Birmingham office market research — Q1 2019

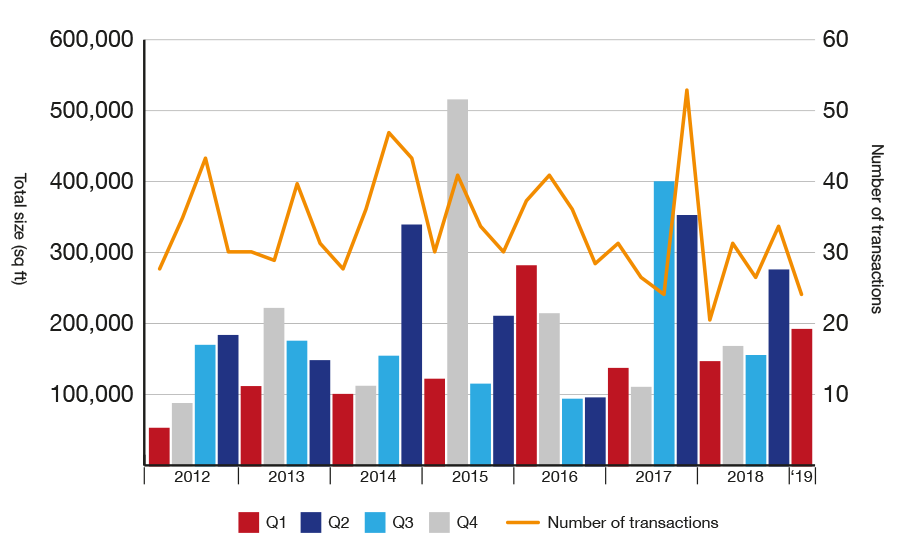

The Birmingham office market achieved 194,014 sq ft of sales and lettings across 25 deals in Q1 2019 – one of the strongest first quarters since the recession. The quarter’s total was bolstered by large lettings to the public sector.

A respectable Q1 is expected to give way to a quieter Q2, as occupiers are likely to sit on their hands until there is more clarity on the UK’s departure from the European Union. Though the rate of new enquiries for office space is currently down, we anticipate more activity in Q3 and Q4, leading to a strong end-of-year total for the Birmingham office market.

Birmingham office market at a glance

- On your marks. Get set. Sublet. – Commonwealth Games takes space from Deutsche Bank

- The Colmore Building fills up – recent lifestyle investments have paid off

- A strong Q1 – good deals at top end of the market and an even spread

- Public sector tops it again – a driving force in the market, the public sector takes most space

- A diverse quarter – excellent variety in sectors taking space helped make a strong Q1

- Serviced offices ebb and flow – quarter-by-quarter operators take either all or nothing

- The core continues to dominate – lack of space in fringe areas gives the core 80% share

- Outlook – Q2 likely to be quiet, but Q3 and Q4 will pick up the pace

On your marks. Get set. Sublet.

The largest letting was an impressive 72,261 sq ft at One Brindleyplace let to the ‘team’ that will deliver the 2022 Commonwealth Games, which is to be hosted in Birmingham.

This deal alone accounts for 37% of the Birmingham office market take-up in the quarter and, without it, the picture would have been quite different. The transaction also serves as inward investment, as these are newly created operations.

Notably, it was recently announced that the Brindleyplace development is to undergo significant investment in refurbishment. The £7m that has been committed to by asset manager Hines UK will be focused primarily on three buildings as part of an overall rebrand of the site.

One Brindleyplace itself was purchased by, German fund manager, Munich-based GLL Real Estate from Trinova Real Estate for around £37 million. The entire building has an existing lease to Deutsche Bank, which will run up until 2029. However, in 2014 the bank took 134,000 sq ft of office space at Five Brindleyplace to house a 1,500-strong team, and building One has since been somewhat surplus to requirements.

Consequently, the letting to the Commonwealth Games is in fact a sublet and will likely provide the large team with all the time they need to deliver both the Games and the process to ensure the regeneration legacy.

The Games is a big operation and whilst 72,261 sq ft is, by all accounts, a large letting, it is unlikely to be the full story. We would expect to see further office space being taken by contractors instructed on the delivery of the Games.

Of course, these requirements could ultimately be facilitated by serviced or managed offices, rather than a traditional office letting. If these functions have a shorter life span, a serviced office solution would deliver the required flexibility in length of stay.

The Colmore Building fills up

The second largest letting in Q1 2019 was to the solicitor firm, Irwin Mitchell, which took 46,750 sq ft at The Colmore Building. Irwin Mitchell had previously been located at Imperial House on Temple Street.

This large deal, and the letting to Interface Europe of 7,859 sq ft which also took place in Q1, represents the disposal of the last remaining space in the 320,600 sq ft office building. As a new building in 2004, the property had struggled to become fully income producing. However, in 2016 the property underwent a programme of refurbishment and enhancement, worth £3.5 million, by new owners Ashby Capital.

One of the aims of this programme was to improve the lifestyle offering of the building, including the creation of a coffee house, gym and treatment rooms, as well as cycling facilities such as bicycle parking, changing rooms and a drying room. Along with an enlarged and refurbished reception area, these works have clearly made a significant impact on the appeal of the property.

The Colmore Building

Whilst not all commercial properties are big enough to accommodate such facilities, the success of The Colmore Building and similar repositioned properties, like the rebranded Alpha, serve as proof of what office occupiers are looking for. They want to provide appealing office space for their employees by creating a community and accommodating those embracing flexible hours and ‘bring your own device’ working.

A strong Q1 for the Birmingham office market

Thanks to the diversity of occupiers taking space and the large lettings to the Commonwealth Games and Irwin Mitchell, the quarter was one of the strongest since the recession – second only to Q1 2016.

The last year of the market acknowledged as having been during recessionary times was 2012. The first quarter of that year saw 54,573 sq ft transacted across 28 deals – equating to an average transaction size of just 1,949 sq ft. The peak first quarter since then was Q1 2016 with 283,697 sq ft across 36 transactions – including the 90,000 sq ft pre-let to PWC – with an average letting size of 7,880 sq ft.

Q1 2019 delivered a very similar average transaction size to 2016, at 7,761 sq ft, demonstrating the quarter’s even spread of deals. If in any given quarter there is a large deal, yet a relatively small average transaction size, that indicates that there are few or even no deals at all taking place in the middle of the market.

| Q1 of year | Total space (sq ft) | Number of transactions | Average transaction size (sq ft) |

|---|---|---|---|

| 2019 | 194,014 | 25 | 7,761 |

| 2018 | 148,470 | 22 | 6,749 |

| 2017 | 138,943 | 31 | 4,482 |

| 2016 | 283,697 | 36 | 7,880 |

| 2015 | 123,760 | 30 | 4,125 |

| 2014 | 102,353 | 28 | 3,655 |

| 2013 | 113,326 | 30 | 3,788 |

| 2012 | 54,573 | 28 | 1,949 |

Public sector tops the office market again

Two of the top three deals this quarter were to public sector entities. In addition to the Commonwealth Games, the third largest letting was to the NHS which took 10,917 sq ft at the Wesleyan Building/1 Colmore Circus. Combined, these two deals total 83,178 sq ft representing 43% of the total square footage transacted in the quarter.

The public sector and companies servicing the public sector have frequently appeared at the top of the market over recent years. Last year, we saw large lettings to the Secretary of State, Home Office, General Dental Council and Network Rail – to name a few. These lettings represented a significant amount of the office space taken overall in 2018.

Given that as much as 800,000 sq ft of office space requirements for quasi-governmental bodies are in the marketplace at this time, the public sector is likely to continue to top the list of quarterly transactions.

A diverse quarter

Typically, the range of sectors taking space within Birmingham city centre will be quite narrow, focused primarily around the professional services, TMT businesses, recruitment, the public sector and financial services. However, from manufacturing to healthcare, Q1 2019 was one of the Birmingham office market’s most diverse quarters to date.

Should such variety continue, the City would be enjoying the kind of sustainability in lettings that we see in the out-of-town office market, which is well-known for having a broad occupier-base.

But why are more diverse businesses choosing to take office space in Birmingham? After years of strong activity, Birmingham’s out-of-town office market is now struggling to provide readily available office space of a good quality. Conversely, Birmingham city centre has been growing and enhancing its supply of office stock.

One of the most attractive things about Birmingham city centre at this point, is the amount of investment being put into the area. Over recent quarters, we have seen the highest level of office development, work on growing the Metro system which is vital to improve the City’s public transport and now, with a project like the Commonwealth Games, yet more money will be invested in the City’s infrastructure.

Serviced offices ebb and flow

Birmingham is said to be one of the fastest growing flexible office markets in Europe. However, this quarter, we saw no lettings to serviced office operators. An uptick in demand could lead to a more consistent rate of take-up in the coming quarters.

Until now, the demand for flexible office space has been driven by the uncertainty of Brexit and the need for project-led space – primarily relating to infrastructure projects such as HS2. As a result of these specific demands, serviced office operators are either the dominant type of occupier taking space in a quarter or are completely absent from the transaction figures.

Last year, serviced office operators represented a 29% share of Birmingham office space take-up –some 215,316 sq ft. However, in Q1 and Q3 they represented just 7% and only about 0.5% of transactions. This makes it difficult to predict what share of office space serviced office operators will take on a quarter-by-quarter basis.

It’s understood, however, that the City is now seeing growth in demand for this type of space by start-up digital and creative businesses. The interest from new businesses in these sectors is likely to be the reason that well-known serviced office brands such as WeWork are seeking a location for their first operation in the City.

In our annual review of the Birmingham office market for 2018 we suggested that the reduction in transactions in the 0-3,000 sq ft size band could serve as an indicator as to the volume of serviced office space being taken up. This calculation indicated that there is a significant amount of space that has been let to serviced office operators that is currently vacant.

The core continues to dominate

80% of transactions in the Birmingham office market in Q1 took place in the City’s core. The deals that took place in the fringe areas of Birmingham city centre, such as Edgbaston and the Jewellery Quarter, amount to just 17,647 sq ft – less than 10% of the quarter’s overall office take-up.

| Office building | Size (sq ft) | Occupier | Location |

|---|---|---|---|

| Tricorn House | 6,980 | Alzheimers Society | Edgbaston |

| 26-28 Ludgate Hill | 4,923 | Stoford Developments | Birmingham Jewellery Quarter |

| Tricorn House | 4,360 | Kenton Black | Edgbaston |

| Assay Studios | 820 | Koala TV | Birmingham Jewellery Quarter |

| 30 St Pauls Square | 564 | First Point Healthcare | Birmingham Jewellery Quarter |

| Total | 17,647 | Number of transactions | 5 |

As we have commented on in previous quarters, whilst the core’s office stock has grown stronger, stock in the fringe areas of the City has diminished significantly due to take-up and the conversion of office space to residential.

The residential market in Birmingham city centre has prospered greatly over recent years, and rents have risen significantly in some areas. This prosperity has been driven primarily by a growing student market.

Although we are now seeing new residential developments such as The Bank complete, the growth in residential stock, until now, has largely been the result of converting office buildings. It must be said, however, that many of the buildings that have been converted by landlords no longer met modern occupier requirements.

Outlook

Q2 2019 looks set to be a quiet quarter, as it is likely to be for many office markets across the country, and that is understandable given the current uncertainty surrounding the fulfilment of the EU referendum.

There are significant office requirements, though some of these enquiries may not currently be in the market. Some companies are taking the view that if they don’t need to make a decision imminently they should hold off. These businesses are waiting until more is known about what implications Brexit will have upon their business, which will undoubtedly inform the decision-making process.

Furthermore, landlords will be inclined to agree to short extensions – particularly if they don’t have an occupier lined up to fill the space. Such extensions are likely to have been agreed at the end of last year and we are aware of a number of landlords that had already taken the decision not to serve notice on occupied properties.

That said, we anticipate seeing an upturn in enquiries and transactions during Q3 and Q4 as it remains the case that many lease events are due to take place this year.

See full details of the transactions featured in our Birmingham office market research, comprising office space in Birmingham city centre and Edgbaston.

For more information on the Birmingham office market, please contact Malcolm Jones on 0121 233 2330 or email mjones@kwboffice.com.To register for future research updates, click here. See also our M42 and Solihull office market research.