Birmingham office market research – quarter 3 2018

In Q3 2018, the Birmingham office market achieved 158,935 sq ft across 28 transactions, indicating that 2018 could be the most quarterly-consistent year to date. The figures also point to a potential dip in the number of traditional transactions for the year, which could be the impact of growth in demand and availability of serviced offices.

The letting of 36,484 sq ft at Norfolk House to the Secretary of State is the latest substantial letting we have seen to a government department, in the wake of the landmark pre-let of 238,988 sq ft at 3 Arena Central to HMRC in Q3 2017.

A year of consistent lease-driven activity

Whilst 36,484 sq ft is an excellent contribution to the market figures, the year has not, so far, delivered a landmark deal closer to or above 100,000 sq ft, which historically has tended to result from consolidation or inward investment. Inward investment has been modest in 2018, with the majority of transactions representing the normal, sustainable churn of the local office market. The absence of a landmark deal puts the year-to-date at 477,347 sq ft. This would see the year fall about 15% shy of the annual average level of take-up if Q4 delivers a similar square footage to the first, second and third quarters.

Public services dominate the top

When examining the top transactions in Q3 2018, the ‘headline’ transactions are to companies and organisations providing public services. Large lettings to the public sector have been commonplace in recent quarters, as the government has undertaken a programme of property consolidation, which has seen many of its regional satellite locations being relocated into singular, large office premises.

Baskerville House, Birmingham

Network Rail took a considerable amount of additional office space at Baskerville House. The letting of 14,320 sq ft at the Birmingham office property, where it already occupied 83,406 sq ft, brought its total stake at the building to 97,726 sq ft. It’s understood that Network Rail’s expansion at Baskerville House is to house the consolidation of another regional office.

The letting of 13,825 sq ft to Jacobs Engineering represents an expansion by the HS2 contractor. In Q2 2015, Jacobs took 19,284 sq ft at 2 Colmore Square at a time when they were thought to be connected to the HS2 project and this was later confirmed. The new letting brings Jacobs’ total stake at 2 Colmore Square to 33,109 sq ft.

| Office building | Location | Size (sq ft) | Occupier | Business sector |

| Norfolk House | Birmingham city centre | 36,484 | Secretary of State | Government |

| 1 Colmore Square | Birmingham city centre | 22,043 | General Dental Council | Health |

| Baskerville House | Birmingham city centre | 14,320 | Network Rail | Transport |

| 2 Colmore Square | Birmingham city centre | 13,825 | Jacobs Engineering | Engineering |

Many of the largest lettings in recent years have been to public sector driven occupiers:

- Q3 2017 – HMRC took 238,988 sq ft in a pre-let at 3 Arena Central

- Q2 2016 – Network Rail took 83,406 sq ft at Baskerville House

- Q4 2014 – HS2 took 97,958 sq ft at Two Snowhill

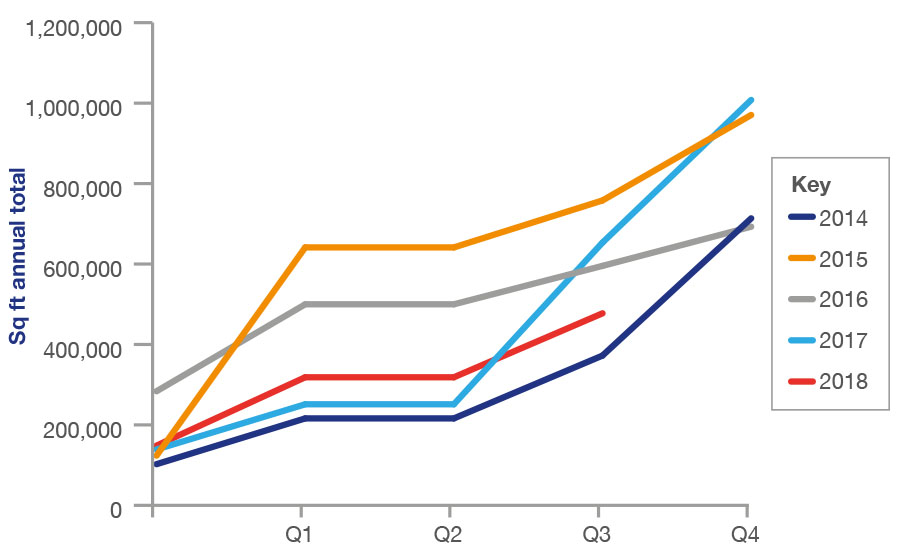

The most consistent year to date

2018 has been the most consistent year – with regards to quarterly totals – that the market for Birmingham city centre office space has seen in recent years.

All 3 quarters sit within a range of just over 20,000 sq ft, which is far smaller than we would usually expect. In 2017, the difference between the smallest and largest quarters was 289,813 sq ft, 2016 was 188,151 sq ft and 2015 was 400,761 sq ft. On the face of it, it would seem that this is because 2018 has lacked a landmark deal of 100,000+ sq ft. However, even when taking the larger deals of previous years into account, the ranges between quarters are still substantially larger than we see in 2018.

| Quarter | Number of transactions | Total (sq ft) | Average transaction size (sq ft) |

| Q1 2018 | 22 | 148,483 | 6,749 |

| Q2 2018 | 31 | 169,929 | 5,482 |

| Q3 2018 | 28 | 158,935 | 5,676 |

| Year to date | 81 | 477,347 | 5,893 |

Whilst the market has been more consistent than previous years, it has not been as successful. 2018 has so far yielded 477,347 sq ft over 81 transactions – which would suggest a projected end of year total of c.636,463 sq ft over 108 transactions. This compares to:

- 1,007,812 sq ft over 132 transactions in 2017

- 692,729 sq ft over 139 transactions in 2016

- 970,458 sq ft over 132 transactions in 2015

This means that the year will both fall short of the average annual total sq ft of c.750,000 sq ft, by c.110,000 sq ft, and have substantially fewer transactions than any year since our records began. The average number of deals in a year in Birmingham city centre is 135, and 2018 is set to achieve around 80% of that average. The question, then, is why?

Well, the answers are many:

- Lease events: In 2014, the market achieved well over its annual long term average number of transactions – with 148 deals completed within that year. Office markets often see a cyclical pattern where lease events dictate heightened periods of market activity. It’s anticipated that 2019/2020 will see a spike in volume of lettings as companies, who took 5-year leases in 2014, look to relocate.

- Availability of space: Whilst plenty of office space is currently under construction in Birmingham city centre – the most in recent memory – the amount of high quality, readily available office space is both limited and dwindling with every quarter of transactions. Pre-lets aren’t for everyone, particularly if you need space now or if your budgets cannot reach the latest rental levels for new space – which are significantly higher than that of high quality, but older space.

- Uncertainty: Understandably, many businesses have suspended long-term decision making until next year when that uncertainty clears and circumstances are better known and understood. Once the impact upon their own business and factors such as rental levels are established, decision makers will be able to determine how they will move forward on matters such as employment and occupancy.

There is a fourth factor to be taken into account, and that is serviced offices. For the impact of serviced offices upon the Birmingham city centre office market, see below.

Chromex keeps serviced offices ticking over

The letting of 10,088 sq ft at 65 Church Street to Chromex is the only letting to a serviced office operator in Q3 2018 but represents the continuation of the narrative of high volumes of space becoming serviced offices. This is the first time that Chromex has taken space in the City – potentially having been drawn to the area by the rise in demand for flexibility here.

With 2018 delivering fewer transactions than is typical of the Birmingham office space market, it could be that the City’s available serviced offices – which have grown and grown over the past two years – are now securing a larger number of occupiers than in previous years.

Unfortunately, it is not possible to establish accurate figures on the number of occupiers taking serviced space, and the volume of serviced space being taken up. Going forward, the only indicators for the popularity of serviced offices will be serviced office operators continuing to take space, and fundamental changes to the traditional patterns of the market.

In London, we know that the majority of office requirements below 5,000 sq ft are now going into serviced offices, which provide occupiers with a comprehensive occupier solution and the flexibility they require. Whether or not Birmingham will move in this direction is a developing story, but at this point in time, there are plenty of sub 2,000 sq ft transactions still taking place.

Notable deals

Although Q3 2018 yielded a good number of healthy-sized deals, other than lettings to public services companies and serviced offices, there was only one transaction over 10,000 sq ft to the more traditional financial/professional services type occupier that Birmingham normally benefits from – and that was Unity Trust Bank taking of 10,088 sq ft at 4 Brindleyplace.

4 Brindleyplace, Birmingham

Flexibility

Supporting the popularity of flexibility for occupiers is the rise in demand for temporary staff. Lettings to recruitment companies have been strong in recent years, and temporary employment agencies have seen a spike in demand for their services over the past 18 months. The adjustments in the markets for serviced offices and temporary staffing would suggest a link between the appeal of flexibility and the uncertainty generated following the result of the EU referendum.

The use of temporary employment agencies takes the onus off the employer to identify good staff – and the responsibility to keep staff in employment. This allows companies to overcome the struggles of skills shortages and, importantly, prevents them from being tied to employing a certain number of staff.

Serviced offices provide much the same benefit, as occupiers are not obligated to sign a 5-year lease, and as such are able to respond to significant changes in their business. The money required upfront is also far less than a landlord would expect for a traditional lease, with serviced office operators requesting just two months’ rent as deposit in order to secure occupancy.

The situation is now such that some serviced office operators are seeing an average tenancy length of just 7 months, with businesses exercising their flexibility to such an extent as to become nomadic. With no commitment to the offices they are in, occupiers are free to find the ‘better deal’ and change their serviced office supplier as often as they like. The more serviced office providers there are, the more competitive they become, and this has encouraged a flight to price.

Smaller occupiers still playing ball

Despite the likelihood that the number of occupiers in serviced offices is rising and only one deal sub 1,000 sq ft was secured in Q3 2018, smaller office lettings are still taking place. Serviced offices are not the solution for everyone, however, and the traditional office lease provides important benefits for an occupier that serviced offices do not. Occupiers choose traditional leases over a serviced office solution for several reasons, including:

- Cost – serviced office occupiers pay a premium for flexibility. Overall, it’s cheaper to take a traditional lease. On a monthly basis, an occupier will spend less by paying for rent and other occupancy costs than the one-fee model, which a serviced office would charge.

- Security – by agreeing a traditional lease, occupiers can secure their occupancy for longer periods of time. Many occupiers require this for their long-term operations and future planning.

- Stable headcount – once a company has traded at a certain size for a period of time, they are confident of the amount of office space they require longer term.

- Perception – serviced offices can mean a business is still regarded as a ‘start-up’ by many.

It’s worth noting, again, that office space availability is also a prevalent issue for smaller occupiers, particularly in areas such as the Jewellery Quarter. Residential rental values have continued to rise in Birmingham and, as a result, many smaller offices in the Jewellery Quarter have been converted into residential space, giving office occupiers fewer options.

Outlook

There are a number of larger requirements for office space in Birmingham city centre, which are expected to come to fruition in the quarters to come, potentially in Q4 2018, but due diligence could see completion pushed into Q1 2019. As previously stated, 2019/2020 is expected to be a particularly active period – both in respect of inward investment and lease events.

Whilst new build developments are great news for the market, landlords and commercial property developers should be encouraged to continue bringing high quality refurbished space to the market to satisfy occupier needs. This should include smaller office suites too, as demand for them is strong and properties – such as Guildhall Buildings – have enjoyed great success in catering for smaller occupiers seeking traditional leases for all the reasons discussed above.

HS2 Curzon Street Station, Birmingham

With expansions in Birmingham city centre from both Jacobs Engineering and Network Rail in Q3 2018, HS2 moves closer and closer. The HS2 ‘halo effect’ will continue in the quarters to come, with more businesses considering making inward investment in the City as HS2 becomes a reality.

See full details of the transactions featured in our Birmingham office market research, comprising office space in Birmingham city centre and Edgbaston.

For more information on the Birmingham office market, please contact Malcolm Jones on 0121 233 2330 or email mjones@kwboffice.com.

To register for future research updates, click here. See also our M42 and Solihull office market research.