Birmingham office market research — Q1 2020

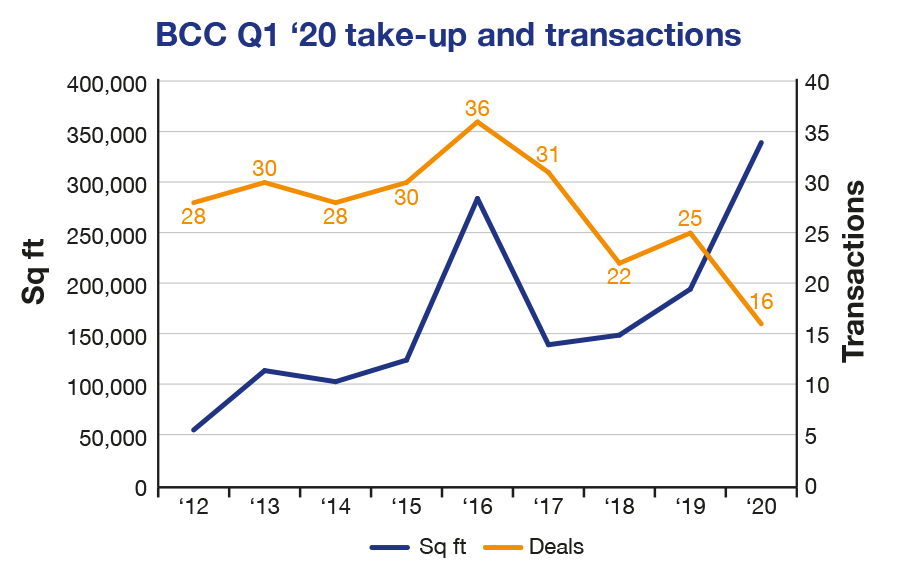

Birmingham office market secures an impressive Q1 total of 338,985 sq ft across just 16 deals – bolstered by the landmark letting of Three Snowhill to BT. The figure is unlikely to be a sign of things to come in subsequent quarters, with the market’s momentum mired by coronavirus.

Although the Q1 2020 total for the Birmingham office market was the largest amount of office space we’ve seen transacted in a first quarter, since records began, the letting to BT is not supported by an otherwise active quarter. The reason behind this is that the market was effectively put on hold in March. As the country headed into lockdown, many contracts stayed firmly in solicitors’ hands.

Birmingham office market at a glance

- Coronavirus conversations need to happen – advice for occupiers and landlords

- Landmark BT pre-let – fulfillment of long-time development opportunity

- BT hides quiet quarter – number of deals down as market hit pause in March

- Fringe pipes up – flurry of deals across Edgbaston and Jewellery Quarter

- Serviced office world likely to be hardest hit – flexibility is a double-edged sword

- Green light for HS2 – a reason for many businesses to be cheerful about the future

- Outlook – deals on hold for a while but will be signed when market starts back up

Coronavirus conversations need to happen

During lockdown, many occupiers are no longer based within their offices and, with revenues across various sectors slipping, businesses are making the decision to furlough their staff and/or reduce operating hours. This puts strain on everyone’s ability to ‘pay the bills’. It’s therefore important for both occupiers and landlords to be finding the best way through this unprecedented situation.

For occupiers

Occupiers experiencing difficulties at this challenging time must speak to their landlords to discuss a way forward. Ultimately, it’s a mutually beneficial conversation, as landlords will be looking to avoid the forfeiting of leases.

The options that could be agreed are varied, so there is plenty of opportunity to find a solution that works for both sides. These may include:

- Monthly rental payments – rather than quarterly – to aid cashflow

- Deferring part or all payment of a period of rent until later in the year

- Incentives in return for a longer lease

Above all, be honest with your landlord and seek the advice of your property advisor, who can discuss with you what options are available to you as a valued tenant.

For landlords

We understand the difficulties of the current situation, with forthcoming occupiers holding off on signing leases, and existing occupiers struggling to maintain their rent and service charge payments. What’s required is a considered and empathetic approach from all parties, and this will also include your lender, where you have borrowings to fund your property portfolio.

Banks are now actively supporting landlords with schemes to provide capital repayment holidays on their commercial mortgage loans for a period of say 6 months, depending on their situation. Whilst interest payments will tend to stay in place, the capital repayment holiday will cause more interest to be charged on the loan in the long-term. However, with the Bank of England base rate being so low, this is likely to be negligible over the term of the loan.

Landlords should seek the advice of their property management company or property advisor to discuss how their tenants’ leases could be restructured to retain tenants and protect a level of revenue. Whilst this is likely to impact the value of investments in the short-term, this is a foregone conclusion in any case. However, this is probably more preferable than the alternative – if leases are forfeited, then significant rent-free incentives will be required to re-let the space.

BT pre-let signals fulfilment of long-time development opportunity

BT Group has taken the lion’s share – 283,000 sq ft – of the available 400,000+ sq ft of office space at Three Snowhill. More than 4,000 staff will be working out of the new offices when they move to the building from the end of 2020, occupying the majority of the 17 floors. Following the letting, Three Snowhill – the largest speculative development in the UK, outside of London – has 119,950 sq ft remaining.

Whilst it’s not been confirmed where all the staff will be moving from, Graeme Paton, MD of Property & Facilities Services for BT plc, said it would become a “strategic hub location” for the company in the UK, and would see five times the current number of its staff working in Birmingham. As a result, BT will become one of Birmingham’s largest employers.

The letting is also understood to be the largest single office space transaction ever to have taken place in the Birmingham office market.

Birmingham has had, and continues to have, occupiers with a larger overall office stake – Deutsche Bank at Brindleyplace, for example. However, this occupation has grown through phased take-up, rather than one single letting.

Three Snowhill finding a major occupier signals the culmination of 50 years in the making for the Snowhill scheme. It has been a long journey for the development site, which had been ‘earmarked’ for big things for several decades. The Snowhill site has been an area for potential development even since the early 1970s, beginning with the redevelopment of the ‘new Snowhill train station’ in 1970.

For a few decades, ownership of the site changed hands between several investors until, in 2001, the Snow Hill Development Brief was created by then owners, Birmingham City Council and Railtrack.

In response to the brief, Ballymore and Hammerson purchased the site for £63m in 2002 and began planning a phased scheme for a mixed-use development with a budget of c. £500m.

Two Snowhill, the previous phase of the scheme to complete, also staged one of the market’s other largest lettings in recent memory. In 2014, 97,958 sq ft of Two Snowhill was let to the team in charge of delivering HS2. This letting was not just significant for the market in itself, but also for the numerous HS2 contractors that took space in close proximity to Two Snowhill soon after.

BT hides quiet quarter

Whilst Q1 was the largest first quarter that Birmingham city centre has seen since records began, the BT deal significantly skews the overall picture.

Typically, we would expect Birmingham city centre to secure a far higher number of transactions. The long-term average for Q1 would be around 29 deals, so – at just 16 deals – Q1 2020 comes in at almost half that. The reason for this is the coronavirus pandemic.

When the Brexit extensions came to an end and the UK entered the transition phase, many businesses saw this as an end to at least some of the prevailing uncertainty and a reason to finally push forward with their plans. However, at the beginning of March, occupiers were already responding to COVID-19 and shifting their teams to work from home, ahead of the countrywide lockdown that was eventually mandated on 23rd March.

As a result, the deals we see in Q1 2020 are essentially the fruits of just January and February, with the market in limbo from early March. In normal times, we would expect to see Q1 and Q2 produce significant lettings and volume of transactions. However, the Birmingham office market has been stopped in its tracks.

Nevertheless, demand is still there. However, because occupiers are unable to move in or out of property at this time, there is no desire to commence leases. Transactions that were due to complete in Q1 or Q2 will now most likely take place much later in the year.

When we take the BT deal out of the equation, the market achieved only 55,912 sq ft. In spite of that, within these deals we can see positive activity from SMEs, which affirms that the market was in a good place after several years of Brexit uncertainty. Indeed, the resilience demonstrated in both the in- and out-of-town office markets is encouraging and suggests there will be a strong ‘bounce-back’ post lockdown.

Fringe pipes up

Fringe areas were responsible for 37.5% of the transactions in Birmingham city centre this quarter, with 6 out of 16 deals. Fringe areas have been noticeably quiet over recent quarters due to lack of supply in locations such as Digbeth, Jewellery Quarter and Edgbaston. The transactions total 35,343 sq ft, 10 % of the overall square footage in Q1 2020.

Fringe deals in the Birmingham office market in Q1 2020

| Office building | Size (sq ft) | Occupier |

|---|---|---|

| 49 Calthorpe Road | 19,881 | Quadrant Court (formerly Somerville House) |

| Tricorn House | 7,581 | FIS Global |

| Birmingham Assay Offices | 2,497 | Lightwave RF Technology |

| 10 Harborne Road | 2,368 | Tetra |

| Tricorn House | 1,569 | 5i |

| Tricorn House | 1,447 | Creditfix |

| Total | 35,343 |

The second largest transaction of the quarter took place in Edgbaston. Serviced office provider, Quadrant Court – formerly known as Somerville House – took 19,881 sq ft at 49 Calthorpe Road. This will allow Quadrant Court to relocate from 123 Hagley Road, which is being redeveloped as part of Calthorpe Estates’ New Garden Square development. This will be a mixed-use scheme with high quality offices and new apartments, shops, cafés and restaurants set around an attractive public garden square.

Serviced offices are, in fact, a sector at particularly high risk at this moment in time, with all occupiers unable to access their office space.

Serviced office world likely to be hardest hit

To date, serviced office operators have prospered in the region and taken significant amounts of Birmingham city centre office space over recent years. However, they could now be particularly vulnerable. The unique flexibility that has fuelled the popularity of serviced offices may, at this time, work against them.

Currently, most, if not all, occupiers within serviced office operations have vacated their offices – either working from home or pausing their operations entirely until the lockdown is relaxed or lifted. Indeed, the very open nature of the serviced office working environment makes them more of a risk than a small, stand-alone, traditional office.

With many businesses expected to consider working from home after the lockdown, and the lockdown itself due to last for an unknown period of time, occupiers are currently ‘sitting at home’ considering their options.

Serviced office contracts and licenses will usually allow an occupier to terminate their occupancy with 1-2 months’ notice. This makes it easy for these occupiers to end their occupancy either temporarily, with the intent of returning at some point, or permanently. Some may also be deferring license payments at this time.

WeWork is a good yardstick in this respect. On 1st April, with many countries across the world in various degrees of lockdown, Japanese conglomerate and major shareholder of WeWork, SoftBank, decided not to buy $3bn in WeWork shares. This retraction of anticipated funding during, and in response to, the COVID-19 pandemic leaves WeWork at great risk.

Serviced office operators will need to be extremely proactive in retaining their occupiers, offering significant incentives, but this will come at a cost. Operators will need to negotiate with their landlords and creditors, and pass on some of this loss of revenue, to avoid insolvency.

Green light for HS2

In February, PM Boris Johnson approved the decision to press ahead with HS2, after a much-publicised review of its costs.

He committed to both the London to Birmingham rail line and the next phase from Birmingham to Leeds and Manchester, with the hope that the first trains would be running by the end of the decade. Whilst the decision to go ahead has been controversial, there has been pressure on the Government not to abandon HS2 from a number of regional politicians, including the Mayor of the West Midlands, Andy Street.

Large infrastructure projects are a fundamental driver of the economy, and a decision such as this for HS2 may be the antidote the Birmingham business community needs post lockdown.

Outlook for Birmingham office market

With the country still in lockdown for the foreseeable future, we would anticipate Q2 2020 to be very quiet, perhaps the smallest quarter we have seen in the market. However, as we have said, this won’t necessarily represent the existing and future demand for office space in Birmingham city centre. We expect deals, which were due to complete in late Q1 and Q2, to be pushed to later in the year and we should see them take place in Q3 or, perhaps, Q4.

It is, undoubtedly, an extremely difficult landscape that we find ourselves in but, for now, we must ‘lockdown and look forward’, using this time – the likes of which we hope we’ll never have to experience again – to navigate and negotiate the way through this period and make plans for the other side.

See full details of the transactions featured in our Birmingham office market research, comprising office space in Birmingham city centre and Edgbaston.

For more information on the Birmingham office market, please contact Nigel Tripp on 0121 233 2330 or email ntripp@kwboffice.com. To register for future research updates, click here. See also our M42 and Solihull office market research.