Birmingham office market research: 2017 annual review

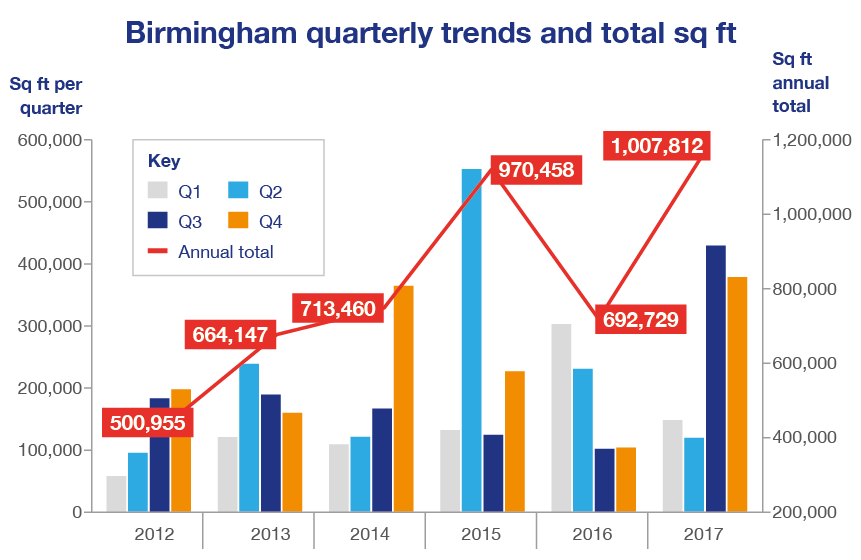

The commercial property world was taken somewhat by surprise when quarters 3 and 4 of 2017 proved to be a remarkable turnaround for the year overall. Total take-up for the Birmingham office market topped 1 million sq ft for the first time in the last decade.

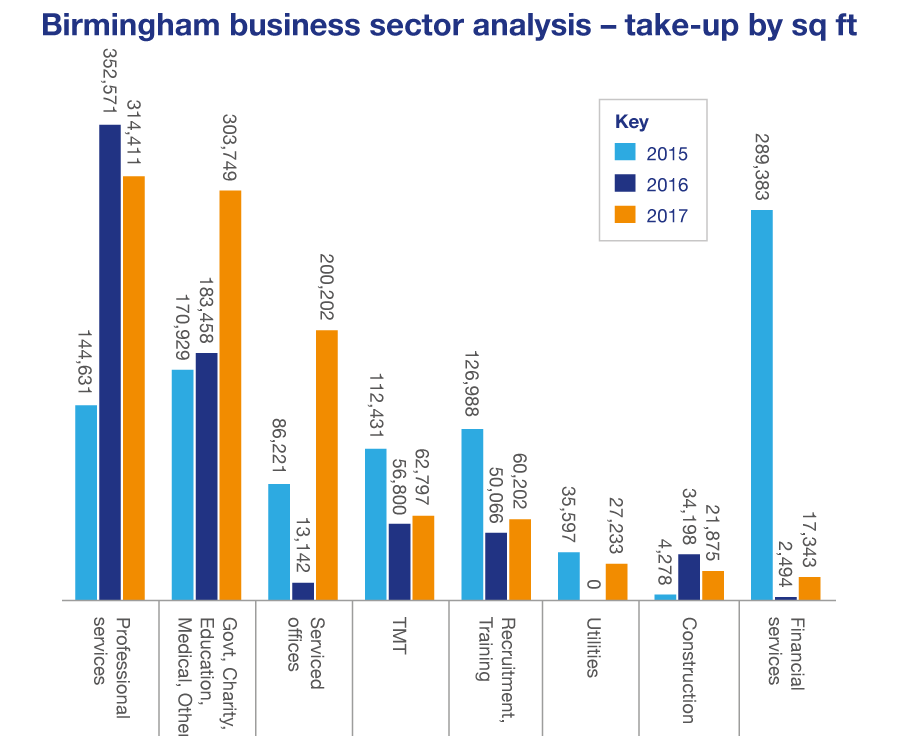

Of course, this was due in part to HMRC’s 239,000 sq ft pre-let at Arena Central. Previous similar ‘spikes’ over the last few years included HSBC’s 212,000 sq ft in 2015 – also at Arena Central, and HS2’s 98,000 sq ft at Two Snowhill in 2014. These landmark transactions are all helping to fuel the Birmingham economy at the moment, and in years to come, with related suppliers and contractors being attracted to the City, as well as a growing workforce with all its inherent additional demands for recruitment, amenities and living space. The result is a 10-year average annual take-up now of 750,000 sq ft for the Birmingham office market, compared with last year’s 716,000 sq ft.

“The West Midlands is a booming region. The level of inward investment we’re seeing is a clear response to the ever-growing, strong talent pool of the City, the major regeneration projects both current and ongoing, and the promise of HS2.

“With new landmark office developments like Three Snowhill being speculatively built, we have the new home for major relocations – such as Channel 4, for which we have spearheaded a substantial campaign. Our call to the television group – to move to the West Midlands – has captured both the City’s imagination and ambition, and would bring yet another huge boost to the region.”

Andy Street, Mayor of the West Midlands

A remarkable turnaround

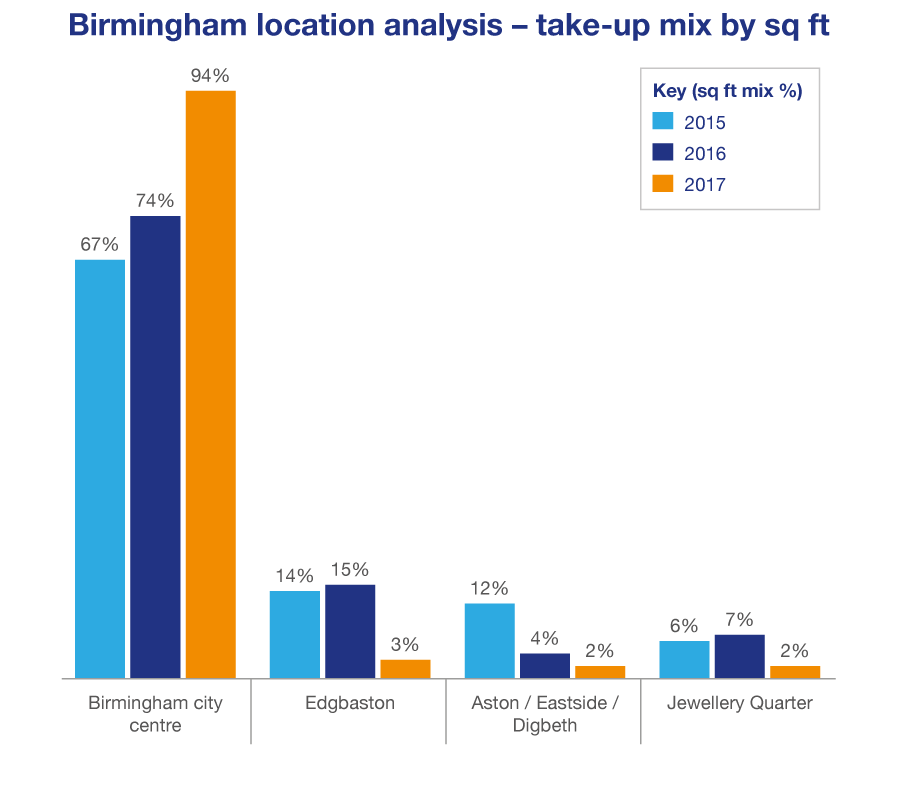

Following quarter 3’s (Q3) much welcome ‘shot in the arm’ from HMRC, quarter 4 (Q4) saw a number of office requirements fulfilled in Birmingham city centre sooner than expected. This includes the RICS moving from Coventry to c. 31,000 sq ft at 55 Colmore Row – helping boost the year to record heights. 55 Colmore Row has recently been purchased by TH Real Estate for £100 million.

In contrast, the tone of the first half of the year effectively followed on from that of the second half of 2016, a 12-month period which yielded only c.444,000 sq ft of take-up, with Birmingham seeing a post-referendum lull, driven by the uncertainty therein.

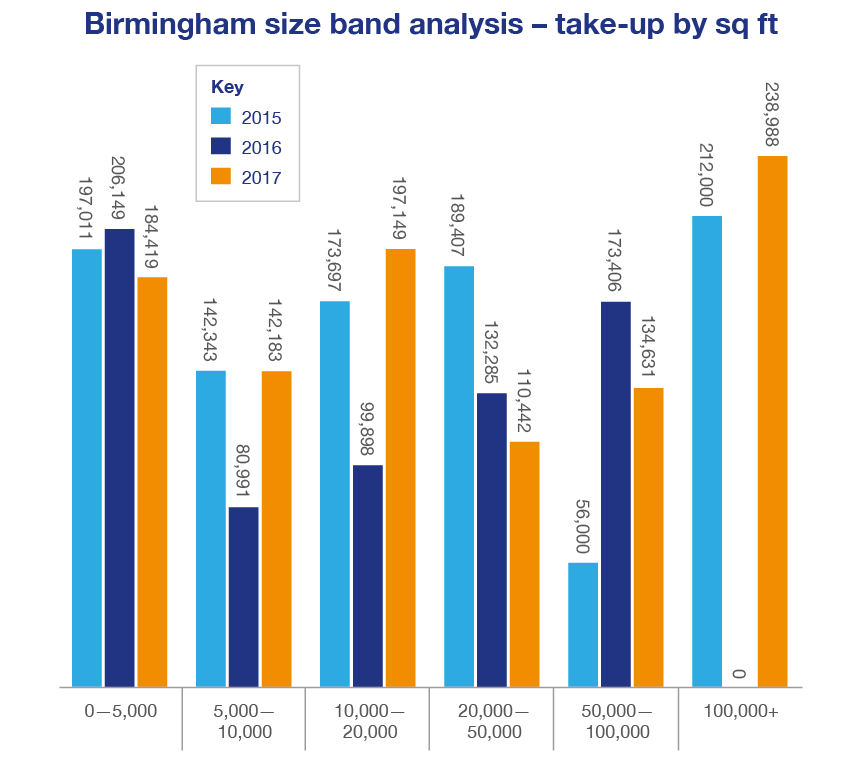

The 238,988 sq ft pre-let to HMRC at 3 Arena Central was largely responsible for the Q3 total of 402,076 sq ft – the second largest square footage transacted in a single quarter since our records began, bettered only by Q2 2015 (which, itself, was bolstered by the pre-let to HSBC at 2 Arena Central). Q4 broke a record of its own, delivering a total of 354,530 sq ft across 49 transactions – the highest ever number of office space transactions for a quarter and demonstrating what would appear to be a sustainable quarter of office space take-up.

Much of the 15,000+ sq ft activity within the year – 9 of the 11 transactions – occurred in the last six months. By securing office space at this moment in time, with leases stretching over much of the forthcoming, initial-Brexit process, occupiers can guarantee themselves occupancy at a rent they are happy with.

It is possible that occupiers were keen to secure premises, in a timely fashion, to capitalise upon the incentives, rental rates and levels of flexibility which was previously unavailable. With the lacklustre performance of the market from June 2016 to June 2017, it could be argued that the terms secured by occupiers in the second half of the year were better than had been previously offered, which accelerated their decision-making process.

Key transactions

| 1. | HMRC | 3 Arena Central | 238,988 sq ft |

| 2. | Regus | The Crossway (formerly Civic House) | 76,000 sq ft |

| 3. | PWC | One Chamberlain Square | 58,631 sq ft |

| 4. | Regus | The Lewis Building | 33,293 sq ft |

| 5. | RICS | 55 Colmore Row | 30,808 sq ft |

| Total | 43% of annual take-up | 437,720 sq ft |