Office space Birmingham city centre – quarter 1 2016 research

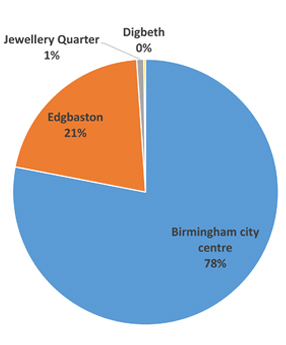

2016 saw a record breaking Q1 for office sales and lettings in Birmingham city centre – with 36 transactions yielding a total of 283,697 sq ft.

2016 has seen the momentum of a ‘momentous’ 2015 carried straight through into the new year, with several larger transactions reaching completion, securing office space for high profile occupiers that have long awaited suitable property – the largest of these being the pre-let of 90,000 sq ft at Paradise’s 1 Chamberlain Square to PWC.

A healthy market, top to bottom

Q1 2016’s, unprecedented, 283,697 sq ft of transactions exceeded the previous Birmingham office market record for an opening quarter by more than 100,000 sq ft – that was back in 2010. The breadth of activity in the quarter was topped with 5 transactions over 15,000 sq ft, despite shrinking levels of readily available, high quality office stock. These top 5 alone account for 215,644 sq ft or 76% of the Q1 total, increasing the average letting size to 7,880 sq ft – up from 7,082 sq ft in Q4 2015. Combined with the number of smaller, ‘bread and butter’, transactions, the Birmingham office market had an excellent start to the year.

| Office building | Location | Size (sq ft) | Occupier |

|---|---|---|---|

| 1 Chamberlain Square | Birmingham city centre | 90,000 | PWC |

| 55 Colmore Row | Birmingham city centre | 40,538 | Pinsent Masons |

| Tricorn House | Edgbaston | 40,045 | DAC Beachcroft |

| Centre City | Birmingham city centre | 25,600 | Ingeus |

| Louisa House | Birmingham city centre | 19,461 | Acivico Building Consultancy |

Premiere pre-let for Paradise will house PWC

Professional services company and blue-chip occupier, PWC, has taken 90,000 sq ft of office space at 1 Chamberlain Square on Birmingham’s forthcoming mixed-development – Paradise, which will, in effect, link Brindleyplace to Birmingham city core. The pre-let to PWC satisfied an enquiry that has been in the market for some time. Until now, PWC had been taking short term lease extensions on their current offices at Cornwall Court, until a better, and realistic, alternative presented itself.

As demolition work of the old Paradise development has been in progress for several months now, the offices, due to be built there, have become a far more tangible proposition. Over the past few years, choosing to take a pre-let on this space simply wasn’t a viable option – contracts were yet to be signed, there was uncertainty over Birmingham Conservatoire’s location, and demolition work had not begun. Now, with PWC kicking things off, we anticipate further Paradise pre-lets in the coming months – sure to be welcomed by commercial property developers, Argent.

Large occupiers calling the shots to get upcoming new supply

It’s interesting to see prominent occupiers, such as PWC, ‘stay put’ at their lease-end – by way of short term lease extensions. The market would usually dictate that an occupier would need to relocate, if they did not want to renew their existing lease. The buying power that corporate occupiers have is allowing them to stick it out, following the end of their original lease, until the right piece of new office space becomes available.

In these situations, landlords agree to the extensions because they want to retain a larger occupier for as long as possible. The reasons that an extension would be rejected would be if the landlord has another occupier lined up, or they are looking to reposition, refurbish/restructure the building. With large, new build office projects and refurbished office space coming to the market, it is quite possible that we will see more of these larger occupiers, who have been extending their leases incrementally, now making the move to pastures new.

Similar to PWC, Pinsent Masons has taken 40,538 sq ft of Birmingham office space at 55 Colmore Row. Now that the extensive refurbishment is well under way, they have seen the opportunity to take a pre-let on space at the building – with its enticing floor plates. This will see them relocate from their current offices at Wesleyan Building, which has been their intention for a few years.