit about BT

The letting of 283,000 sq ft to BT has just been signed in Q1 2020. We’ll explore this in detail in next quarter’s analysis, however, there are a few things worth saying at this point about the landmark deal.

The letting at Three Snowhill is thought to be the largest single office space transaction ever to have taken place in the Birmingham office market. This will, of course, make Q1 2020 a spectacular quarter for the Birmingham office market, and only time will tell as to whether it will be the largest single quarter the market has ever seen.

Interestingly, as Three Snowhill is still some time off completion, and will require substantial time for custom fit out, BT needs somewhere to go. We understand that, whilst some of the teams will be fine to stay put until Three is ready, others will be housed in serviced offices in the short term.

Three Snowhill, Birmingham

Outlook

As far as rents are concerned, we are unlikely to see an increase over the coming year, having held steady over 2019. Landlords are currently offering incentives in negotiations for office space in Birmingham city centre. As such, we will need to see landlords reigning in incentives before rents can increase.

2020 also offers landlords with offices of 2,500-5,000 sq ft an opportunity to capitalise on increased interest in this area of the marketplace.

It’s possible we will see some businesses that would typically choose an out-of-town location, choosing Birmingham city centre instead. This is something we have already seen with a number of transactions over the past few years. Companies that relocate from out-of-town do so typically for HR reasons, with the city centre being more ‘staff-friendly’ due to its excellent public transport links and wealth of local amenities. Furthermore, the supply of office stock in Birmingham city centre provides far more choice than the out-of-town market, which is in severe drought.

Finally, the letting to BT, already contributing 283,000 sq ft to the office space take-up, will, of course, put the market on track for a great year.

See full details of the transactions featured in our Birmingham office market research, comprising office space in Birmingham city centre and Edgbaston.

For more information on the Birmingham office market, please contact Nigel Tripp on 0121 233 2330 or email ntripp@kwboffice.com.

To register for future research updates, click here. See also our M42 and Solihull office market research.