Birmingham office market research – Q4 and 2018 annual review

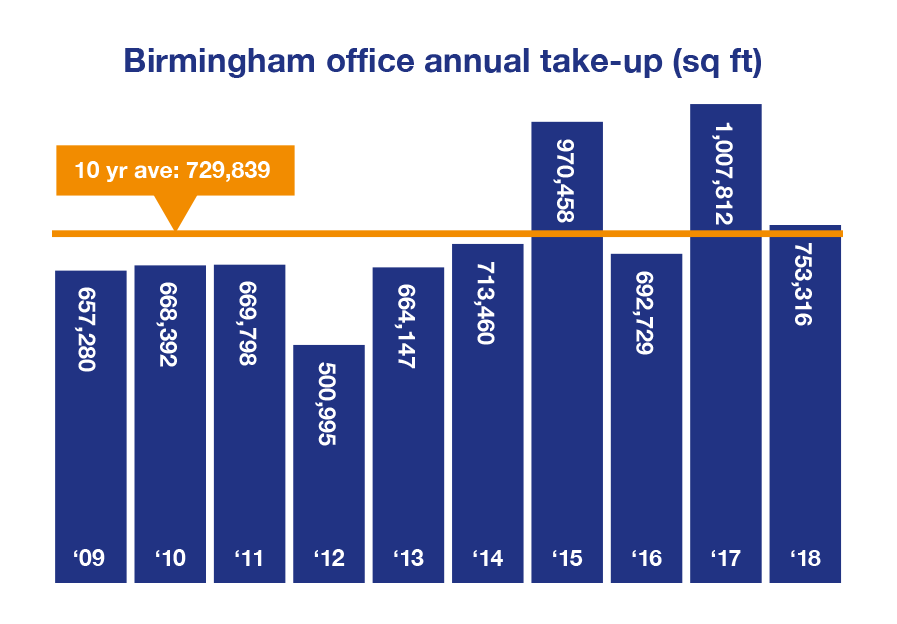

A strong finishing quarter resulted in the Birmingham office market ending 2018 at just over 753,000 sq ft across 113 transactions. Whilst the number of transactions was lower than typically expected, the average transaction size was 6,667 sq ft, and this put the annual total above the long-term average (based on 10 years) of c. 730,000 sq ft.

Birmingham office market at a glance

- Full STEAM ahead on BCU incubator project – landmark deal of 2018 at just over 118,000 sq ft

- Key transactions – a solid performance at the top of the table

- Serviced offices – increased serviced office provision impacting traditional office transactions

- WeWork eyes up the second city – currently seeking 60,000 sq ft of space

- A crowded serviced office marketplace – is there sufficient demand?

- Flight to flexibility – opportunities for landlords to reposition and repackage

- Codemasters increases office presence – has taken c. 14,000 sq ft in Alpha

- Rejuvenated Lewis Building – attracts further lettings with Freightliner and BGF taking more than 28,000 sq ft collectively in Q4

- Office space conversions –rising residential values driving changes of use

- Fringe locations – lack of office space behind another quiet year

- Grade ‘A’ office stock availability – over 650,000 sq ft of new stock set to enter the market this year

- Outlook – Birmingham office market should be set for a strong year of transactions

Full STEAM ahead on BCU incubator project

By the third quarter, 2018 had been the most consistent year for square footage, quarter-by-quarter, in the Birmingham office market. This changed in Q4, with the year’s largest transaction, the landmark deal of just over 118,000 sq ft to Birmingham City University (BCU) at Belmont Works, accounting for 16% of the year’s total. This transformed the last quarter and the year as a whole for the Birmingham office market.

The currently derelict Belmont Works will now house the second phase of its STEAMhouse project. Plans include the construction of a five-storey building, as well as the partial demolition, restoration and extension of the former cycle plant, which was destroyed in a fire ten years ago.

With such a large commitment, STEAMhouse is an exciting project for Birmingham. A spin-out from the University, it will provide a large-scale incubation, collaboration and fabrication space, designed to “unite talented people from different backgrounds in science, technology, the arts, engineering and maths – the STEAM sectors – to bring amazing new ideas to life”. It will also incorporate the STEAMacademy, an education centre offering interdisciplinary courses. The intended varied use of the building would suggest that the final square footage ‘badged’ as office space may differ.

Second phase of STEAMhouse project (CGI)

Key transactions

Whilst this year’s total square footage was not at the ‘heady heights’ of 2017 or 2015, there was a solid performance at the top of the table, with 9 transactions over 20,000 sq ft in 2018, compared with 7 in both 2017 and 2016, and 8 in 2015.

| Transactions for office space in Birmingham city centre over 20,000 sq ft in 2018 | ||

|---|---|---|

| Office building | Size (sq ft) | Occupier |

| Belmont Works | 118,240 | BCU |

| The Mailbox | 46,100 | WSP Parsons Brinckerhoff |

| Somerset House | 38,162 | BE Offices |

| Norfolk House | 36,484 | Secretary of State |

| Aqua | 26,799 | Environment Agency |

| The Colmore Building | 23,380 | Zurich Insurance |

| 1 Colmore Square | 22,043 | General Dental Council |

| 134 Edmund Street | 21,743 | West Midlands Trains |

| 2 Colmore Square | 21,232 | Highways England (via Instant Managed Offices) |

| Total | 354,183 | 47% of annual take-up |

Quasi-governmental organisations and HS2 contractors have been the most prominent ‘true occupiers’ at the top end of the market. It is understood that as much as 800,000 sq ft of office space requirements for quasi-governmental bodies are currently in the marketplace, so the public sector is set to continue to drive the Birmingham office market.

Serviced offices

The BCU transaction raises, once again, the matter of serviced offices, which continue to skew the Birmingham office market. The rationale for including lettings made to serviced office providers within the market figures has been, historically, because the serviced office space then taken by occupiers on licences within these buildings would never be taken account of, as it is not published data.

Decoding the serviced offices trend within the Birmingham office market has been one of the more pressing topics for research. The volume of serviced offices within Birmingham city centre has ballooned following a flurry of transactions to serviced office operators over the last 2 years. In 2018, with the inclusion of BCU, serviced office operators were responsible for 29% of office take-up in Birmingham city centre – over 215,000 sq ft of the total c. 753,000 sq ft that was transacted.

| Serviced office providers taking space in 2018 | ||

|---|---|---|

| Office building | Size (sq ft) | Serviced office provider |

| Belmont Works | 118,240 | BCU |

| Somerset House | 38,162 | BE Offices |

| Colmore Gate | 18,378 | iHub |

| Apex House | 11,560 | Regus |

| The Colmore Building | 11,343 | Orega |

| 65 Church Street | 10,088 | Chromex Group |

| GN House | 4,595 | Citibase Group |

| 11 Brindleyplace | 2,950 | MSO Workspace |

| Total | 215,316 | 29% of annual take-up |

An issue facing the serviced office market is the occupier-driven shortening of contract lengths. With an average contract length of around 6 months and an average length of stay of around 21 months, occupiers are pushing for shorter contract terms at each renewal. This reduction in commitment demonstrates that occupiers are becoming increasingly fleet of foot and negotiating with serviced office operators from a point of strength.

BE Offices serviced offices in Somerset House

The impact of serviced offices

The overall drop in the number of transactions in Birmingham could be due to smaller occupiers choosing to occupy one of the many new serviced office locations.

The past two years have seen a sharp rise in lettings to serviced office operators. If we exclude the transactions for managed office space that were facilitated by Instant Managed Offices, then the lettings to serviced office operators were 158,814 sq ft in 2017 and 215,316 sq ft in 2018, almost 375,000 sq ft in total.

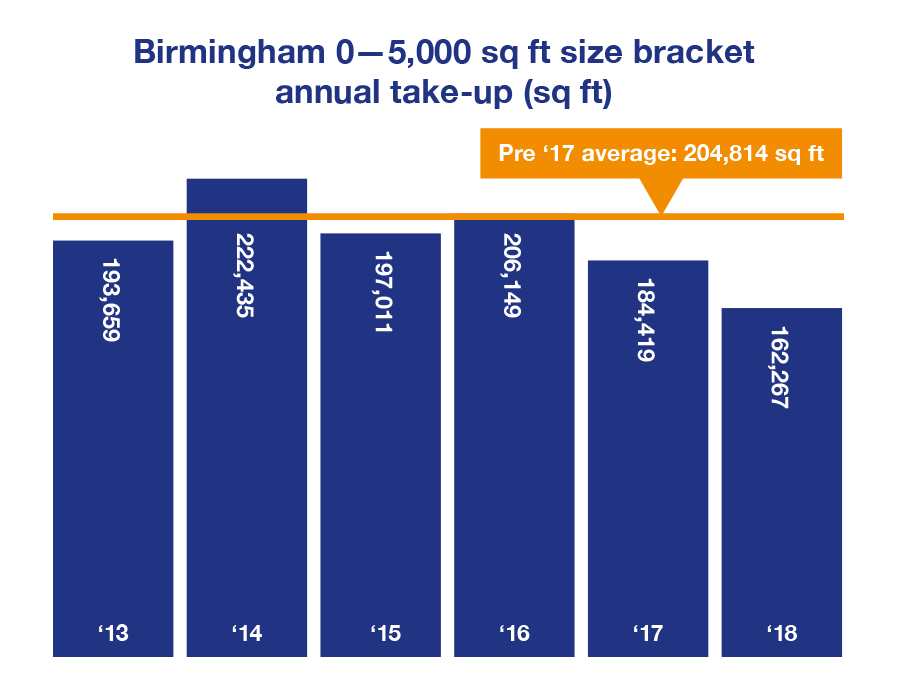

However, whilst we have seen a concurrent decline in the level of lettings within the 0–5,000 sq ft bracket, it has not been a proportionate change. In the years running up to the influx of lettings to serviced office operators, the average annual amount of space taken in the 0-5,000 sq ft bracket was 204,814 sq ft (based on 2013-2016 figures).

It could be said that a drop of c. 63,000 sq ft in the last two years (as shown by the following chart) may have been absorbed by the increased service office provision. However, this falls far short of the growth in provision for serviced offices, which may indicate high availability of space in these buildings.

WeWork eyes up the second city

In our 2017 Birmingham office market review, we speculated on the possibility of the growing market for serviced offices attracting US serviced office group, WeWork, to the City.

In Q4 2018, it was announced that JLL had been instructed by WeWork to find 60,000 sq ft of appropriate space for its first ever Birmingham location.

Although the company halved its rate of office take-up in London last year, it remains the largest private occupier of office space in the capital, with some 3.2 million sq ft of office space.

As for WeWork’s options in Birmingham, brand new properties such as Three Snowhill could provide the prominence and quality of space required.

A crowded serviced office marketplace

Serviced operators, such as Regus, Orega, BE Offices, iHub and Chromex Group have all taken space in the past two years. Considering these, and the unique offering presented by BCU at Belmont Works, and with WeWork’s interest in Birmingham, volume of competition could push quoting rates down in the serviced office world.

With so many players in the market, it raises the question as to whether they can all succeed. If we again exclude the Instant Managed Offices transactions, we haven’t as yet seen any substantial occupiers moving into a current serviced office building. This means that they are dependent on the 0–5,000 sq ft size bracket.

In isolation, the growth of individual serviced office operators within Birmingham city centre may appear sustainable. However, when examining them together with the reduction in 0-5,000 sq ft deals over the last 2 years, the combined increase in volume of serviced offices appears to be beyond requirement.

That being said, we could see a significant change in demand if the economy should see more challenging times ahead. Furthermore, The Commonwealth Games is thought to be seeking serviced offices, rather than a traditional lease, to house its office operations, thought to be in the region of 80,000 sq ft. This makes logistical sense, with the Games taking place in 2022, as a traditional lease on a letting of this size of space would typically require a commitment of 10 years or more.

Orega serviced offices in The Colmore Building

Flight to flexibility

Whilst the flight to flexibility may be great news for the serviced office world, it also presents a great opportunity for landlords with smaller office properties. Although serviced offices may be ‘in vogue’, they are as much as double or possibly 3 times more expensive per sq ft than traditional office space. If landlords can offer a competitive degree of flexibility – such as a 3-year lease with an 18-month break – they will attract lettings.

Previously, we’ve detailed the reasons that many smaller occupiers are still choosing traditional leases over serviced offices, such as lower cost, security of occupancy and business perception.

Guildhall Buildings, located adjacent to Grand Central, is an excellent example of a property that has succeeded by positioning itself in direct competition with serviced office operators. The fully refurbished property offers both flexible terms and inclusive WiFi, whilst maintaining a traditional lease model. The result has been met with great interest and a flurry of lettings.

Landlords should consider offering a competitive specification, including fit-out, fast internet connection and a ready-to-go approach to the space that allows occupiers to ‘move in and begin’ quickly and easily. This, combined with flexible lease terms, would see a property gain interest from occupiers that are also considering serviced office space.

In return for these adjustments, landlords can also expect higher rents that still undercut the cost of serviced offices. Occupiers that choose a traditional lease will still have lower occupancy costs than if they were in serviced offices.

Codemasters increases its office presence in Birmingham

In Q4, Codemasters has taken 13,966 sq ft of office space across two floors at Alpha. The computer game developer, which is headquartered in Southam, near Leamington Spa, and has further offices in Cheshire, first moved into Birmingham in 2016 when it opened a studio of 9,000 sq ft in the Custard Factory.

An upgrade in quality is understood to be the reason behind the company’s decision to move. Alpha has attracted a significant number of lettings since it was remodelled and repositioned in 2016, enjoying its most active quarter in over a decade immediately after the space was reintroduced to the market.

Alpha, Birmingham

Rejuvenated Lewis Building attracts further lettings in Q4

Both Freightliner and BGF (Business Growth Fund) took office space at The Lewis Building in Q4 – 15,881 sq ft and 12,462 sq ft respectively. BGF has taken the decision to relocate from its offices in 45 Church Street to the Lewis Building on Bull Street, which recently underwent major renovation and refurbishment.

In Q4 2017, the Lewis Building also saw the letting of three whole floors, totalling 33,293 sq ft, to serviced office operator, Regus, for its ‘Spaces’ brand. The level of take-up at The Lewis Building is clear evidence that the positioning of the property, owned by Legal and General, has been both well timed and well considered.

Office space conversions

In a picture similar to that of Solihull town centre, many older office buildings in Birmingham city centre, which could no longer meet modern office occupier requirements, have been converted to residential space. The conversion of such a property allows it to command a higher value per square foot than it would as office space.

Residential values have grown rapidly in Birmingham city centre, driven primarily by the increase in demand from the student and young people markets. The number of young people aged between 21 and 30 in Birmingham city centre has grown by almost 50,000 in the past 15 years to c. 200,000, putting pressure on the City to provide ample and adequate living space.

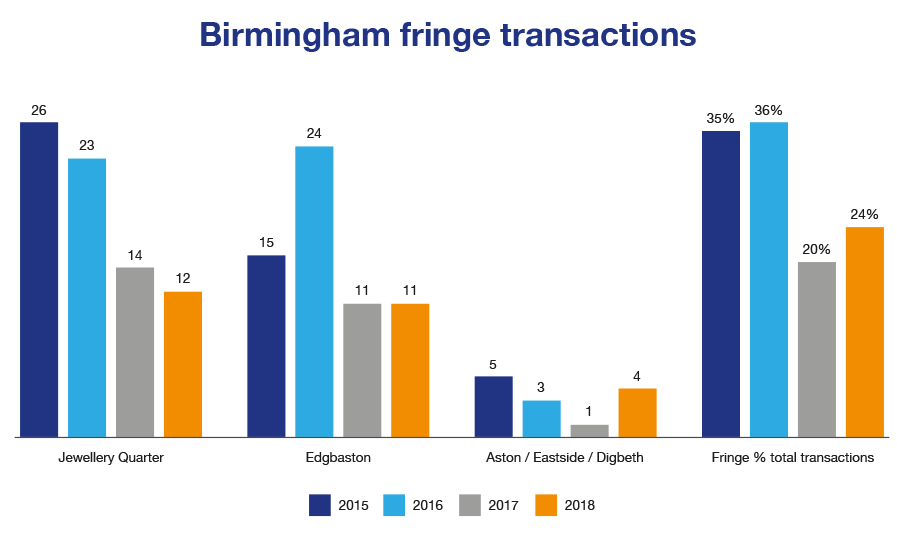

Fringe locations

The fringe areas of Birmingham city centre have recovered a little this year, having grown quieter in 2017. Depletion of office stock is a major factor in the reduced level of transactions outside the core of Birmingham city centre, with many properties in key fringe areas, such as Edgbaston and Digbeth, being converted to residential space.

Furthermore, fringe developments, such as Edgbaston Gardens, will not provide additional new office space. Instead, this mixed-use scheme will focus on a retail and residential offering.

Grade ‘A’ office stock availability

| Grade ‘A’ available/under construction/refurbishment | Size (sq ft) |

|---|---|

| Readily available | |

| Baskerville House | 55,506 |

| 55 Colmore Row | 55,092 |

| No 1 Colmore | 52,946 |

| 1 Newhall Street | 46,235 |

| Lewis Building | 36,125 |

| Alpha | 34,759 |

| Oozells Building | 29,399 |

| The Colmore Building | 23,380 |

| 10 Temple Street | 17,440 |

| 11 Brindleyplace | 14,462 |

| Total | 365,344 |

| Completing 2019 | |

| Three Snowhill | 388,000 |

| Two Chamberlain Square | 166,626 |

| Platform 21 New Street | 112,000 |

| Total | 666,626 |

| Pipeline 2020+ | |

| Post & Mail | 424,628 |

| One Centenary Way | 280,000 |

| Beorma | 235,000 |

| 103 Colmore Row | 223,000 |

| 1 Axis | 217,500 |

| Luminar | 160,000 |

| SBQ 3 & 4 | 150,000 |

| 1 Arena | 135,000 |

| Total | 1,825,128 |

2019 Outlook

2019 will present a set of both unique and unknown circumstances. However, with the strength of quasi-governmental requirements and the volume of leases up for renewal, the Birmingham office market should be set for a strong year of transactions.

We would expect the volume of 0–5,000 sq ft transactions taking place as traditional leases to potentially continue to decline, as more occupiers take serviced office space in search of greater flexibility during uncertain times – to allow them to respond effectively to change.

With a high number of occupiers seeking space and brand new Grade ‘A’ stock reaching the market, we could see rents nudged up to record levels on properties such as Three Snowhill.

See full details of the transactions featured in our Birmingham office market research, comprising office space in Birmingham city centre and Edgbaston.

For more information on the Birmingham office market, please contact Malcolm Jones on 0121 233 2330 or email mjones@kwboffice.com.

To register for future research updates, click here. See also our M42 and Solihull office market research.