Birmingham office market research — Q3 2020

Many businesses are learning to ‘work with COVID’ and make their workplaces COVID-secure, enabling them to continue with their plans. With 16 transactions and 79,953 sq ft, the wheels of the Birmingham office market started to spin once again in Q3.

In comparison with the five deals that took place in Q2 – now referred to as the ‘COVID Quarter’, Q3 saw the Birmingham office market pick up, as lockdown eased. Whilst clearly still short of the average level of take-up, the Q3 figures are encouraging, as is the level of enquiries.

Whilst in global news we see reports of occupiers considering downsizing or abandoning the office model altogether, so far this is not evident in Birmingham. If it were to happen, occupiers – in most instances – would need to wait until a lease event, by which time the situation may be very different.

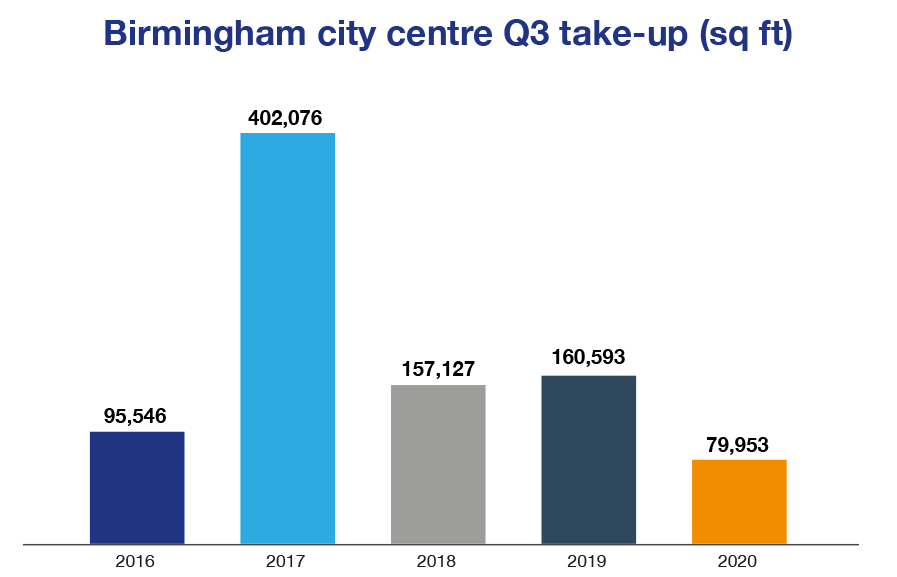

If we review Birmingham city centre Q3 take-up over the last five years, the latest quarter’s c. 80,000 sq ft is not dissimilar to the c. 95,000 sq ft in 2016. Brexit was the obvious factor in 2016, causing uncertainty and inertia. Whilst this year the headline cause is different, the impact and resulting take-up are the same. Nothing hinders office transactions more than uncertainty, which leads to a lack of decision-making within the boardroom.

Birmingham office market at a glance

- Market perking up – four transactions over 10,000 sq ft

- Offices ARE open – although occupation is significantly less than usual

- COVID-secure offices – businesses work to minimise the risk of COVID-19 to their staff

- Better than expected enquiry levels – occupiers keen to know what’s available

- Some occupiers can see the light – albeit that light is well into next year

- “Shovels officially in the ground” – construction work on HS2 officially begins

- Outlook – can the Birmingham office market continue its recovery in Q4?

Market perking up

Whilst the 16 transactions and 79,953 sq ft of Birmingham office space secured during Q3 equate to just under half the long-term average for this quarter, it’s still very encouraging following the ‘COVID quarter’. The number of transactions is on a par with Q1, and if we exclude the BT deal of 283,000 sq ft in that quarter, c. 80,000 sq ft in Q3 compares favourably with c. 56,000 sq ft in Q1!

The results we see in the third quarter are made more impressive given the lack of government-related transactions. Typically, public sector and quasi-government occupiers are responsible for some of the largest amounts of office take-up. In Q2, public sector occupiers accounted for two of the five transactions and 88% of the total square footage secured in the Birmingham office market.

Whilst in Q1 we saw two transactions over 10,000 sq ft, and only one in Q2, there were four such deals in Q3:

| Location | Size (sq ft) | Occupier | Business sector |

|---|---|---|---|

| Two Chamberlain Square | 17,835 | Knights | Legal |

| Two Snowhill | 12,613 | Carter Jonas | Property consultancy |

| Two Chamberlain Square | 11,764 | Mazars | Accountants |

| 1 Colmore Square | 10,056 | Isio | Pensions |

| Total | 52,268 | 65% of take-up |

Fast growing legal and professional services firm, Knights, took 17,835 sq ft at Two Chamberlain Square in the largest letting of the quarter. Towards the end of last year, Knights acquired law firm, Emms Gilmore Liberson (EGL), based at Lancaster House on Great Charles Street, for £4.7m, which signalled their entry into the Birmingham professional services market. In January this year, they announced the purchase of ERT Law, based in Lombard House – also on Great Charles Street, for £1.8m. The new office space will house both teams, comprising 32 fee earners from EGL and 24 fee earners from ERT and will support their continuing expansion plans.

Two Chamberlain Square, Birmingham city centre

London-based property consultancy, Carter Jonas, expanded into 12,613 sq ft on the eighth floor at Two Snowhill, having occupied flexible offices at the building since 2016. They opened their Birmingham office four years ago with just 12 staff and now employ more than 80 people in the building. Two Snowhill is also home to HS2 HQ, for whom Carter Jonas undertakes a range of work related to the high-speed rail project.

Carter Jonas Chief Executive, Mark Granger said in September of the move: “Opening in the City nearly four years ago marked a pivotal moment in our expansion, enabling us to pursue additional national mandates and helping to transform our approach to client contracts. As a business, we are fortunate to be continuing with our planned investment in this area, given the exceptional challenges presented this year. This office provides a strong platform from which we can review the many opportunities that will present themselves in the coming months.”

Two Snowhill, Birmingham city centre

Accounting and advisory firm, Mazars, has taken 11,728 sq ft on the first floor at Two Chamberlain Square, Paradise Birmingham. They are relocating 200 staff from their existing offices at 45 Church Street, which they moved to in 2010 from Lancaster House, taking c. 9,000 sq ft, to which they subsequently added a further c. 2,000 sq ft in 2015.

Mazars Birmingham Office Managing Partner, Ian Holder, said of the office relocation in August: “Our new offices in the city centre reinforce our commitment to remaining part of the fabric of the vibrant Birmingham business community, and underscore our confidence in the continued growth of the team for years to come.”

At the end of last year, KPMG consented to the management buyout of its UK pensions consulting and advisory unit, employing 20 partners and 500 staff. In March this year, the newly independent practice rebranded to Isio and has now taken 10,056 sq ft at 1 Colmore Square – clearly with sights on growth.

1 Colmore Row, Birmingham city centre

Offices ARE open

If you walk through Birmingham’s office hot spots, around the Colmore Business District for example, you’ll see that offices are open. Whilst the number of staff currently in occupation is significantly less than usual, office buildings that were closed through lockdown are now welcoming ‘skeleton staff’. The extra space afforded through either reductions in staffing, flexible hours or a mixture of remote working does provide social distancing for those on-site. The test will be if it also provides a sustainable business model for companies in the short to medium-term – before a vaccine can be developed.

Colmore Row, Birmingham city centre

COVID-secure offices

Current Government advice (updated 16th October 2020) for people who work in or run offices, states that office workers who can work effectively from home should do so over the winter. However, for many businesses that have worked to minimise the risk of COVID-19 to their staff within their workplaces, they will be looking to retain the benefits that they have seen from a return to the office.

In major cities elsewhere in the world, we see examples of large corporates acquiring new office space and taking the long-term view. In New York City (NYC), for example, the four companies known as ‘Big Tech’ – Amazon, Apple, Facebook and Google – have continued to progress their previous growth plans by expanding their office stakes and recruiting staff, the latter by over 13% on average across the four companies so far this year. The office space they’ve signed up to will allow them to increase their collective workforces by a further 70%!

Of course, it’s also widely reported that these companies have allowed their employees to work remotely and some, including Facebook, envisage up to 50% of their employees continuing to work from home in the future. However, it’s what the decision-makers at these companies say about the draw of the City – its diversity, culture, regional transportation network and numerous colleges and universities. Sound familiar? These will always be at the top of occupiers’ lists when it comes to locating their workforce. Nevertheless, the final clincher for these players and smaller tech companies is the belief that “being physically present with colleagues in an office can offer important opportunities for in-person interaction, collaboration, and connection that are important for success”. And that’s a sentiment to which most of us can relate.

So, what does this mean for Birmingham? If we value more than ever those 3Cs – collaboration, connection and creativity – can we get our offices back to work? Only time will tell, but it has to start with landlords and occupiers working together to make their workplaces safe for staff to return.

Better than expected enquiry levels

The current level of enquiries is much better than we would have expected earlier in the year. Occupiers are keen to know what’s available as they try to plan the direction of their businesses. This enthusiasm is encouraging, although currently it seems to be more exploratory, rather than progressing to viewings.

What we do see is the pandemic accelerating decisions for those in serviced offices, who would normally look to move to office space on traditional leases as they outgrow the serviced office model. The attraction of relocating to their own self-contained office space is so much more relevant today.

As already mentioned, uncertainty is the antithesis of progress for the Birmingham office market. In today’s world, occupiers are faced with numerous considerations – not least the size of their office space requirement. What they seek right now is good advice and commercial property agents are well placed to provide this.

We would recommend to occupiers that do have lease events upcoming, or need to change their current office space stake, now is the time to act.

Some occupiers can ‘see light…’

There are some occupiers who are making longer-term decisions to proceed with relocation within or into Birmingham city centre. The occupiers in question see light at the end of the tunnel, albeit that the light is well into next year. Consequently, they are not turning their back on Birmingham city centre – quite the contrary. They value the recruitment aspects that the City affords – and the possibility of some good deals being laid on the table.

“Shovels officially in the ground”

CGI of the new HS2 Curzon Street Station, Birmingham

In September, construction work on HS2 officially began – with the pledge of creating 22,000 jobs over the next few years. The main West Midlands works contractor, the Balfour Beatty Vinci JV, is expected to become one of the largest recruiters in the region over the next two years.

The government says that the jobs now created by the project will support the post-COVID recovery.

We cannot underestimate the importance of HS2 to Birmingham and the entire West Midlands region. We’ve already seen its impact on office transactions over the last 4 years – and we’ve seen it again this quarter, with the Carter Jonas expansion. It’s also most likely to be linked to the fifth largest deal in Q3 in which Instant Offices has taken 7,128 sq ft at 2 Colmore Square. Instant operates a managed office model on behalf of occupiers, particularly where the requirement is contract-led.

Outlook for the Birmingham office market

Given the transaction stats in Q3 and the encouraging level of enquiries at present, we would expect to see activity in the Birmingham office market continue its recovery in Q4. However, this relies upon the current talk of a circuit-breaker serving as just a blip on the road to recovery.

It remains to be seen to what extent downsizing will become a factor at lease breaks and lease ends and whether occupiers will be hastening to sublet space within their existing offices. Whilst there are one or two instances of ‘grey space’ being made available, this has so far not become evident within the market.

What is clear from the activity this quarter is the dominance of the city’s stalwart sector – professional services accounted for over 80% of the office space transacted. Now we need some of those tech companies to move in…

See full details of the transactions featured in our Birmingham office market research, comprising office space in Birmingham city centre and Edgbaston.

For more information on the Birmingham office market, please contact Nigel Tripp on 0121 233 2330 or email ntripp@kwboffice.com.

To register for future research updates, click here. See also our M42 and Solihull office market research.