M42 and Solihull office market research — Q4 and 2018 annual review

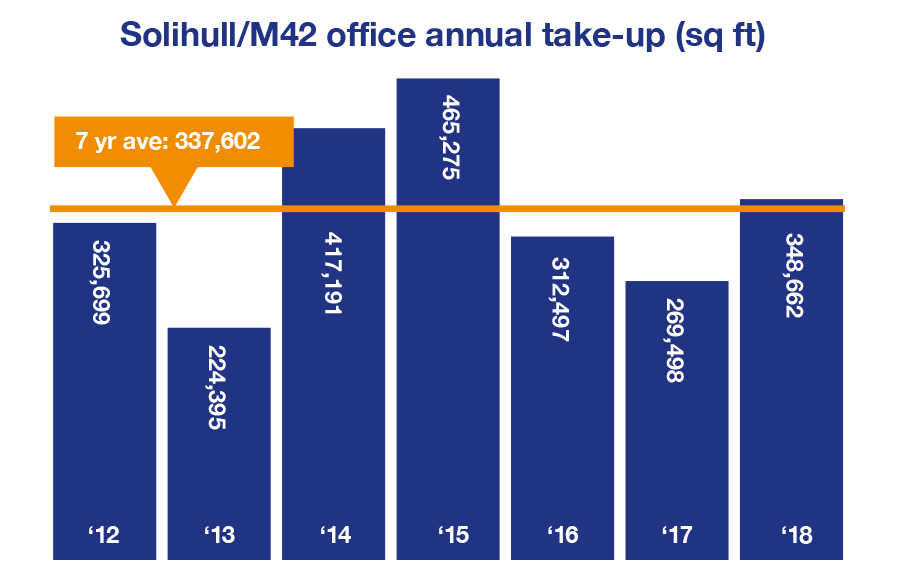

The M42 and Solihull office market concluded 2018 with a total of just under 349,000 sq ft across 56 transactions. This was markedly higher than 2017, by almost 80,000 sq ft, and exceeded the long-term annual average (based on the last 7 years) of c. 338,000 sq ft.

Solihull office market at a glance

- Plenty of larger deals – 13 transactions over 10,000 sq ft deliver a successful year overall

- Inward investment – Q4 inward investments driven by electric vehicles and medical devices

- Flight to quality – many of the relocations represent a move to superior fit out and M&E provision

- Birmingham Business Park – takes 26% of the Solihull office market

- Refurbishment – attracts successful office lettings

- Conversion to residential – further reduces office space availability

- First speculative offices for 8 years – but further development on hold

- A repeat of 2014 ahead? – a peak year for lease events, 2019 could see strong activity

- Outlook – major transaction will kickstart Q1 2019

Plenty of larger deals

The largest office space transaction of the year was 25,200 sq ft let to Beiersdorf in Q1 at newly-refurbished Trinity Central. In addition to the quality of the new space, the main driver here was Trinity Park’s proximity to Birmingham International train station.

In itself, the largest office deal was fairly modest for the Solihull office market. However, the sheer number of transactions over 10,000 sq ft secured in 2018, 13 in total, delivered a successful year overall, even with the ever-diminishing availability of space.

These 13 deals totalled just over 210,000 sq ft, 60% of the annual take-up. In contrast, 2017 saw just 5 deals in this bracket, with 9 in 2016 and 10 in 2015. This strength at the top of the market enabled it to surpass the long-term average take-up, with an average letting size of 6,226 sq ft, the highest since 2015.

| Transactions for office space in Solihull over 10,000 sq ft in 2018 | |||

|---|---|---|---|

| Office building | Size (sq ft) | Location | Occupier |

| Trinity Central | 25,200 | Trinity Park, J6 M42 | Beiersdorf UK |

| Zenith | 23,749 | Cranmore, J4 M42 | BizSpace |

| 31 Homer Road | 21,217 | Solihull town centre | Serco (via Instant Offices) |

| 2650 Kings Court | 17,633 | Birmingham Business Park | Zhuzhou CRRC Times Electric |

| 31 Homer Road | 16,833 | Solihull town centre | CGI |

| 2940 Trident Court | 15,965 | Birmingham Business Park | CSI Group |

| Blythe Valley Park, Plot F3 | 15,288 | Blythe Valley Business Park | Prologis |

| FIRST | 15,081 | Blythe Valley Business Park | Jerroms |

| 2800 Birmingham Business Park | 13,356 | Birmingham Business Park | Align Technology |

| 31 Homer Road | 12,796 | Solihull town centre | Blue Systems/Sales-i |

| One Central Boulevard | 11,450 | Blythe Valley Business Park | GKN Aerospace |

| 3700 Parkside | 10,815 | Birmingham Business Park | Personal Touch Financial Services |

| One Central Boulevard | 10,633 | Blythe Valley Business Park | Wavenet |

| Total | 210,016 | 60% of annual take-up | |

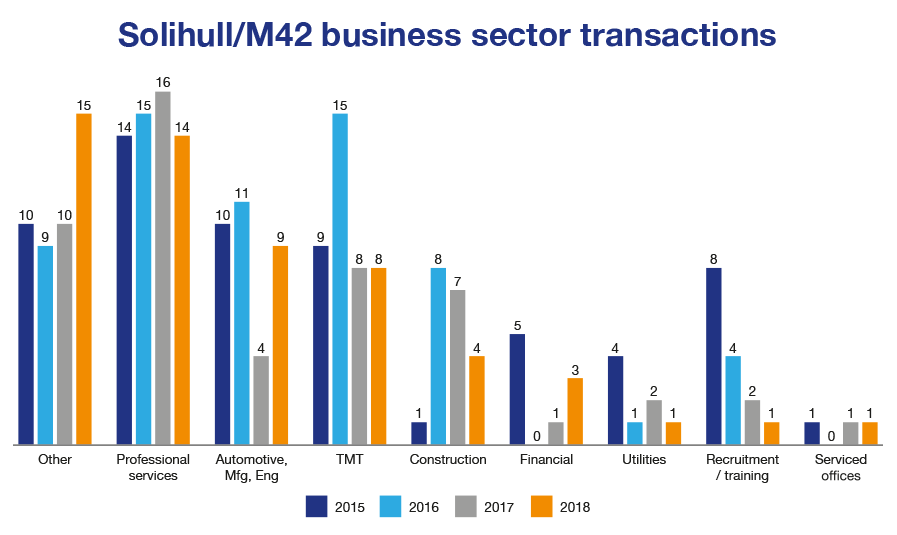

The number of healthy-sized deals in 2018 is testimony to the Solihull office market’s sustainability, driven by the current strength of demand and its diversity, skilled workforce and appeal to a wide range of sectors and occupiers, as illustrated in the chart below.

Inward investment

Whilst no stranger to the West Midlands, in Q1 BizSpace acquired Zenith – 23,749 sq ft and the second largest deal of the year – in the established Cranmore area for its first serviced office location in Solihull.

In Q3, and the third largest deal, Serco relocated from the Franklin Building in Bournville to 21,217 sq ft in the newly refurbished 31 Homer Road. In that quarter, we also indicated that there were several more inward investors set to take office space in the region.

In Q4, we saw a number of these transactions take place, the largest being Zhuzhou CRRC Times Electric. The Chinese manufacturing company, known for building trains, took 17,633 sq ft at 2650 Kings Court on Birmingham Business Park. The building will house Zhuzhou’s new UK research and development innovation centre for electric vehicles. The overall investment being made by the Chinese company is reported to be up to £50 million and will see the employment of over 150 engineers by 2022.

Align Technology, a US medical device company, that manufactures 3D digital scanners and clear aligners used in orthodontics, relocated its London offices to 13,356 sq ft at 2800 Birmingham Business Park.

With some of the requirements that had been known to be near completion not appearing in the transactions for Q4 2018, we would expect to see them complete in the coming months.

BizSpace serviced offices at Zenith, Solihull

Flight to quality

Whilst a flight to flexibility is very much a trend within Birmingham city centre, quality has driven many of the relocations in Solihull and the M42 corridor. Many occupiers taking space in 2018 have moved into space with a superior fit out and M&E provision to their existing space.

This is likely to be due to the nature of the occupiers in the area. Choosing office space in the out-of-town office market is a particularly strategic decision, valuing proximity to both transport links and companies with complementary services and technology, in effect creating industry clusters. As such, occupiers are happier, or indeed keen, to sign longer contracts. With longer contracts comes an increased importance of choosing high quality, or even future-proofed, office space that will stand the test of the lease length and appeal to both staff and visitors over the longer term.

Birmingham Business Park

Birmingham Business Park achieved 26% of the year’s office space take-up within Solihull and the M42 corridor, with 13 transactions for the year and 9 in the last quarter.

| Transactions for office space on Birmingham Business Park in 2018 | |||

|---|---|---|---|

| Quarter | Office building | Size (sq ft) | Occupier |

| Q4 | 2650 Kings Court | 17,633 | Zhuzhou CRRC Times Electric |

| Q2 | 2940 Trident Court | 15,965 | CSI Group |

| Q4 | 2800 Birmingham Business Park | 13,356 | Align Technology |

| Q4 | 3700 Parkside | 10,815 | Personal Touch Financial Services |

| Q4 | 3100 Park Square | 9,021 | Countryside Properties |

| Q4 | 2630 Kings Court | 5,934 | LTK Consultants |

| Q4 | 1760 Birmingham Business Park | 4,464 | Open Study College |

| Q3 | 6070 Knights Court | 4,164 | Akaal Group |

| Q4 | 2665 Kings Court | 2,865 | Cintas |

| Q3 | 2675 Kings Court | 2,018 | Flatpack Assembly Services UK |

| Q2 | 2625 Kings Court | 1,736 | PERI |

| Q4 | 2625 Kings Court | 1,599 | Kelvion |

| Total | 89,570 | 26% of annual take-up | |

Birmingham Business Park has attracted a high volume of occupiers over recent years due to its quality and size of available space, and proximity to Birmingham Airport, Birmingham International train station and Junction 6 of the M42, as well as the variety of amenities nearby, most notably the NEC and Resorts World.

The 91,000 sq ft transacted in 2018 further reduced the available space. As it stands, the Park, which is the largest and most prominent business park in The Midlands, now has a vacancy rate of just 6%. This is a historic low in vacant space for the Park, which has seen an increasing momentum over the year, culminating in a strong Q4.

2650 Kings Court, Birmingham Business Park

Refurbishment

The success in refurbishing and subsequently letting office space, like 31 Homer Road, One Central Boulevard and key locations, such as Birmingham Business Park, has motivated other landlords to upgrade their properties.

31 Homer Road, which has undergone comprehensive refurbishment, has enjoyed a flurry of lettings in 2018 – totalling 52,547 sq ft across four transactions (Serco, CGI, Sales-I and BPG Investments). As a result, the property has just part of its ground floor now remaining, which can provide up to 7,560 sq ft of office space.

Following a high-quality refurbishment and upgraded specification, One Central Boulevard has attracted key occupiers, including Wavenet, GKN Aerospace, Oracle and Taylor Wimpey.

It remains the case that landlords choosing to upgrade their space will let it, as transactions in recent years have proven. Demand for commercial property that is well-located and provides the right specification to meet occupier requirements continues to be strong.

A bi-product of landlord decisions to refurbish this year has been the relocation of multiple occupiers at the end of their lease, as opposed to a possible renewal, to allow their existing space to be refurbished, repositioned and reintroduced to the market.

31 Homer Road, Solihull town centre

Conversion to residential and lack of space

A key driver for lack of space is the conversion of office space to residential, particularly in Solihull town centre where there are plans to convert c. 200,000 sq ft. Rising residential values in the town centre have attracted the attention of landlords with vacant offices, due to the higher sales figures commanded per square foot. The office vacancy rate is now only 3% in Solihull town centre.

Shortage of space in the Solihull office market coupled with strong demand will continue, as it has in recent quarters, to drive rental increases in office space, giving further incentive for landlords to reposition the vacant space they have in their portfolio to attract occupiers.

The FIRST in quite a while, but further speculative development on hold

In Q3 2018, FIRST on Blythe Valley Business Park, the first new speculative development in the Solihull office market since FORE in 2010, was let to Jerroms Accountants. The letting of the 15,081 sq ft office building was a stand-out deal of the year, not least for being secured during its construction phase. The transaction serves as yet more evidence of the appetite for new space, and the lack of it.

Whilst the market had reached optimum conditions for speculative development during 2018 – with high demand and low readily available supply – it is thought that any such plans or decisions are likely to now be on ice. With the prevailing lack of uncertainty, which has intensified at the start of 2019, such substantial commitments are unlikely to see progress until the political and economic picture is much clearer.

At present, any businesses that wish to occupy brand new office space will need to take a Design & Build approach in order to fulfil their requirements. Had any speculative developments materialised during 2018, given the strength of interest in large new space, they would most likely have been let during construction, as seen at FIRST.

FIRST, Blythe Valley Business Park

A repeat of 2014 ahead?

In 2014, we saw the Solihull office market achieve c. 417,000 sq ft across 80 deals, which were evenly distributed throughout the year, with no single transaction skewing the figures – as Interserve did in 2015 with c. 114,000 sq ft.

2014’s sustainable level of take-up bodes well for 2019. The cyclical nature of the office market, driven by lease events, dictates a series of peaks and troughs in market activity. With the average lease length in the current market being around 5 years, the statistics point to 2019 seeing a similar, strong level of take-up, but the one issue that could derail this is the lack of office stock.

Outlook

Demand for office space in locations, such as Solihull town centre, should galvanise more landlords with vacant property to refurbish. Particularly when the prospect of speculatively developed space is on hold, now should be the time to invest in bringing any outdated space in line with occupier requirements.

HS2 has still yet to have a tangible impact on the out-of-town office market. Instead, inward investing contractors and consultants have opted to establish bases in Birmingham city centre, close to the HS2 offices at Two Snowhill and the site of Curzon Street Station.

2019 is also expected to see the announcement of a major transaction within the Solihull office market – the relocation of engineering company, ZF, from The Green. The deal is currently awaiting planning approval and, once announced, will give a substantial boost to the Solihull office market.

See full details of the transactions featured in our M42 and Solihull office market research.

For more information, please contact Malcolm Jones on 0121 233 2330 or email mjones@kwboffice.com.

To register for future research updates, click here. See also our Birmingham office market research.