Office space Birmingham city centre – quarter 3 2015 take-up

Set against the backdrop of an exceptional year of transactions for office space in Birmingham city centre, quarter 3 – at just under 91,000 sq ft across 27 deals – was relatively quiet.

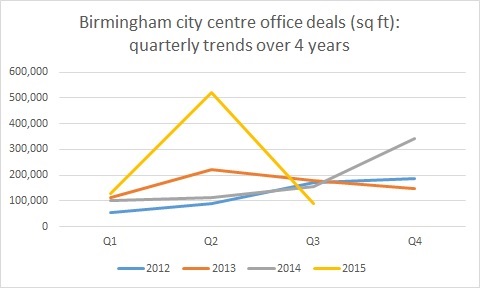

Even without HSBC’s 212,000 sq ft, Q2 was still in excess of 300,000 sq ft, making it a remarkable quarter and therefore, potentially, at the expense of Q3, as companies sought to secure office space within a market of dwindling supply. The magnitude of Q2 is well illustrated by the following chart, which tracks the quarterly figures for each of the last four years.

Big deals spent in Q2, though demand for office space in Birmingham continues

What Q3 lacked was notable, substantial deals for offices in Birmingham city centre – there was only one transaction over 10,000 sq ft compared with ten in Q2. This was not due to lack of demand but just lack of take-up, as enquiries within the market remain good. A number of sizeable deals are expected to be announced next quarter, with further large transactions likely to fall into Q1 2016 as due diligence periods become lengthy.

What this does mean is that, even without a projection for Q4, 2015 year-to-date has already surpassed the annual take-up for office space in Birmingham city centre since 2008, as illustrated in the following table:

| Year | Annual take up (sq ft) |

| 2015 (Q1 -3) | 741,318 |

| 2014 | 713,460 |

| 2013 | 664,147 |

| 2012 | 500,995 |

| 2011 | 669,798 |

| 2010 | 668,392 |

| 2009 | 657,280 |

| 2008 | 959,317 |

Notable transactions for offices in Birmingham this quarter

The largest transaction for offices in Birmingham city centre this quarter was the letting of 10,406 sq ft of office space to financial services provider, Platform Securities, at Canterbury House – representing a relocation within the building. It is believed that their relocation to lower floors will allow for the landlord’s plans to turn the upper floors into residential space.

Other notable deals within Birmingham city centre included:

- Freeths Solicitors: 7,720 sq ft at Colmore Plaza

- Optical Express: 7,014 sq ft at Imperial House

- Gleeson Recruitment Group: 6,335 sq ft at Edmund House

Most development activity in over a decade

As the scaffolding goes up around 103 Colmore Row/NatWest Tower, in preparation for its demolition, developments for offices in Birmingham city centre reach their highest level in over 10 years. The joint venture between Sterling Property Ventures and Rockspring at 103 Colmore Row will see the replacing of the current structure with a new, speculatively-built 26-storey, 200,000 sq ft office building. Elsewhere in the city we have the Paradise development, which continues, Three Snowhill looking increasingly likely with a new funding deal and 55 Colmore Row.

Incremental expansions symptomatic of a still cautious office market

Although larger deals may not be abound during Q3, what we see is cautious expansion by many local businesses that are doing well, continuing to grow and increasing their office space requirements:

- Freeths Solicitors, as already mentioned, has expanded into Colmore Plaza, a prime building which improves their brand and profile

- Gleeson Recruitment Group – Edmund House

- Blackhams Solicitors – Lancaster House

- Accountancy firm, Mazars – 45 Church Street

Recruitment sector continues to prosper

As a barometer of the local economy, we have seen now for over a year a healthy level of recruitment companies taking office space. This quarter, we see five recruitment companies taking space:

| Company | Sq ft | Office Building | Location |

| Gleeson Recruitment Group | 6,335 | Edmund House | Birmingham city centre |

| BC Legal | 3,285 | Grosvenor House | Birmingham city centre |

| Brook Street Recruitment | 3,200 | Wellington House | Birmingham city centre |

| Now Careers | 2,513 | Pinnacle House | Edgbaston |

| 118 Recruitment | 1,164 | Ansty | Birmingham city centre |

| Total | 14,767 |

Property sector also active

Again we see the property sector active with three companies taking space this quarter – fit-out specialists Estilo Interiors, property developers Ashfield Land and large US architecture firm, Gensler, moving to Birmingham for the first time.

Reposition, refurbish, raise rent

Currently, whilst we do see incentives reducing slowly but surely, rentals on older buildings are still mainly static because a lot of office stock, such as that on Bennetts Hill and Waterloo Street, has not yet been repositioned and therefore the rentals are unaffected.

However, we have seen a recent flurry of investment activity, such as Temple Court, 43 Temple Row, One Colmore Square – and Aspect Court close to being acquired – which will lead to their new property owners investing in the fabric of their assets, repositioning those office buildings and ultimately improving their rental yields. KWB has long advocated refurbishment of office space in Birmingham city centre, and these changes of ownership are a catalyst to this activity.

Fringe locations are cost effective and attractive

Edgbaston, Digbeth and Jewellery Quarter all continue to attract occupiers this quarter, as they have done throughout the year, which underlines the strength and depth of Birmingham’s office locations and that it’s not all about the city centre core.

The second largest deal in Q3 was Willoughby PR taking 9,150 sq ft at 39-40 Calthorpe Road offices in Edgbaston – a great achievement for the fringe market.

Another particularly notable deal that highlights the appeal of fringe locations is the decision by Gensler, a large American architectural company, to take space at The Custard Factory.

Not long after the close of Q3, it was announced that Staples had taken 20,000 sq ft at Euro Innovation Centre at Aston Cross Business Village – the largest letting at the park in the last ten years.

Projection for Q4 and full year 2015

Q4 could well yield some notable deals, depending on the length of due diligence taken by corporates looking to secure office space. Although it is possible that these deals may fall into Q1 2016, we are still looking at a distinctly good year for the Birmingham city centre office market with a transactions total that will significantly outstrip the average annual take-up.

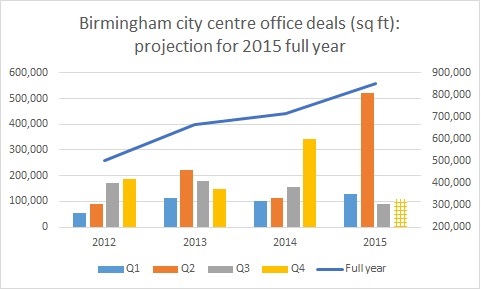

If we project forward to the end of the year, we would hope to achieve at least 850,000 sq ft of office take-up for 2015, as represented by the following chart:

See full details of the transactions for office space in Birmingham city centre and Edgbaston.

For more information, please contact Mark Robinson on 0121 212 5994 or email mrobinson@kwboffice.com.